October 2021 was the fifth month I traded options in the US market. It was the busiest month to date in terms of number of trades.

I opened 14 positions and closed 14 positions (which is double the number of trades I made the previous month). 2 trades incurred a small loss and 1 trade resulted in assignment.

Btw, you can read all of my previous options trading recaps here.

What options strategies I am trading

I sell cash secured puts, covered calls and credit spread (bull put).

I won’t be going into the details of each strategy, because it’s gonna take another 1000-2000 words. I will write a separate post regarding covered call and credit spread (bull put) in the future when I have the time =) in the meantime, you can use Google or YouTube to learn about them.

What platforms I use

I use Moomoo to trade sell secured puts and covered calls. I had written a post on the step-by-step ways to trade options in Moomoo.

I use Interactive Broker (IBKR) to trade credit spreads because Moomoo doesn’t allow credit spread yet.

What are the sizes of my accounts

At the beginning of the month, my fund sizes are US$ 19,203 in Moomoo and US$ 960 in IBKR.

Trading Recap

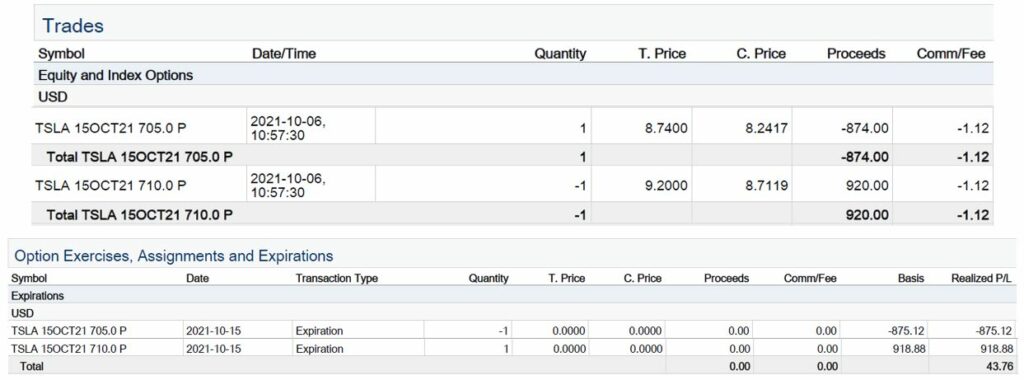

Trading Recap #1: TSLA Sell Credit Spread Bull Put (Profit: $43.76)

Strike Price: $710/705

Qty: 1

Date open: 6 Oct 2021

Expiry date: 15 Oct 2021

Days to Expiration: 9

Stock Price at Open: $780

Delta at Open: 0.09

Date Closed: 15 Oct 2021 (exp)

Days in trade: 9

Option Price at Open: $46

Option Price at Close: $0

Fee: $2.24

Profit: $43.76

Return: 43.76/454 = 9.6%

Annualized: 391%

I’ve been very cautious about doing credit spread (bull put) on Tesla because I usually feel more comfortable doing it when the share price is near the bottom. In early Oct, Tesla didn’t show any sign of falling (I was waiting for it to fall).

On 6 Oct, I decided to open the position with expiry date of 15 Oct (which means it’s 9 days to expiration) because I figured, it’s quite unlikely that Tesla will fall 10% in the next 1 week. When I opened this position, Tesla was trading around $780, and I chose strike price of 710/715 (which is about 10% below current stock price). As expected, my spread expired worthless by 15 Oct as Tesla closed the day at $843.

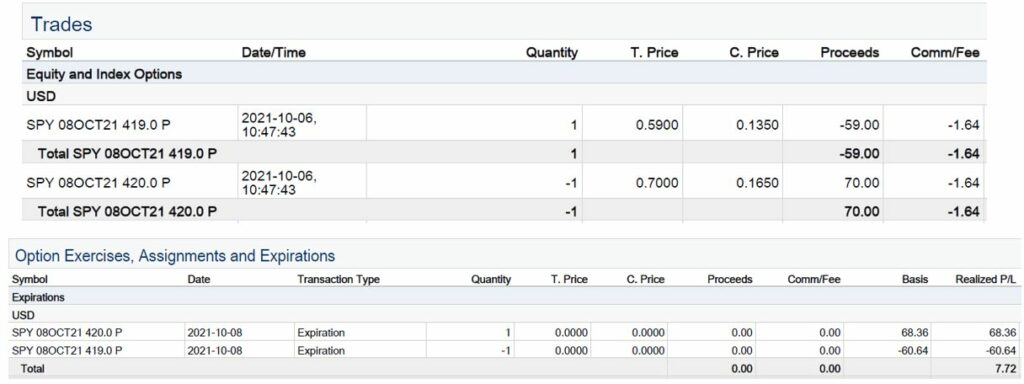

Trading Recap #2: SPY Sell Credit Spread Bull Put (Profit: $7.72)

