September 2021 was the fourth month I traded options in the US market. It is quite a busy month in terms of number of trade. I opened 7 positions and closed 7 positions. No loss was incurred.

This month, I felt more emotionally stable compared to the previous 3 months. So, this month’s recap will be less about emotional struggle. I wouldn’t lie, there were a couple of days when I was very fearful, especially on 20 and 21 Sep when Evergrande was making headlines and every single stock in my portfolio & watchlist tanked.

I rode through the storm and came out a bit scathed, one of my CSP (BABA, expiring in Oct) is deep in the money, I’ll wrote about this next month. In the meantime, here’s my recap for trades that were closed in September 2021.

Btw, you can read all of my options trading recaps here.

What options strategies I am trading

I sell cash secured puts, covered calls and credit spread (bull put).

I won’t be going into the details of each strategy, because it’s gonna take another 1000-2000 words. I will write a separate post regarding covered call and credit spread (bull put) in the future when I have the time =) in the meantime, you can use Google or YouTube to learn about them.

What platforms I use

I use Moomoo to trade sell secured puts and covered calls. I had written a post on the step-by-step ways to trade options in Moomoo.

I use Interactive Broker (IBKR) to trade credit spreads because Moomoo doesn’t allow credit spread yet.

What are the sizes of my accounts

At the beginning of the month, my fund sizes are US$ 16,960 in Moomoo and US$ 960 in IBKR.

Trading Recap

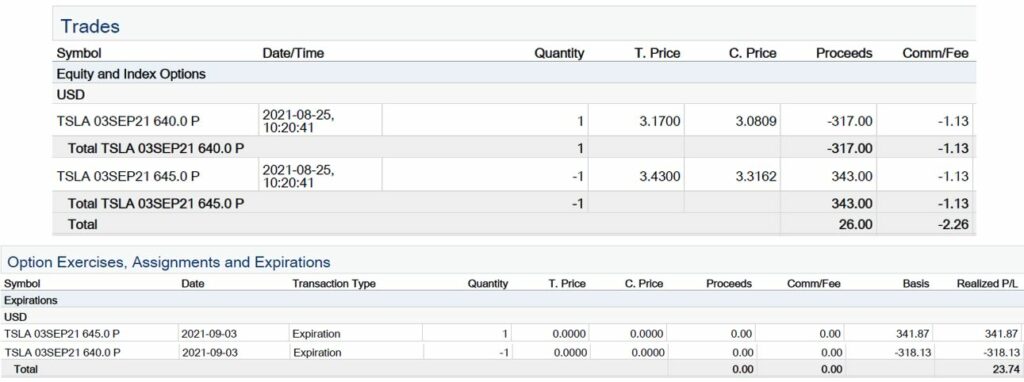

Trading Recap #1: TSLA Sell Credit Spread Bull Put (Profit: $23.74)

Strike Price: $645/640

Qty: 1

Date open: 28 Aug 2021

Expiry date: 3 Sep 2021

Days to Expiration: 6

Stock Price at Open: $708

Delta at Open: 0.03

Date Closed: 3 Sep 2021 (exp)

Days in trade: 6

Option Price at Open: $0.26

Option Price at Close: 0

Fee: $2.26

Profit: $23.74

Return: 23.74/476 = 5%

Annualized: 304%

This is a trade that I’d call “a reluctant trade” because the setup wasn’t perfect for a bull put spread. TSLA had a slight dip when I opened my position. At $708, TSLA was near a 5-month high, so I wasn’t confident that there are a lot bull potential. I chose the expiration date in 6 days, and strike price of 8% below current price, and the resulting delta is 0.03 (3% chance of losing).

As expected, the spread expired worthless. Looking back, this was a very safe trade. Too safe, in fact. Anyway, no regret, it’s better to be safe than sorry. In a bull put spread, you don’t want the options to expire in the money at all cost.

