January 2022 was the eight month I traded options in the US market. It was one of the hardest recaps to write, because it’s my first month with negative profit.

This recap is more than 1 month late because of many reasons. One of them was because I was busy with my newly-adopted fur kid. And another reason was I needed time to process my loss and try to find the silver lining.

As a stock investor, I’m always looking for stocks that are undervalued and have potential to go up in price. In other words, my outlook has always been bullish. Without realizing it, my option strategies are mostly based on the same principle, I look for undervalued stocks and sell puts on them with the hopes of earning premium and owning them at cheaper price.

So, it makes sense why I’ve been making too many losses since November 2021. That’s because prices have been going down since November and I’m mostly employing bullish option strategies.

Alright, without further ado, here’s my trading recap for January 2022.

Btw, you can read all of my previous options trading recaps here.

Summary of Trades Done in January 2022

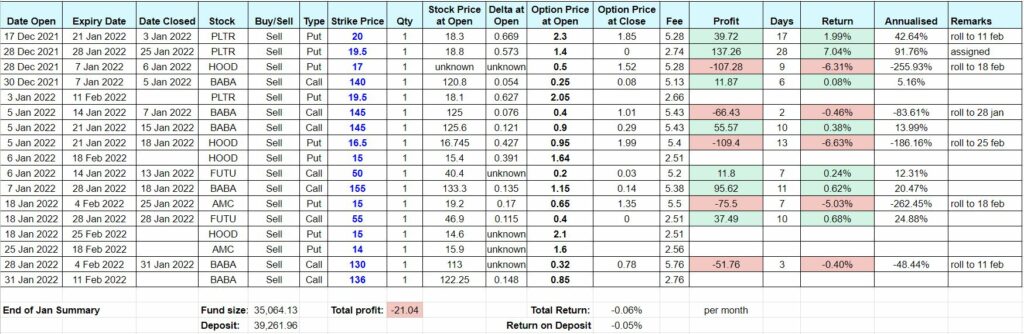

In January 2022, I opened 13 new positions and closed 12 positions. I had 5 losing trades, 1 assignment and 6 winning trades.

At the end of the month, there are 5 positions that I carried over to next month. My return is -$21.04 which is -0.06% a month based on my fund size.

Refer to the bottom line and you’ll see that my fund size was 35k while my deposit was 39k. So, that’s 4k paper loss, which is the same as last month.

Brief Trading Stories about Each Stock

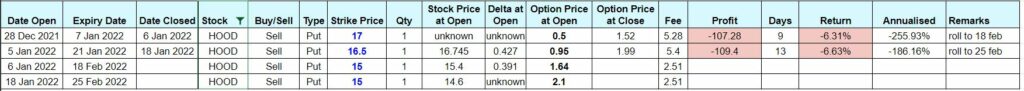

HOOD

HOOD kept falling down in January so I had to keep rolling my puts to further date. I made sure that I earn money during rolling (i.e. I receive more money when selling new put than what I paid to close my losing trade). I had 2 HOOD short put positions and I rolled both of them to February.

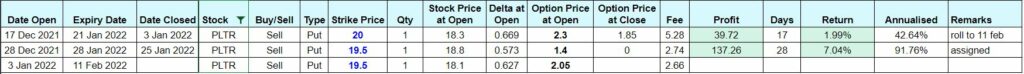

PLTR

At the beginning of the month, I was bag holding 2 PLTR puts. One of them got assigned early; the expiry date was 28 Jan but I got assigned at 25 Jan, so I didn’t have time to roll it. The other one I rolled to 11 Feb.

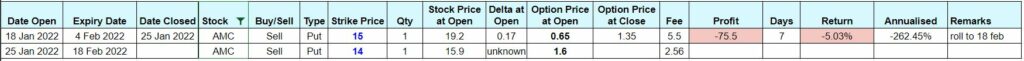

AMC

When I noticed that AMC fell to $19 range, I decided to sell put because the last time AMC traded at $19 was in May 2021, which was 8 months ago. I chose $15 strike price which I thought was conservative. With 3 weeks to expiration, the premium that I collected was $65.

A week later (25 Jan), AMC fell to $16 range, and the put price went up to $1.35, which was double the price when I first sold it. That means, I’m at 100% loss! I decided to roll it further to 2 weeks later, 18 Feb, and collected $160 premium with new put at $14 strike price. I netted $20 from rolling and I hoped AMC price would reverse up. The result of this new put will be discussed in Feb 2022 recap.

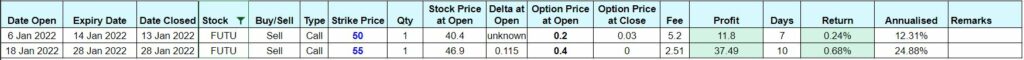

FUTU

I sold 2 calls when FUTU was trading at the price I deemed quite high. I chose extremely out-of-money strike prices so that they can expire worthless. As a result, I only collected small premiums but both expire worthless, yay! $50 is better than nothing!

BABA

For BABA, I decided to focus on selling calls because I didn’t expect BABA will shoot up anytime soon. Out of the 5 completed trades, 3 were winning trades and 2 were losing trades that I rolled further out. I feel that I’m slowly getting the hang of selling calls!

Lesson Learned

I guess I learned acceptance. Accept that option trading is risky. Accept that stock market is tumbling and there’s nothing I can do to make stock prices go up to save my puts.

So, that wraps up my very brief recap for January 2022! I will be working on my Feb recap soon, so stay tuned! Spoiler: it’s worse than Jan 2022!

If you want to take a look at the spreadsheet that I use to track my option trading, click here. That’s what I use to calculate how much profit I have made versus time decayed at any point in time.

That’s all for this month. See you in next month’s trading recap! If you want to get notified of my new posts, do subscribe to my email.

PS: If you don’t have a moomoo account yet, you can sign up here and get up to free 1 Amazon share, SGD 40 stock cash voucher, SGD 60 cash upon deposit and completing the necessary tasks. Promotion valid till 31 Oct 2022, 0959 SGT. Here’s the detail on moomoo’s latest welcome bundle.

If you find this post helpful, feel free to buy me a coffee :)