Strike Price: $420/419

Qty: 1

Date open: 6 Oct 2021

Expiry date: 8 Oct 2021

Days to Expiration: 2

Stock Price at Open: $430

Delta at Open: 0.09

Date Closed: 8 Oct 2021 (exp)

Days in trade: 2

Option Price at Open: $11

Option Price at Close: $0

Fee: $3.28

Profit: $7.72

Return: 7.72/89 = 8.7%

Annualized: 1583%

Because Tesla’s credit spread is not so attractive anymore for my risk appetite (it’s too risky for my low-risk tolerance), I wanted to find new ways or new stocks to do credit spread that could give me consistent return with minimum downside.

Tesla credit spread’s maximum loss is $500, which is the width of the spread ($5) times 100. Meanwhile, SPY’s spread is only $1, so the maximum loss of doing SPY credit spread is only $100. That sounds like something that will suit my risk appetite.

As a start, I decided to open a credit spread (bull put) position with SPY on 6 Oct. SPY was trading at 430. SPY options expire every Monday, Wednesday and Friday. I decided to choose 8 Oct as my expiry date (which was 2 days later). For strike price, I chose the price that has Delta of 0.09 (9% chance of losing), and that strike price happened to be 420/419.

On 8 Oct (Friday), SPY closed at $438. Hence, my spread expired worthless. My profit was $7.72. It wasn’t a lot, but it was nice to earn $7.72 in 2 days.

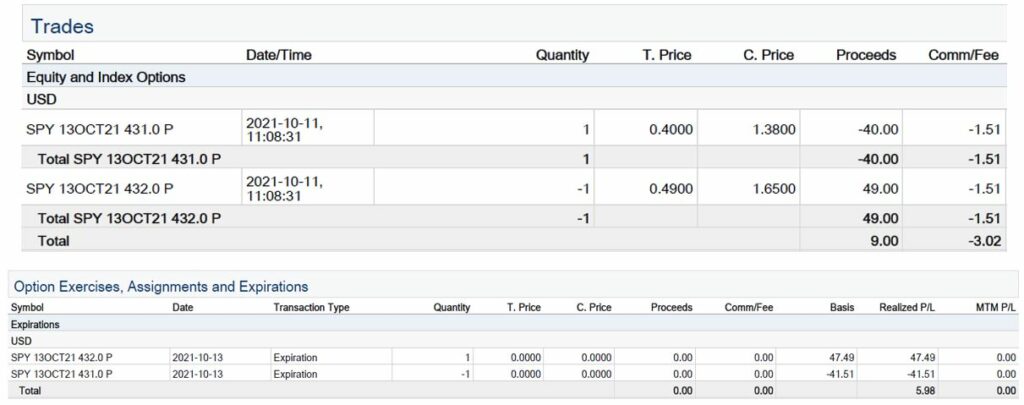

Trading Recap #3: SPY Sell Credit Spread Bull Put (Profit: $5.98)

Strike Price: $432/431

Qty: 1

Date open: 11 Oct 2021

Expiry date: 13 Oct 2021

Days to Expiration: 2

Stock Price at Open: $439

Delta at Open: 0.1

Date Closed: 13 Oct 2021 (exp)

Days in trade: 2

Option Price at Open: $9

Option Price at Close: $0

Fee: $3.02

Profit: $5.98

Return: 5.98/91 = 6.6%

Annualized: 1200%

On Monday, 11 Oct, I decided to do the same thing with SPY. I entered a credit spread with expiry date 2 days later, on 13 Oct. For strike price, I chose Delta 0,09 again, which happened to be 432/431. SPY was trading at 439.85 when I opened the position.

The next 2 days were very choppy. SPY was bearish. On Tues, 12 Oct, SPY closed at 433, which was very close to my strike price. On the day of expiration, 13 Oct, I had a decision to make. I could close my position early and suffered $50 loss, or I could go to sleep and leave it to fate. I chose the latter.

Fortunately, SPY ended the day at 435, so I got to keep my $5.98. After these 2 trades, I realized how volatile and risky it is to enter credit spread with 2 days of expiration. That’s because most of the time decay had already happened, so there’s nothing much left in the premium.