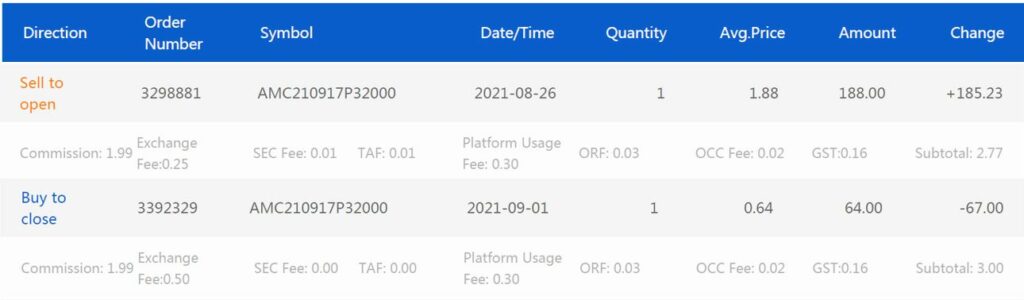

Trading Recap #2: AMC Sell Cash Secured Put (Profit: $118.23)

Strike Price: $32

Qty: 1

Date open: 26 Aug 2021

Expiry date: 17 Sep 2021

Days to Expiration: 22

Stock Price at Open: $42.6

Delta at Open: 0.2

Date Closed: 1 Sep 2021

Days in trade: 6

Option Price at Open: $1.88

Option Price at Close: $0.64

Fee: $5.77

Profit: $118.23

Return: 3.7%

Annualized: 225%

I opened this trade when AMC fell to $42 from $48 the day before. I chose strike price of $32, which is 25% lower than the current price. Yup, I learned my lesson from my AMC trades in July 2021. For meme stock, always choose a strike price at least 20% below current price, and always sell CSP near support.

The next day, AMC had a bull run for 5 consecutive days until 31 Aug. Then, on 1 Sep, AMC was going down, I had paper hands and decided to exit before it’s too late. When I closed my position, my trade was already at 65% profit. Even though it hasn’t reached my target of 70% profit, it’s alright, I just want a good night sleep.

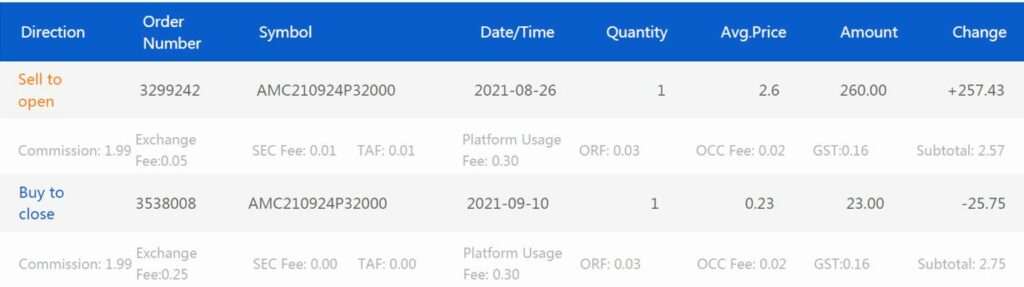

Trading Recap #3: AMC Sell Cash Secured Put (Profit: $231.68)

Strike Price: $32

Qty: 1

Date open: 26 Aug 2021

Expiry date: 24 Sep 2021

Days to Expiration: 29

Stock Price at Open: $42.4

Delta at Open: 0.18

Date Closed: 10 Sep 2021

Days in trade: 15

Option Price at Open: $2.6

Option Price at Close: $0.23

Fee: $5.32

Profit: $231.68

Return: 7.2%

Annualized: 176%

This trade was done minutes after I opened Trade #2. The setup was so good, I didn’t want to waste it, so I opened 2 AMC CSP with same strike price but different expiry date. This one expires 1 week after Trade #2.

When I closed the previous Trade #2 on 1 Sep, this trade was at only 48% profit, so I decided to ride through the bear. It turned out that after 1 Sep, AMC was sideway for a few days then it kept going up until $51 range on 10 Sep. By 10 Sep, this trade already reached 91% profit, so I closed my position even though there were still 14 days to go until expiration. The day after I closed this trade, AMC fell. Thank God I escaped from the bear.

