November 2021 was the sixth month I traded options in the US market. It was a rollercoaster month and it was really tough. I even contemplated not writing this recap anymore because it’s just too painful.

But then, I remembered the reasons I wrote the trading recaps: to serve as a learning diary for myself, to paint the whole picture for other people who want to get started in options trading as well as to share the lessons I’ve learned along the way.

My previous month recaps have been all rosy with very little loss thanks to the bull run in the stock market. But, this month is really different. I was so near to margin call, not just once, but twice. Sigh. This definitely impaired my ability to stay calm.

Furthermore, November is the month of earning announcement, so there’s too much uncertainty and volatility in the market.

I won’t be using the same recap format that I used in my previous recaps simply because I want to shake things up (and to save everyone’s time). Instead, I’ll try to keep it short and goes straight to important points.

Btw, you can read all of my previous options trading recaps here.

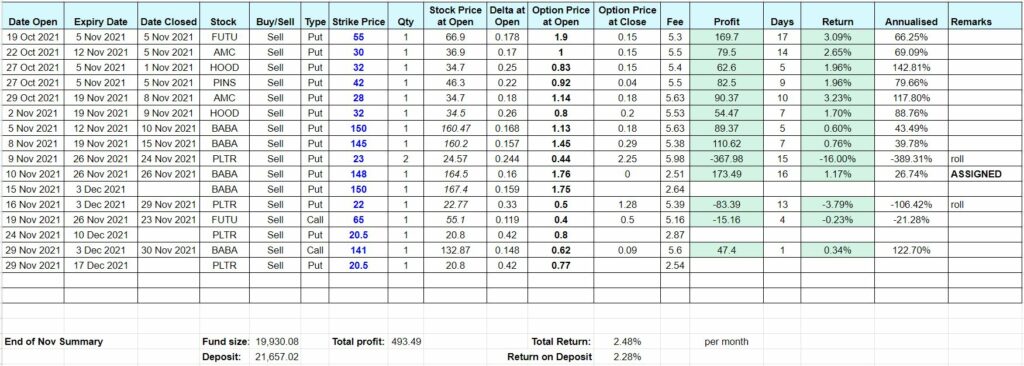

Summary of Trades Done in November

Instead of breaking down each trade like what I did in the previous recaps, I’ll try to present all the information in a single table for ease of reference.

I opened 11 positions and closed 13 positions. At the end of the month, there are 3 positions that I carried over to next month. My return is slightly above 2% a month and if you notice the bottom line, my fund size is less than my deposit amount, which means I’m in red.

I have 4 losing trades. 2 of them I rolled. 1 of them I got assigned. The other one, I just accepted the loss without rolling.

Brief Trading Stories about Each Stock

AMC

I sold AMC put twice in the late October, both done when the stock price was quite low (right timing) and with conservative strike price. As time goes by, stock price increase and option value decayed, so I closed them early. Perfect timing and execution.

HOOD

I sold HOOD put on 27 Oct, right after the stock price tanked due to low Q3 earning result. The stock price stayed flat and time decay ate the value of the put, so I closed it early on 1 Nov at 80% profit.

I sold HOOD put again on 2 Nov as the price was still low. By 9 Nov, the value of option has decayed by 75%. I had wanted to wait til the profit gets to 80%, but then came the news about data breach in Robinhood. I didn’t want to risk it and closed it at 75% profit. I was fortunate to spot the news. If not, this will be a losing trade, as HOOD kept on falling day after day, all the way into December.

