As a personal finance enthusiast, nothing excites me more than finding a new way to earn extra income. I stumbled upon option trading in early 2021 and I was immediately hooked. My first option trade was selling a cash secured put.

After trading for a few months, I feel that option trading is something that I want to put more effort into, and it’s something that might help propel me to FIRE slightly faster than if I just rely on my day job and dividend.

In this article, I will share what I know about selling cash secured puts for income. Perhaps, it’ll help you earn income on the side and propel you a bit further towards your FIRE goal too.

But first, I’d like to make a disclaimer. I’m not an expert at all in option trading. I’m just a beginner and I’m still learning every day. That’s why this article has “A Beginner’s Guide” in the title =)

What is Cash Secured Put?

Imagine Apple stock is currently trading at $140. You sell one contract of put option at the strike price of $120 which is expiring on 31 December this year, for the premium of $7/share. 1 contract consists of 100 shares, so the premium of 1 contract is $700.

Someone buys your put option today and pays you $700 cash. The $700 premium is now in your trading account.

Between today and 31 December this year, if Apple stock falls below $120, the buyer may decide to exercise the option. If that happens, they will sell you 100 shares for the price of $120, regardless of the stock price at that time, and your brokerage will deduct $12,000 from your account to pay them. Between today and 31 December this year, you need to have a cash amount of $12,000 in your trading account (also called as collateral), in case your buy exercise the option and you get assigned the shares.

If Apple stock price remains above $120 on expiration date, which is 31 December this year, the buyer will not sell their shares to you because they will rather sell their stocks on the market. If they sell to you, they’ll only get $12k, if they sell to the open market they’ll get more than $12k. So, the put option that you sold will expire worthless. And you get to keep the $700 as side income.

In a layman’s term, when you sell cash secured put, you are an insurance company for stock owner. When stock price falls below $120, you protect them by buying the share at $120 from them regardless of the stock price at that time. Because you’re protecting them, you deserve to be paid the premium, which is $700 in this example.

So, that’s selling cash secured put in a nutshell. You earn money by consistently selling put options that will become worthless at expiration.

What do you need to sell cash secured put?

1. Cash. You need to set aside the cash required to purchase shares in the event your buyer exercise the option and you have to buy the shares from them. The amount of cash required is: strike price x no of contract x 100.

2. Permission to trade option. Some brokerage immediately grant you the permission to trade option when you open an account with them, other brokerage require you to submit application to get the permission to do option trading. Make sure your account allows you to trade option before placing an order.

How much can you make by selling cash secured put?

It really depends on a lot of factors, like what stock you choose, how far it is to expiration, how close the strike price is to the current price, etc.

Personally, my target is to make 2% per month on my capital. In my first 2 months trading option as a beginner, I’ve earned about US$ 600 from selling cash secured put with the capital of US$ 10,300. That’s about 3% per month, not too bad; probably a beginner’s luck though!

In the coming weeks and months, I’ll share my option trading recap as well as lessons I learned along the way. If you’re interested, do subscribe to my email to get notified of my new posts and updates.

When to sell cash secured put? And when not to?

You should sell cash secured put when you think a stock is bullish. And you should not sell cash secured put if you think the stock is bearish.

Which stock should you choose to sell cash secured put?

Generally, you should choose the stock that you don’t mind holding for the long term. And since you need to set aside a collateral first before selling cash secured put, you can only choose stocks that you can afford buying with your collateral.

For example: if you have $10k, you can’t sell Apple’s cash secured put at strike price $120. You can only sell at strike price below $100.

Keep in mind that you can’t trade option in SG market; you can only do so for US market.

Which expiration date should you choose to sell cash secured put?

It totally depends on your own preference. Do try out weekly expiration, monthly expiration and multiple month expiration, then you’ll know which one you prefer.

| Comparison | < 1 week to expiry | > 1 week but < 1 month to expiry | > 1 month to expiry |

|---|---|---|---|

| Premium | Less premium | Moderate premium | More premium |

| Volatility | Less uncertainty | Moderate uncertainty | More uncertainty |

| Volume | High liquidity | Moderate liquidity | Low liquidity |

As you can see in the table above, high risk equals to high reward. So, if you are risk adverse, you can choose shorter days to expiration. Also, remember that you need to spend time monitoring your option performance everyday until expiration. If you’re going to a remote part of the world next month, don’t sell a cash secured put that’ll expire when you’re off the grid, unless you don’t mind getting assigned.

Personally, I have a mix of shorter days to expiration and longer days, depending on my risk appetite and how much time I have to assess each stocks.