In this trade, in order for me to earn $6, I needed to bet the stock will not drop 2% (9/440=2%) in the next 2 days. I feel that the odd is not in my favor. I decided not to pursue this further. I will probably try a weekly or monthly spread when I’m ready.

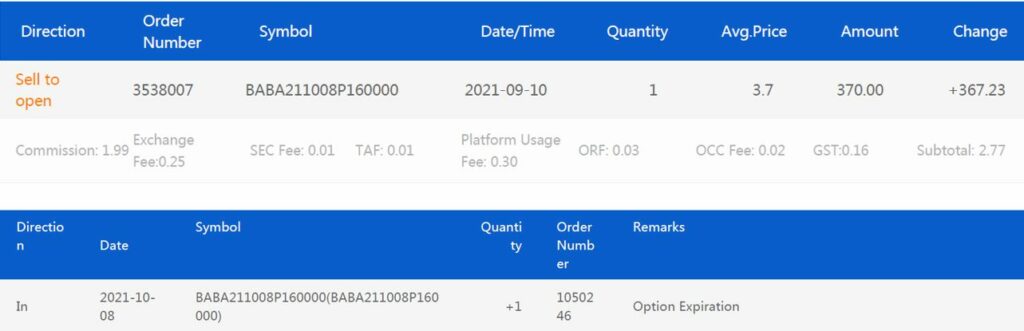

Trading Recap #4: BABA Sell Cash Secured Put (Profit: $367.23)

Strike Price: $160

Qty: 1

Date open: 10 Sep 2021

Expiry date: 8 Oct 2021

Days to Expiration: 28

Stock Price at Open: $170.2

Delta at Open: 0.276

Date Closed: 8 Oct 2021 (exp)

Days in trade: 28

Option Price at Open: $3.7

Option Price at Close: $0

Fee: $2.77

Profit: $367.23

Return: 2.3%

Annualized: 30%

I opened this on 10 Sept, when BABA was trading at 170.2. I thought the downtrend was over, I thought 158 on 20 Aug was the bottom. So I sold a cash secured put with 28 days to expiration at strike price of $160, and received $370 in premium.

Well, after that, BABA kept dropping every single day. I was catching a falling knife. The value of my put option kept increasing day after day, I didn’t have any opportunity to exit the position without suffering a loss. This period really tested my conviction of BABA stock.

BABA’s rock bottom was $139 which happened on 4 Oct, just 4 days before the expiration. At that time, I was fully prepared to be assigned. And then.. on 7 Oct (1 day to expiration), all of a sudden, BABA shot up to $156 probably because of the news that Charlie Munger increased his stake in BABA. Then, on 8 Oct, BABA closed at $161.52, just $1.52 above my strike price. So.. my csp expired worthless.

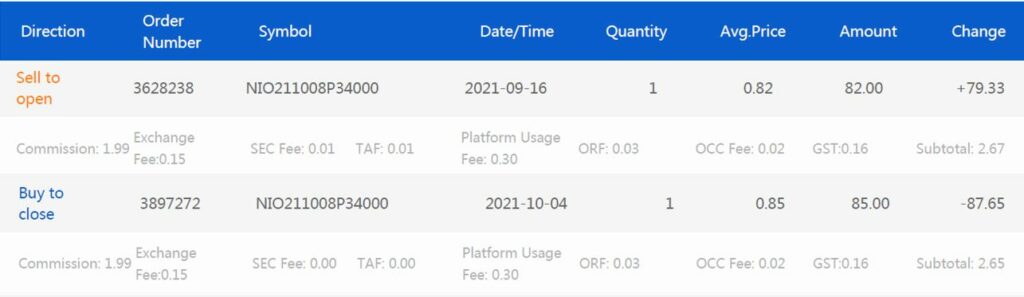

Trading Recap #5: NIO Sell Cash Secured Put (Profit: -$8.32)

Strike Price: $34

Qty: 1

Date open: 16 Sep 2021

Expiry date: 8 Oct 2021

Days to Expiration: 22

Stock Price at Open: $37

Delta at Open: 0.243

Date Closed: 4 Oct 2021

Days in trade: 18

Option Price at Open: $0.82

Option Price at Close: $0.85

Fee: $5.32

Profit: -$8.32

Return: 0.24%

Annualized: -5%

I wrote NIO csp on 16 Sep, when NIO was trading at $37 and the recent bottom was $36.3 on 19 Aug. I felt the price was near bottom, so there was upside potential. I chose strike price of $34 (Delta 0.243).