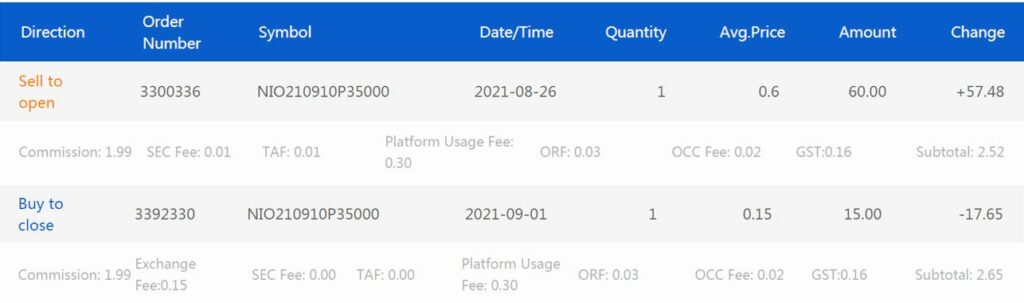

Trading Recap #4: NIO Sell Cash Secured Put (Profit: $39.83)

Strike Price: $35

Qty: 1

Date open: 26 Aug 2021

Expiry date: 10 Sep 2021

Days to Expiration: 15

Stock Price at Open: $38.2

Delta at Open: 0.2

Date Closed: 1 Sep 2021

Days in trade: 6

Option Price at Open: $0.6

Option Price at Close: $0.15

Fee: $5.17

Profit: $39.83

Return: 1.1%

Annualized: 69%

This is a perfect trade. I initiated my position when NIO was trading at $38.2. Its nearest low was $36, which was a week before. NIO traded sideways for the next few days, and time decay enabled my CSP to gain profit each day. 6 days later, I decided to close this trade to lock in 75% profit.

Had I held to expiration, this put will expire worthless, but I didn’t want to risk the 75% profit, who knew what could happen in the week of expiration.

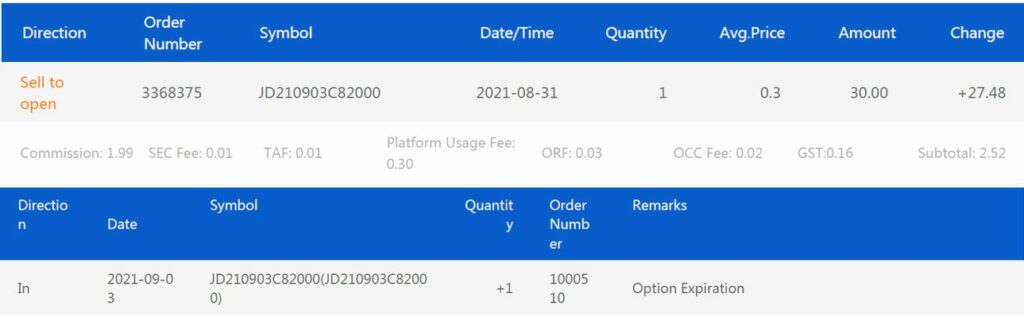

Trading Recap #5: JD Sell Covered Call (Profit: $27.48 )

Strike Price: $82

Qty: 1

Date open: 31 Aug 2021

Expiry date: 3 Sep 2021

Days to Expiration: 3

Stock Price at Open: $78.2

Delta at Open: 0.23

Date Closed: 3 Sep 2021

Days in trade: 3

Option Price at Open: $0.3

Option Price at Close: $0

Fee: $2.52

Profit: $27.48

Return: 0.34%

Annualized: 70%

I got assigned with 100 shares of JD from the CSP that I sold earlier (see Aug Report, Trade #2). So, I tried to sell covered calls. I chose strike price of $82 because it is the price I’m willing to sell. Well, on expiration date, JD closed at $79, so my covered call expired worthless.