Which strike price to sell cash secured put?

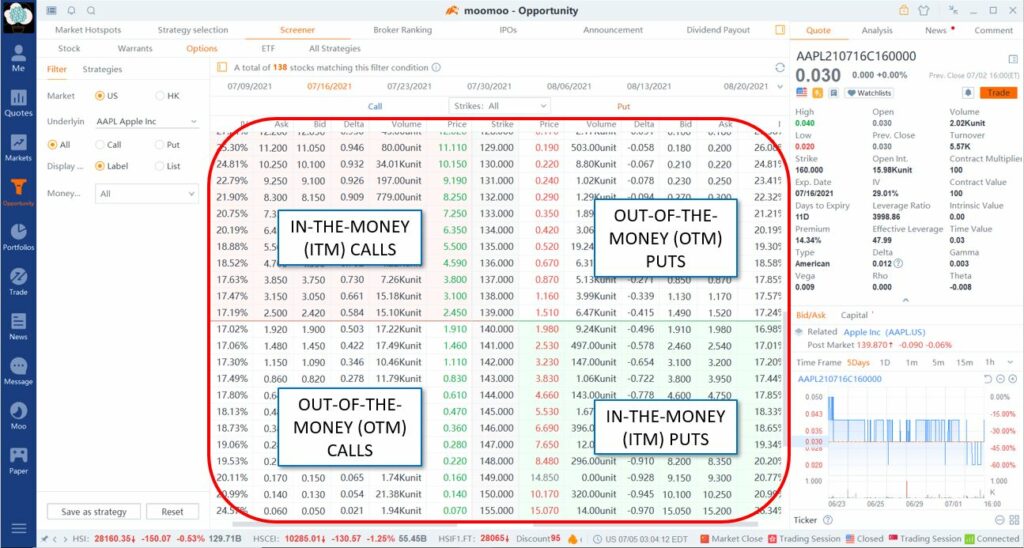

Generally, you want to sell out of the money (OTM) cash secured puts, which is a put with strike price below the current price. Out of the money (OTM) means that IF the option expires today, it will not be exercised because it doesn’t make sense for the option holder to sell you the stock with the strike price that is lower than market price.

The closer the strike price is to the current price, the higher chance the option will be in-the-money (ITM), so the higher chance you’ll get assigned, but you’ll collect higher premiums. In the money (ITM) means that IF the option expires today, it will definitely be exercised.

If you want a trade with high probability of success, a.k.a high probability being out of the money, a.k.a high probability the option will expire worthless, choose the strike price that is far below current stock price, but you’ll also collect lesser premiums.

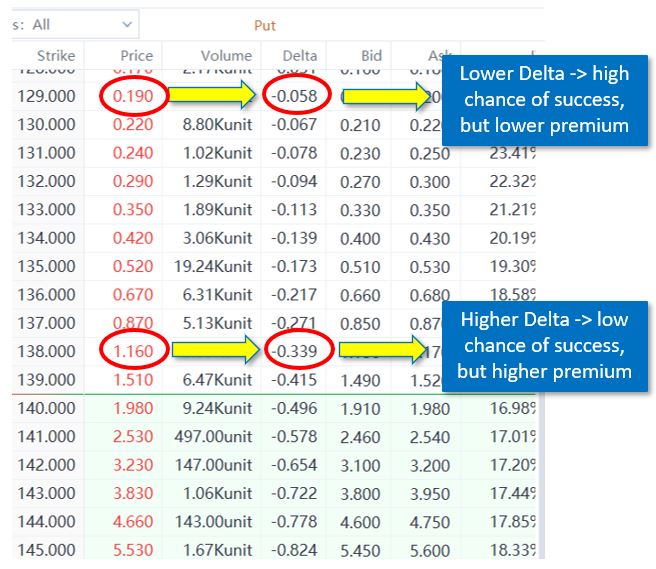

It is a balancing act. There is no fixed rule on what’s the right strike price to choose. Some brokerage does provide a metric called “Probability ITM” which is the probability of you getting assigned. But some brokerage (like Moomoo) don’t, so you need to use Delta metric to gauge your probability of success.

Delta is NOT a measure of probability. But, it is a good estimation of probability. An option with 0.3 Delta means there is approximately 30% of it being in the money, and 70% of it expiring worthless. I am quite a kiasu person, so most of the time I tend to choose Delta value between 0.2 and 0.1, which means that my probability of success is more than 80%.