Well, NIO was bearish and kept falling. I set alert to buy back the option of stock price fall to $35. On 4 Oct, which is 4 days before expiration, I got the alert during pre-market that NIO price was down to $35. I couldn’t close my option during pre-market so I waited until market open.

When market opened, NIO fell to $34. which was my strike price. I couldn’t afford to get assigned because this NIO csp will expire on the same day as BABA, and my cash allowed me to purchase only BABA. I made the hard decision to buy back the option at $3 loss. With fees, my total loss became $8.32. Thank God it’s just a small loss.

Looking back, if I didn’t exit this position early and I held it until expiration, the put option will expire worthless as NIO closed at $35.8 on 8 Oct. Oh well, I guess the lesson here is don’t overstretch yourself. If I had enough money to get assigned with both BABA and NIO, I would probably not exit this position. It’s ok, it is what it is, there’ll be another chance of redemption.

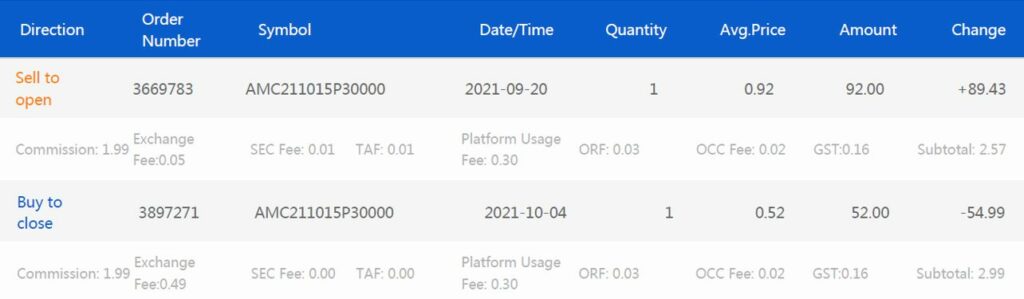

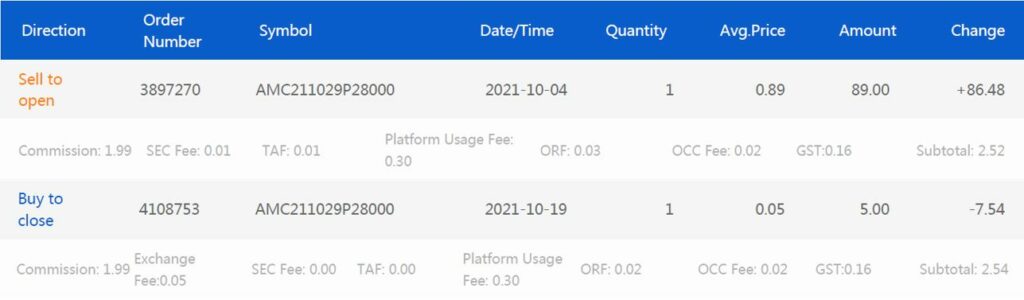

Trading Recap #6: AMC Sell Cash Secured Put (Profit: $34.44)

Strike Price: $30

Qty: 1

Date open: 20 Sep 2021

Expiry date: 15 Oct 2021

Days to Expiration: 25

Stock Price at Open: $42.7

Delta at Open: 0.11

Date Closed: 4 Oct 2021

Days in trade: 14

Option Price at Open: $0.92

Option Price at Close: $0.52

Fee: $5.56

Profit: $34.44

Return: 1.15%

Annualized: 30%

I didn’t wrote this csp when AMC was near the recent bottom. Instead, I wrote this because AMC had been on a bearish trend for the past 1 week; it fell from $51 on 13 Sep to $42 on 20 Sep. Usually, when a stock is on bearish trend, the premium is higher compared to if it’s on a bullish trend. Hence, I entered a position with strike price of $30 and expiry day 25 days later.

On 4 Oct, which is 11 days before expiration, I decided to close this position with 43% profit. It is also the same day I exited my position in Trade #5 and #7. It was a fearful day for me because almost all stocks in my watchlist is in red, so I simply wanted to secure whatever profit I have in my account. It was a completely irrational move.

Looking back, if I didn’t exit on this day, AMC would’ve soared to $40 on the expiration day of 15 Oct and my csp would be worthless. It’s ok, I’m only a human, I do make irrational mistakes from time to time.