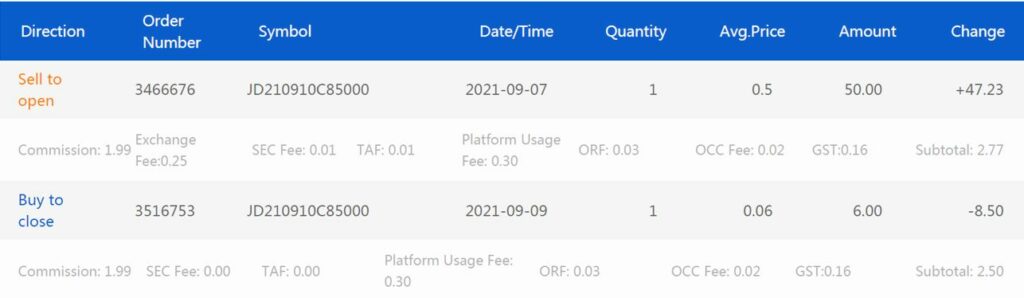

Trading Recap #6: JD Sell Covered Call (Profit: $38.73)

Strike Price: $85

Qty: 1

Date open: 7 Sep 2021

Expiry date: 10 Sep 2021

Days to Expiration: 3

Stock Price at Open: $81.9

Delta at Open: 0.25

Date Closed: 9 Sep 2021

Days in trade: 2

Option Price at Open: $0.5

Option Price at Close: $0.06

Fee: $5.27

Profit: $38.73

Return: 0.46%

Annualized: 83%

After the previous covered call in Trade #5 expired worthless, the next week I sold another covered call. This time, I got greedy, JD was trading at $81.9 so I chose an impossible strike price at $85. Well, JD didn’t go up, instead it went down to $80 range. I decided to close my position to lock my 88% profit on 10 Sep instead of waiting until expiration.

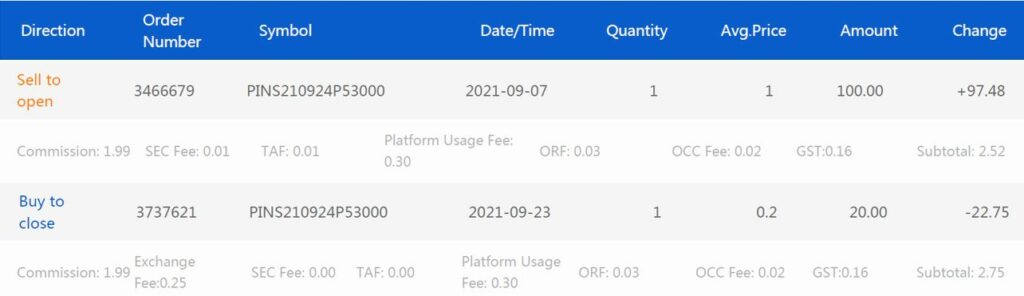

Trading Recap #7: PINS Sell Cash Secured Put (Profit: $74.73)

Strike Price: $53

Qty: 1

Date open: 7 Sep 2021

Expiry date: 24 Sep 2021

Days to Expiration: 17

Stock Price at Open: $55.2

Delta at Open: 0.29

Date Closed: 23 Sep 2021

Days in trade: 16

Option Price at Open: $1

Option Price at Close: $0.2

Fee: $5.27

Profit: $74.73

Return: 1.4%

Annualized: 32%

This trade has 17 days to expiration when I initiated my position. The first 2 weeks were great, PINS was trading sideways and time decay allowed me to gain paper profit every day, until… Evergrande appeared on every news and my put went from 58% profit down to 44% loss.

I persevered through the 2 toughest days in September, 20 and 21 Sep. Eventually, PINS went back up and restored my profit to 80% on 23 Sep. I decided to lock in the profit and closed my position on 23 Sep, which is 1 day before expiration.

Open Positions by 30 Sep 2021

I have 5 open positions by 30 Sep, which I will close in October. All of them are in Moomoo. Because they’ll be closed in October, I will write about them in October’s recap.

Lesson Learned

I learned about Quadruple Witching, which is a date on which derivatives of stock index futures, stock index options, stock options, and single stock futures expire simultaneously (quoted from Investopedia). It occurs once every quarter, on the third Friday of March, June, September, and December.

On the day of Quadruple Witching, a lot of transactions are happening due to these expirations. Hence, the week after Quadruple Witching tends to perform badly, probably due the lesser demand for the stock. In Sep 2021, Quadruple Witching happened on 17 Sep. This explains why 20 and 21 Sep were red days (well, Evergrande played a part too). In the future, I’ll avoid having any option contract being carried over to the week following QW.