Personally, the strike price that I choose depends on the Delta, market sentiments, current stock direction and my own thesis.

What to do after selling cash secured puts?

I recommend that you monitor your option performance on a daily basis so that you can do adjustment whenever necessary.

If the stock price goes up too fast and your option price drops significantly, you can consider realizing your profit early by buying back the put option to close your position.

If the stock price goes down and you might end up being in the money at expiration, but you don’t wish to get assigned, you can buy back the put option at a loss. Alternatively, if the stock price drops and you want to get assigned, then simply hold it until expiration. Remember: in the beginning, you chose this stock because you don’t mind holding it for the long term. Getting assigned doesn’t mean making a loss, it just means you’re buying the stock at the price you’re comfortable paying.

If the stock price is flat, your put option value will drop slowly until 0 at expiration. You can just keep it until expiration, or you can close your position early when the profit has reached a certain amount, so that you can deploy your collateral to sell another put option.

Personally, I track my option performance using a spreadsheet that I designed in such a way that I can compare my profit gained versus time decayed. If time has decayed for 10% but my profit has soared to 50%, I’ll definitely close the position early. I also use the spreadsheet to record my monthly profit and how much money I’ve put into my account so far.

If you want to take a look at my spreadsheet, just click here.

Which is better: close position early or hold it until expiration?

There’s no one size fits all answer to this question. It really boils down to a lot of factors, such as volatility, days left to expiration, market situation and how greedy/risk-adverse you want to be.

Most of the time, for out-of-the-money options, I like to close my position early if the profit has reached 80%. Other times, I like to hold until expiration especially if the expiration is less than a week away and I have 99.9% confidence the put option will expire worthless.

For in-the-money options, if the stock’s fundamental is still great and I don’t mind holding the stocks, I will just keep the option until it expires and I get assigned.

Next

I will write about selling covered calls as well as my option trading recap, when I have the time to do so. Stay tuned! You can subscribe to my email to get notified when I have new articles.

As always, let me know if you have any questions in the comments.

PS: My favorite platform to trade option is Moomoo. If you don’t have a Moomoo account yet, here are the welcome bonus for new users. If you want to start trading option using Moomoo, I have a step by step guide to trade option using Moomoo’s both desktop and mobile platform.

Featured image: Canva Pro

If you find this post helpful, feel free to buy me a coffee :)

Hi, I am a bit late to this article, hopefully you can still see this and reply. I would like to know how often the option buyer exercises before the expiration date? I am trading on MooMoo and just sold a cash secured put and option is ITM meaning the current market price is below the strike price. The expiry date is still 3 weeks away. I don’t mind getting assignment of the shares as i would like to start the wheel strategy. so i would like the assignment to happen sooner rather than later. Given that this is an American type option, the option buyer does not have to wait until expiration to exercise the option. So, what’s your experience trading with Moomoo? thanks

Very informative article !! keep it going!!

Hi Lulu,

I have gotten early assignment quite a number of times, I kinda lost track haha! Most of the early assignment happen around 1 week before expiry. So, if you want to roll it, do it more than 1 week before expiry.

Hi there!

Thanks for doing the post, I’ve searched the net for trading options on Moomoo and it took me a while to find your blog!

Thank you for the very detailed write up!

I was wondering if we can execute the wheel strategy on Moomoo as I’m keen to try.

But a check with Moomoo admin actually came back with a uncertain answer.. which is not helpful at all.

I read that you’re able to do cash covered call as long as you’ve enough funds inside your account.. but what about covered calls? Are you also able to do that for Moomoo?

I tried selling a cash secured put but got spooked the very same day and sold with $30 profit..

Pls enlighten me! Thank you so much!!

Hi Mich! Glad you find it helpful! You can do wheel strategy in moomoo, but you need to do it manually. For covered call, you need to contact admin to activate covered call function for you. I tried to do covered call without activating the function, and I got margin warning; after reaching out to the customer service, I then understood that you need to contact them to get it activated.

Cash secured put doesn’t need any activation. Congrats, $30 a day is pretty great!

Hi Prudent dreamer, I was introduced to Options trading via Kelvin (youtuber) as well.

Reading your options trading journey gave a lot more clarity about the ups/downs of doing Options trading. I really do appreciate the effort and level of details that you put into sharing your journey here!

Looking forward to more post from you!

Hi Ben, thank you so much for your support!

Very good articule. I hope read more about CSP and optiones

Most welcome 🙂

Nice article. Comprehensive writing about the strategy. Keep it up and wish you the success 🙂

Thank you so much, Sean!