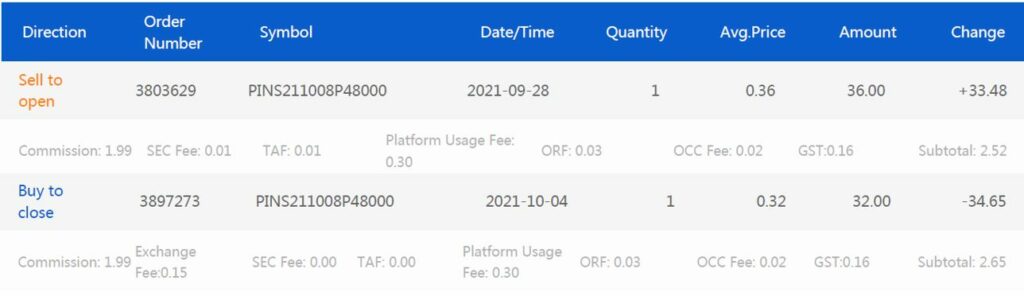

Trading Recap #7: PINS Sell Cash Secured Put (Profit: -$1.17)

Strike Price: $48

Qty: 1

Date open: 28 Sep 2021

Expiry date: 8 Oct 2021

Days to Expiration: 10

Stock Price at Open: $51.6

Delta at Open: 0.16

Date Closed: 4 Oct 2021

Days in trade: 6

Option Price at Open: $0.36

Option Price at Close: $0.34

Fee: $5.17

Profit: -$1.17

Return: -0.02%

Annualized: -1.5%

I wrote this csp because PINS was trading at 9-month low at $51.6. To be extra safe, I chose Delta 0.16 (16% chance of losing) which translated to strike price of $48. It went up to $52.6 on 1 Oct and my unrealized profit was 50% . The option price was $0.36, so the premium I collected was $36.

Then, Oct 4th changed everything. PINS went slightly down, along with other stocks. Remember I said in Trade #6, Oct 4th was a red day and it was a fearful day for me. When PINS fell to $51 and my option price soared to $0.34, I was back at square 0. I decided to give in to my fear and exited this position with $2 profit before fee. After fees, my profit became -$1.17. I’ll take a small loss over a big loss any day.

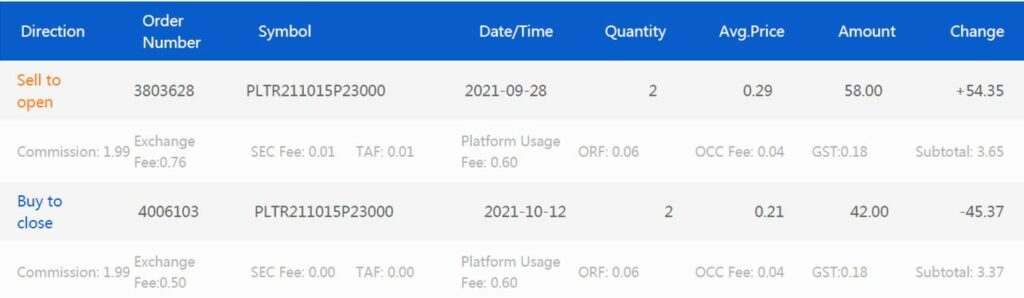

Trading Recap #8: PLTR Sell Cash Secured Put (Profit: $0.98)

Strike Price: $23

Qty: 2

Date open: 28 Sep 2021

Expiry date: 15 Oct 2021

Days to Expiration: 17

Stock Price at Open: $25.75

Delta at Open: 0.28

Date Closed: 12 Oct 2021

Days in trade: 14

Option Price at Open: $0.29

Option Price at Close: $0.21

Fee: $7.02

Profit: $0.98

Return: 0.04%

Annualized: 1.1%

I initiated this position because PLTR was trading at 1-month low at $25.75. The price kept dropping everyday until 4 Oct and PLTR was trading at $23.1. Then, it traded sideways in the $23-$24 range.

My put option price was in red (higher than $0.29) everyday until 11 Oct. On 12 Oct, finally the put option came down to $0.21. I quickly take this chance to exit. Another reason I exit was because I couldn’t afford to buy the stock if I get assigned. I have a total of 4 csp expiring on the same day, 15 Oct. The other 3 are in Trade # 11, #12 and #13.

In case you’re wondering why I could sell so many CSP when I do not have the collateral to buy the stock if assigned, that’s because my account in moomoo is Margin account, so they allowed me to sell csp beyond what I have in my cash + my stock portfolio.

