Before May 2021, I was very skeptical about option trading. I’ve seen plenty of option trading advertisement and courses, and I intentionally ignored them because I knew that option is a risky financial instrument (at least, that’s what everyone says).

However, I accidentally learned it while watching a YouTube video and I was like, “Wait.. Are you sure it’s that easy? It can’t be THAT easy! Let me try it out.” Well, soon enough, I got hooked! I have to give credit to Kelvin for introducing me to option trading.

Before placing my first option trade, I did some research about the basic of option trading, how to trade option safely, what are the downside of selling option, how to adjust my position of the stock goes against my bet. I learned so much from YouTube, especially from BCI and Option Alpha. I did not purchase any course because I did not feel the need to ( because option courses are crazy expensive).

The reason I write this post is because I want to document my (beginner) journey in option trading, the actual amount I made and lost, as well as the mistakes I made along the way. Hopefully, one year later I can look back to this post and see how much progress I’ve made.

I’m combining May & June into one article because my first and second trade were done very late in May (27 May & 28 May), so for ease of writing, I’m grouping them together.

For the benefit of people with no background in option trading, I will briefly explain the 3 types of option strategies that I use.

What options strategies I am trading

I sell cash secured puts, covered calls and credit spread (bull put).

Cash secured put (CSP) means that I am selling put options, so I get to collect option premiums right after someone buys my put. Here, I am bullish and I’m betting that the stock will go up beyond my strike price, if it does, my put will expire worthless and I get to keep my premium. If the reverse happens, I have to buy the stock at the strike price of my put option. In order to sell cash secured puts, I need to first deposit the money that will be required to purchase the stock in the event the stock price falls below my strike price. For more detailed explanation, you can read my guide on selling cash secured put.

Covered call (CC) means that I am selling call options because I am bearish and I believe the stock will not go up beyond my strike price, if I’m right, my call will expire worthless and I get to keep my premium. If the reverse happens, I have to sell the stock at the strike price of my call option. In order to sell covered calls, I first need to own 100 shares of a stock, so that I can sell it in the event the stock price goes beyond my strike price.

Credit spread (bull put) is selling a put at a certain price, and buying another put at a lower price with the same expiration date. Unlike cash secured put, it doesn’t require me to deposit the money required to purchase a stock. All I need is to deposit enough money to cover the maximum loss.

I won’t be going into the details of each strategy, because it’s gonna take another 1000-2000 words. I will write a separate post regarding covered call and credit spread (bull put) in the future when I have the time =) in the meantime, you can use Google or YouTube to learn about them.

What platforms I use

I use Moomoo to trade sell secured puts and covered calls. I had written a post on the step-by-step ways to trade options in Moomoo.

I use Interactive Broker (IBKR) to trade credit spreads because Moomoo doesn’t allow credit spread yet.

How much fund I put into my accounts

I put approximately US$ 10,300 in Moomoo and US $750 in IBKR.

Trading Recap

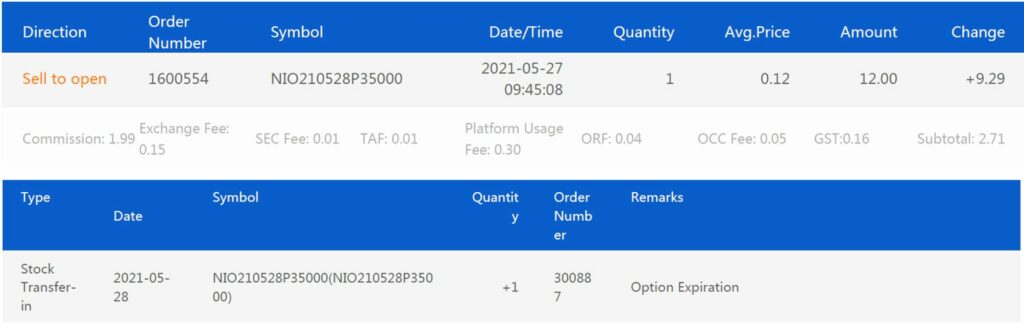

Trading Recap #1: NIO Sell Cash Secured Put (Profit: $9.29)

Strike Price: $35

Qty: 1

Date open: 27 May 2021

Expiry date: 28 May 2021

Days to Expiration: 1

Stock Price at Open: $37

Delta at Open: Forgotten

Date Closed: 28 May 2021 (exp)

Days in trade: 2

Option Price at Open: $0.12

Option Price at Close: 0

Fee: $2.71

Profit: $9.29

Return: 0.27%

Annualized: 96.88%

This was my first ever option trade. As a wide-eyed beginner eager to make money, I sold a very-short-term cash secured put of NIO at strike price of $35. NIO was trading at around $37 when I opened my position. It was a high-probability-of-success kind of CSP. I forgot the Delta that I chose, I think it was about 0.2 iirc.

One day later, the option expired worthless and I was so happy for winning my first option trade. Even though it was only a $9.29 profit, it was a boost to my confidence.