FUTU

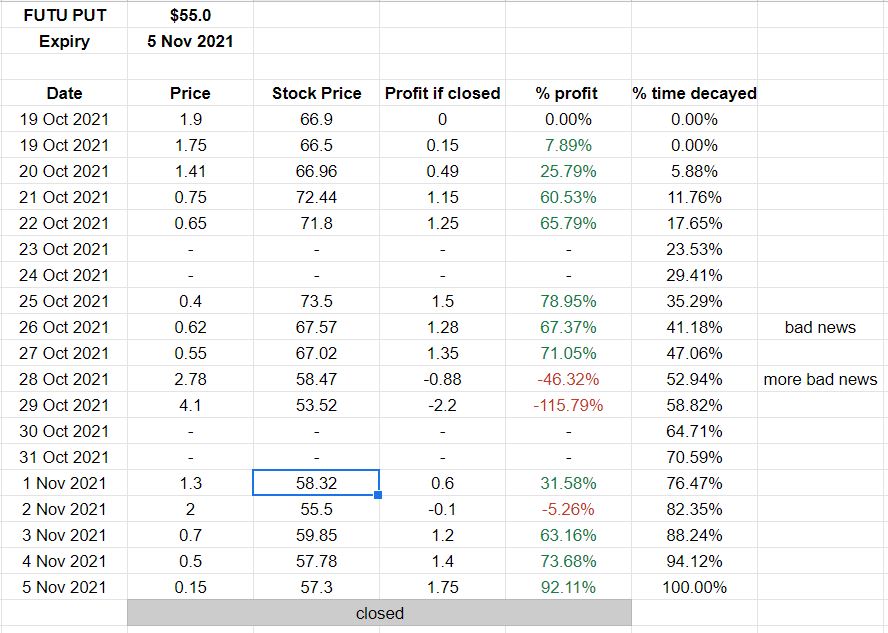

I had 2 FUTU trades. For the first one, I sold put on 19 Oct because the price fell due to news about data privacy violation. The fall didn’t last long, the stock price reversed and kept increasing everyday so the option price keep falling. By 25 Oct, my put was at 78% profit but I didn’t close it because I wanted to wait until 80%. Well, after that, more bad news came and stock fell to the 50s. I didn’t panic and I kept monitoring the price. At expiration, I was able to close it at 92% profit. Phew. Below is my daily monitoring of this trade.

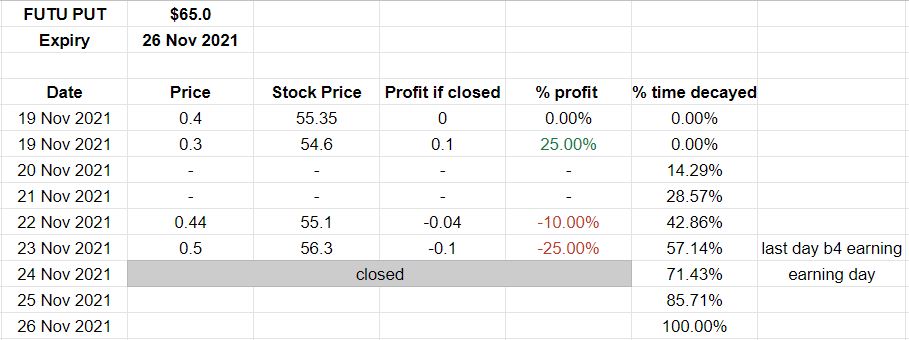

My second FUTU trade was a short call. I wanted to earn premium on the 100 shares that I’ve already owned. I sold a call on 19 Nov, and it’s going to expire in 1 week (26 Nov). Even though the stock price is pretty flat and very far away from my strike price ($10 away from strike price), time decay DID NOT eat away the option price. Why? Because those were days before earning result, so IV is really high, hence premium is also elevated. I did not dare to have open position during earning so I closed it at 25% loss the day before earning. And now I totally regretted it. Below is my daily monitoring of this trade.

PLTR

I don’t know why but I have this feeling that PLTR and I won’t get along well, my previous PLTR put in October 2021 wasn’t doing good. And in November, my PLTR trades were horrible. Since I entered my positions, the stock price would ALWAYS decline. Based on my research, the decline was due to insider selling. Not wanting to get assigned, I kept rolling PLTR put to further expiration and lower strike price.

BABA

I saved the best for the last, yay! Baba oh Baba, you made me happy and you made me sad… Why can’t we have a flat and boring relationship? Why are you always making me go on an emotional rollercoaster?

I was fully aware that BABA earning result date was 18 Nov. The days before that were truly days with high IV, hence high premiums. I’ve been wanting to own BABA for the longest time, so I decided to sell BABA put. Not one, but TWO puts with different expiry date. I had 2 successful trades (1 closed on 10 Nov, another closed on 15 Nov).

After pocketing huge premiums, I got greedy, I went ahead to sell 2 more puts (1 expiring 26 Nov, 1 expiring 3 Dec). I opened these positions before earning result and I was confident that earning would be good and stock price would go up. Even if it’s not good, I wouldn’t mind buying BABA.

Well, earnings appeared to be disappointed and BABA stock PLUNGED from 160ish to 140ish during pre-market. I DID NOT EXPECT A $20 DROP DURING PRE-MARKET!

Anyway, I decided not to do anything to the option expiring 26 Nov. Hence, I got assigned.

For the second option expiring 3 Dec, I decided to roll it out for a debit. This is not reflected here, it will be reflected in December trading recap.

I also sold a BABA call at 141 of which, thankfully, I’m able to close at profit the next day.