Trading Recap #9: AMC Sell Cash Secured Put (Profit: $78.94)

Strike Price: $28

Qty: 1

Date open: 4 Oct 2021

Expiry date: 29 Oct 2021

Days to Expiration: 25

Stock Price at Open: $36.9

Delta at Open: 0.14

Date Closed: 19 Oct 2021

Days in trade: 15

Option Price at Open: $0.89

Option Price at Close: $0.05

Fee: $5.06

Profit: $78.94

Return: 2.8%

Annualized: 68%

I closed AMC csp in Trade #6 on 4 Oct, a very red day. Then it hit me, red day is probably the best day to sell csp because there’s a lot of upside potential. So, I sold a new AMC csp with a lower strike price of $28 and 25 days to expiration.

It was a great decision. After 4 Oct, AMC kept increasing every single day and the price of put option kept decreasing. I exited this position 15 days later when AMC was trading at $40-range and the put option was down to $0.05.

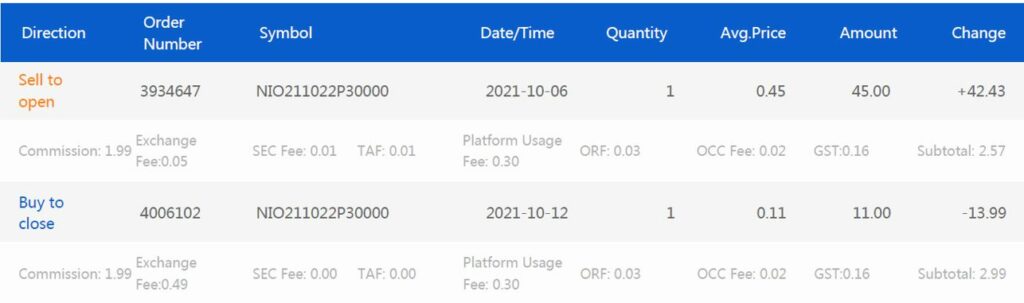

Trading Recap #10: NIO Sell Cash Secured Put (Profit: $28.44)

Strike Price: $30

Qty: 1

Date open: 6 Oct 2021

Expiry date: 22 Oct 2021

Days to Expiration: 18

Stock Price at Open: $33.7

Delta at Open: 0.17

Date Closed: 12 Oct 2021

Days in trade: 6

Option Price at Open: $0.45

Option Price at Close: $0.11

Fee: $5.56

Profit: $28.44

Return: 0.95%

Annualized: 57%

On 6 Oct, 2 days after I closed NIO at a small loss (Trade #5), NIO was trading at $33.7 which was a 5-month low. I decided it’s the right time to sell another csp. This time, I chose a very conservative strike price of $30.

After that, NIO kept going up and the put option kept going down. 6 days later, I closed this position at 75% realized profit.

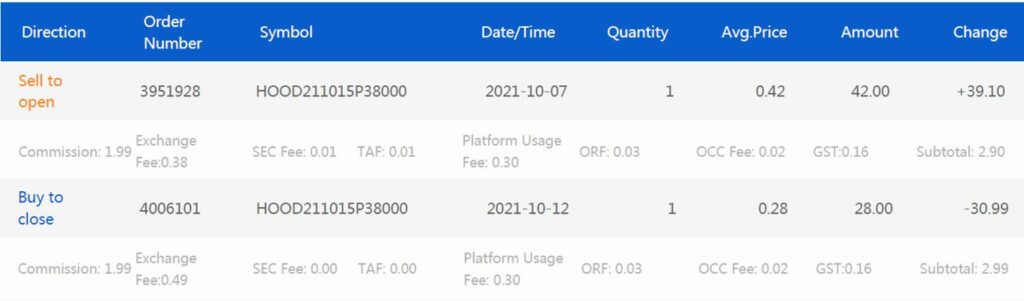

Trading Recap #11: HOOD Sell Cash Secured Put (Profit: $8.11)

Strike Price: $38

Qty: 1

Date open: 7 Oct 2021

Expiry date: 15 Oct 2021

Days to Expiration: 8

Stock Price at Open: $42

Delta at Open: 0.16

Date Closed: 12 Oct 2021

Days in trade: 5

Option Price at Open: $0.42

Option Price at Close: $0.28

Fee: $5.89

Profit: $8.11

Return: 0.21%

Annualized: 15%

On 7 Oct, I sold HOOD csp for the first time because it was on a bearish trend. When I sold csp, HOOD was trading at $42.