Summary

Total premium earned in September 2021 = $554.42

Yield on fund size = 554/17920 = 3%

3% yield exceed my monthly target of 2%. I’m thankful for another good month despite the looming bearish trend.

FYI, I track my option performance daily using my simple spreadsheet. That’s how I get to know how much profit I have made versus time decayed at any point in time. I would close my option early if I’ve gained a lot of profit (more than 70%) within a short time.

That’s all for this month. See you in next month’s trading recap! If you want to get notified of my new posts, do subscribe to my email.

If you find this post helpful, feel free to buy me a coffee :)

Hi, thanks you sharing your experience. All your articles are very easy to read and follow. I am a newbie learning options trading and uses Moomoo as well.

I am curious when you say you locked in the profit, what actually did you do? Where the profit money comes from? Eg. On Trading Recap #4,

“time decay enabled my CSP to gain profit each day. 6 days later, I decided to close this trade to lock in 75% profit.”

I understand you sold CSP, and you were paid premium when someone bought your Put options, and when strike price was reached in the money, you would get assigned and had to buy the stocks.

If it is out of money, the put options would expire worthless and you earned the premiums paid by your put option buyer.

But reading your trading recap #4, it seems the options you sell were not yet purchased by buyer, and you waited and “locked in the profit” – so where the profit is coming from ?

Sorry, the question sounds silly, and thanks if you are still available to answer this.

Dexter.

Hi Dexter,

Regarding Trade #4, when I sold it I received $60 (100*$0.6), over time the option price fell to $0.15 so when I buy back the option I have to pay $15. Hence, instead of 100% profit ($60), I only earn $45 when I close early. So I’m locking it profit of $45/$60 = 75%. If I wait until the option expires, I might be able to earn the entire $60 (100% profit) or I might get assigned.

When I sold it, a buyer already bought it, that’s why I earned $60, as can be seen from the broker’s transaction report. Sorry if the term “profit” confused you. Let me put it another way.

My income for selling the put was $60, this is the maximum income I can earn from this particular trade, hence I see $60 as 100% of the income. If I hold it to expiration, and the put expires worthless, I get to keep the entire $60 (100% of it). However, I didn’t want to hold until expiration because I was worried the price of the stock goes down and my put becomes in-the-money. Hence, I close my position before expiration by buying back the put by paying $15. Therefore, instead of $60, my NET INCOME is $45, which is 75% of the original $60 income. This is what I meant when I said 75% profit.

Don’t worry about sounding silly, we are all still learning and option itself is quite a complex topic. Sorry for my late reply, hope it still helps!

Hi there. I just started trading and happened to chance upon your blog. Your detailed trading recap really helps me understand the nitty gritty and your writing is easy to understand. Thanks so much.

Hi Ish, thank you for sharing, I appreciate it.

btw, why u didt try on Wheel Strategyorr PMCC(Poor Man’s Covered call)?

I did try the wheel strategy (Trade #5 and #6). I didn’t try PMCC cos I don’t feel comfortable buying an ITM call option (it’s expensive and I don’t have enough money & conviction to do it just yet), perhaps I will try PMCC in the future when I’m ready.

Hi,

May I know why dont you use IBKR for cash secured put? You can put more fund in IBKR, right?

Regards,

Lam

Hi Lam,

Yes I can use IBKR for cash secured put. I’ve been using Moomoo because it’s very user-friendly and right now, I’m very familiar with both desktop & mobile app of moomoo. At the risk of sounding stupid, I’m going to admit that I have difficulties setting up the layout in IBKR. As an IBKR newbie, I find the IBKR desktop platform (TWS) to be very confusing. I probably need to find time to learn how to set up IBKR platform.

Hi hi! I just started trading options after reading your blog – thank you for the sharing it’s so helpful!

I just wanted to ask about about Quadruple Witching. You mentioned it happened on 17 Sep and it affects 20 and 21 Aug? So Quadruple Witching will affect previous month too, and not just following week?

Hi Polly, sorry for the typo. I meant 20 and 21 Sep. I’ll fix that, thank you.