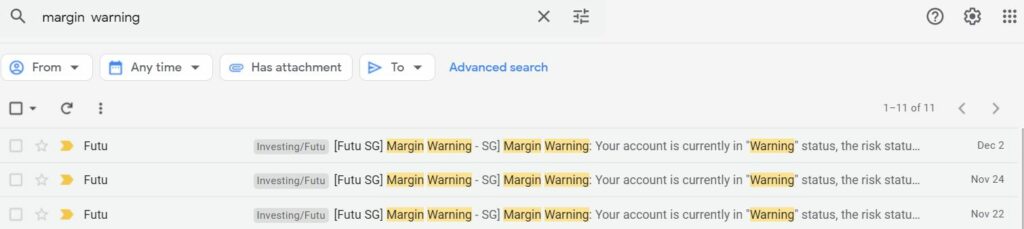

Why I Got Margin Call Warning Twice

That’s because when I sold BABA puts, I did not put the actual collateral into my account. I was able to so because my account is a margin account. When BABA fell after the bad earning report, I was bagholding 3k loss from BABA options (I hadn’t got assigned BABA stock yet on 22 & 24 Nov). Adding it with 3k paper loss from FUTU, my buying power was badly affected. Hence, the system triggered margin warning.

A reader commented in my October 2021 recap that I wasn’t doing cash-secured put and that I was doing naked put which is something risky. He’s absolutely right and he has such a great foresight.

So I did what I had to do, which was to deposit enough money to meet my margin requirement and to purchase 100 shares of BABA.

Even though I had cash reserves outside my trading account, getting a margin warning when you have 4 losing puts (2 baba and 2 pltr) and when the stock market kept going down was debilitating. It was difficult to think straight.

Lesson Learned

1. Don’t over extend yourself! When you over extend yourself and the market goes against you, you’ll be stressed, you can’t think straight, and you’ll make mistake. If you’re selling put, 1 contract is enough for each stock no matter how tempting the premium is.

2. When you say you’re willing to be assigned with the stock, how to confirm your conviction? Here’s how: Ask yourself, will you still be willing to hold the stock if it falls by 30% tomorrow?

3. Don’t trade earning, ever! I knew this rule from watching several YouTubers. I didn’t trade earning for FUTU, but I didn’t know why I traded earning for BABA.

4. Learn how to roll, it’s a useful tool. Before this, I naively think that for every put that I sell, I don’t mind getting assigned, so I won’t need to roll my options ever. But when the stock fell 20% to 30%, your mind will think differently. Your mind will thank you for knowing how to roll a losing trade.

So, that’s it! If you want to laugh at my rookie mistakes or get angry at me because I change the recap format, feel free to do so in the comment section.

If you want to take a look at the spreadsheet that I use to track my option trading, click here. That’s what I use to calculate how much profit I have made versus time decayed at any point in time.

That’s all for this month. See you in next month’s trading recap! If you want to get notified of my new posts, do subscribe to my email.

PS: If you don’t have a moomoo account yet, you can sign up here and get up to free 1 Amazon share, SGD 40 stock cash voucher, SGD 60 cash upon deposit and completing the necessary tasks. Promotion valid till 31 Oct 2022, 0959 SGT. Here’s the detail on moomoo’s latest welcome bundle.

If you find this post helpful, feel free to buy me a coffee :)

Thank you for your posts, it helps people who’re new to options a lot. Sorry if this is a silly question, how do you “roll over” your trades? Is this an in-built function in the trading app?

Hi Jun, to roll a trade, you simply close your outstanding position and open a new position. For me, because I sold put, I have to buy back put to close it. Then, I will open a new position by selling another put. It’s a 2-step process in moomoo.

Hi Prudent Dreamer,

Finally i got to read your Nov Options recap as i always look forward to your posts each month. I really appreciate your transparency and honest take on your progress. I can see that you have been through a rough month in Nov. I am wondering if it would be better to sell Put for a longer period rather than 1 or 2 weeks to expiration? For 1 week options you are exposed to high gamma risk and if the market turns, you will have no time to wait it out and have to roll or be assigned. Nevertheless i like the new spreadsheet summary which is easier to see. To a better month in Dec!

Hi Coco, thank you so much for your support. Yes the premium will be higher if you sell longer period put. Previously I sold BABA put 1 month to expiration (wrote about it in Oct 2021 recap) and I learned that I prefer selling 2wks/3wks put instead of 1 month. But, time has changed, market is now very bearish, I may consider selling longer expiration put, I see how 🙂 Thank you for letting me know that the new summary format is better 🙂 I shall keep the new format to save everyone’s time 🙂 To a better month in Dec to you too! Good luck!

Thank you for sharing everything up or down . Irregardless I have learnt alot here . Keep doing what you do here 🙏

Some sell put I tot that you may wan to take a look – LC – lending club pretty good premium

Hi Xiao Xiao, thank you for your support 🙏 Sure, I will check out LC, thanks!