I decided to exit 5 days later when HOOD was at $41.2 and my put option was at 33% profit. The reason was similar to Trade #8, I couldn’t afford to get assigned because I have 3 other csp expiring on 15 Oct.

Why did I sell this csp if I knew I can’t afford to get assigned? Because when I sold this csp on 7 Oct, I only had 2 csp expiring on 15 oct, so I could still afford to get assigned. But, on 11 and 12 Oct I sold 2 more csp that will expire on 15 oct, so I had to close this NIO csp early.

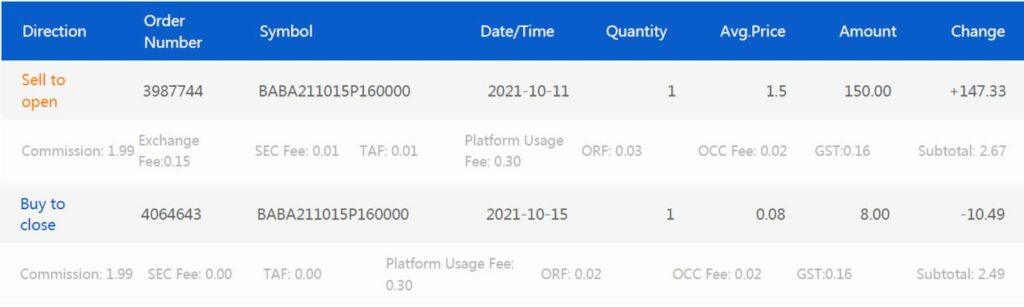

Trading Recap #12: BABA Sell Cash Secured Put (Profit: $136.84)

Strike Price: $160

Qty: 1

Date open: 11 Oct 2021

Expiry date: 15 Oct 2021

Days to Expiration: 4

Stock Price at Open: $167

Delta at Open: 0.24

Date Closed: 15 Oct 2021

Days in trade: 4

Option Price at Open: $1.5

Option Price at Close: $0.08

Fee: $5.16

Profit: $136.84

Return: 0.86%

Annualized: 78%

After my BABA in Trade #4 expired worthless, on Monday, 11 Oct, I decided to sell BABA csp again at the same strike price of $160. This time, instead of 28 days, I sell it 4 days to expiration. The IV was quite high so I could get quite a good premium at $1.5.

On expiration day of 15 Oct, I decided to close the option early because it’s already at 94% profit.

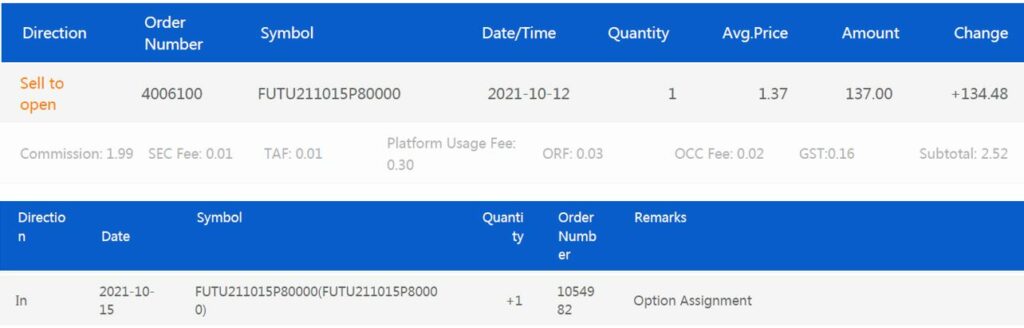

Trading Recap #13: FUTU Sell Cash Secured Put (Profit: $134.48) – Assigned

Strike Price: $80

Qty: 1

Date open: 12 Oct 2021

Expiry date: 15 Oct 2021

Days to Expiration: 3

Stock Price at Open: $83.8

Delta at Open: 0.

Date Closed: 15 Oct 2021 (exp)

Days in trade: 3

Option Price at Open: $1.37

Option Price at Close: $0

Fee: $2.52

Profit: $134.48

Return: 1.68%

Annualized: 204%

I sold FUTU csp on 12 Oct because it was trading at $83.8, which was near the recent low of $81.6. I didn’t expect to get assigned with FUTU. I was expecting to get assigned with BABA (Trade #12).

On 14 Oct, news came out that Beijing was questioning FUTU’s compliance on security risk. It sent FUTU tumbling down to $70-range on 14 Oct, and $60-range on 15 Oct. That’s how I got assigned with 100 shares of FUTU at $80.

I had intended to sell covered calls on this 100 shares but the price in the coming weeks was so low that I couldn’t sell covered call with strike price above $80. It didn’t make sense for me to sell CC at strike price below $80, so I’m still sitting on this 100 FUTU shares as I write this in the first week of November.

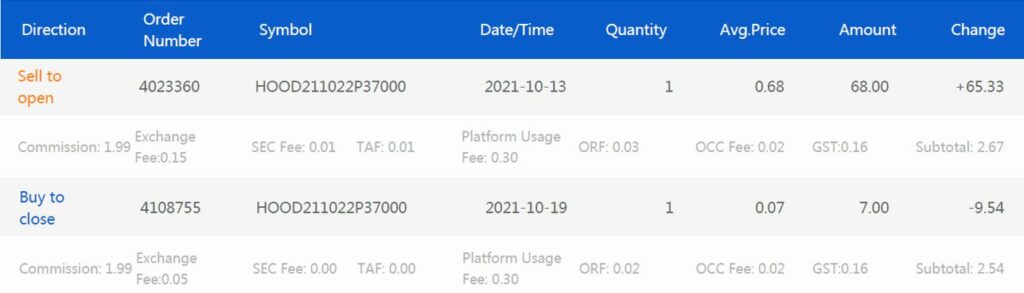

Trading Recap #14: HOOD Sell Cash Secured Put (Profit: $55.79)

Strike Price: $37

Qty: 1

Date open: 13 Oct 2021

Expiry date: 22 Oct 2021

Days to Expiration: 9

Stock Price at Open: $40

Delta at Open: 0.2

Date Closed: 19 Oct 2021

Days in trade: 6

Option Price at Open: $0.67

Option Price at Close: $0.07

Fee: $5.21

Profit: $55.79

Return: 1.5%

Annualized: 91.7%

I sold HOOD csp for the second time on 13 Oct when HOOD fell to $40, which was a 1-month low. I lowered my strike price to $37, which was $1 lower than the IPO price of $38.

HOOD traded sideways in the $40-range for the next 1 week. On 19 Oct, my unrealized profit reached 89%, so I decided to close my position early.

Open Positions by 31 Oct 2021

I have 5 open positions by 31 Oct, which I will close in November. All of them are in Moomoo. Because they’ll be closed in November, I will write about them in November’s recap.

Lesson Learned

Doing a credit spread (bull put) with 2 days of expiration and Delta 0.09 is too risky. The reward is not worth the risk.

At times, I felt that my cash is just sitting idle in my account, hence I would enter a position so that my selling-power is fully utilized. This probably explains why I had too many csp expiring on the same day and I couldn’t afford to get assigned and I had to exit the trade early at not-so-optimal profit. Moving forward, when I want to sell an option, I will ask myself, “Are you doing this because you worry your money is not fully utilized? Or is it because the current price is the right price to enter?”

Summary

Total premium earned in October 2021 = $ 893.22

Yield on fund size = 893/20163 = 4.4%

4.4% yield exceeds my monthly target of 2%. I’m thankful for ending the month in green.

FYI, I track my option performance daily using my simple spreadsheet. That’s how I get to know how much profit I have made versus time decayed at any point in time. I would close my option early if I’ve gained a lot of profit (more than 70%) within a short time.

That’s all for this month. See you in next month’s trading recap! If you want to get notified of my new posts, do subscribe to my email.

If you find this post helpful, feel free to buy me a coffee :)

Hi,

For IBKR, are you using a margin account or cash account to trade spread?

Hi, I’m using margin account.

Hi,

May I know how you place credit spread order with IBKR? Use the strategy combo or manually place 1 sell and 1 buy order?

Regards,

Lam

Hi Lam, I put them at the same time. If you use mobile app, click on the stock name, then at the top, there is a “spread” link. If you use desktop, you can use “strategy builder” button. Hope it helps.

CSP implies that you have the cash on maintenance to get assigned. What you are doing are multiple Naked Puts which is dangerous (as it uses margin) hence why you needed to close at loss at risk of assignment.

Yeah I agree that it was more of a naked put than a cash secured put. I think you’re referring to Trade #5, yes I closed at minor loss because I was at risk of assignment. Naked put is dangerous if you don’t have a warchest to take on assignment. Since I have warchest outside my trading account, I can inject into my account if I have to take on assignment. I definitely won’t close a losing trade at a loss, I’d rather take on assignment because all the stocks that I picked are stocks that I don’t mind holding for the long term anyway.