Trading Recap #2: NIO Sell Cash Secured Put (Profit: $32.6)

Strike Price: $36

Qty: 1

Date open: 28 May 2021

Expiry date: 4 Jun 2021

Days to Expiration: 7

Stock Price at Open: $38

Delta at Open: 0.2

Date Closed: 1 Jun 2021

Days in trade: 4

Option Price at Open: $0.45

Option Price at Close: $0.07

Fee: $5.4

Profit: $32.6

Return: 0.91%

Annualized: 82.63%

For my second trade, I sold another CSP for NIO. This time, instead of 1 day to expiration, I sold it 7 days to expiration. While most traders are comfortable selling CSP at Delta 0.3 (i.e. 70% chance of winning), I am not. I prefer selling at Delta 0.2 (i.e. 80% chance of winning). On 28 May, the strike price for Delta 0.2 is $36, so that’s what I chose.

NIO was on a bullish trend. On 1 Jun 2021, which is 4 days after I opened my position, the stock price increased to $42.2 and the put option price has decreased to $0.07. I decided to close the position early because I was at 84% paper profit already (0.38/0.45=84%). To close it, I bought back the put option at $0.07 and use my collateral to sell CSP again.

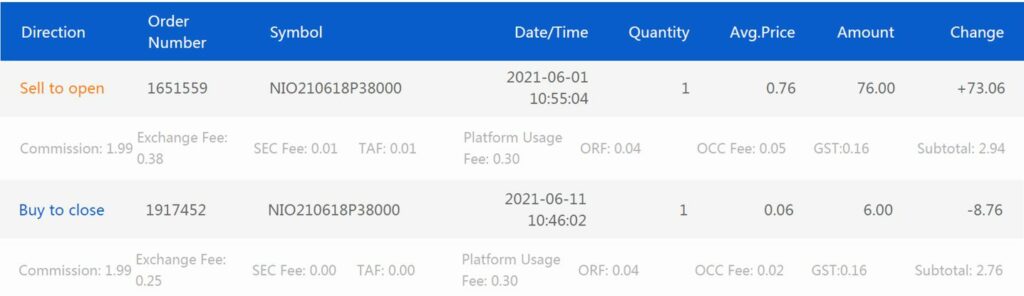

Trading Recap #3: NIO Sell Cash Secured Put (Profit: $64.3)

Strike Price: $38

Qty: 1

Date open: 1 Jun2021

Expiry date: 18 Jun 2021

Days to Expiration: 17

Stock Price at Open: $41.2

Delta at Open: 0.235

Date Closed: 11 Jun 2021

Days in trade: 10

Option Price at Open: $0.76

Option Price at Close: $0.06

Fee: $5.7

Profit: $64.3

Return: 1.69%

Annualized: 61.76%

I was basically repeating the same thing again and again. Right after I closed my Trade #2 above and freed up my collateral, I immediately sold another CSP of NIO. Except, this time I was more confident and more greedy, so I chose the one with slightly longer expiry date (17 days to expiration) to maximize the premium and time decay. I also chose a slightly higher Delta at 0.235 instead of my usual comfort zone (Delta 0.2) because I was bullish.

My bet was right. NIO went up slowly and steadily. On 11 Jun, which was 10 days after my opening position, NIO was trading above $45 and the put option was trading at $0.06. There were 7 more days to expiration but it doesn’t make sense to wait for 7 more days just to earn another $6, so I decided to close my position on that day and collected a handsome profit of $64 after fees.

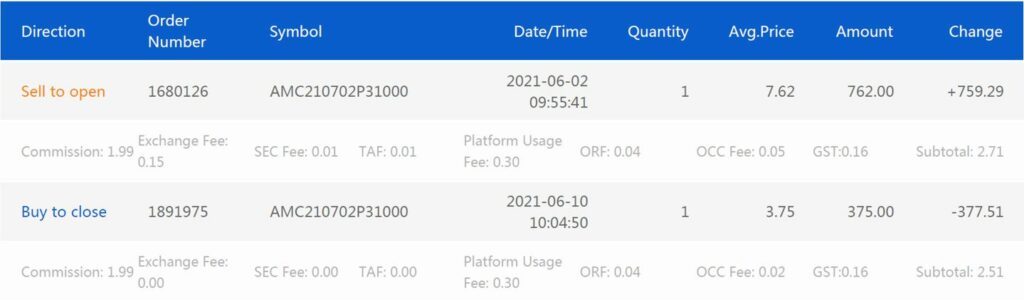

Trading Recap #4: AMC Sell Cash Secured Put (Profit: $381.78)

Strike Price: $31

Qty: 1

Date open: 2 Jun2021

Expiry date: 2 Jul 2021

Days to Expiration: 30

Stock Price at Open: $41

Delta at Open: 0.23

Date Closed: 10 Jun 2021

Days in trade: 8

Option Price at Open: $7.62

Option Price at Close: $3.75

Fee: $5.22

Profit: $381.78

Return: 12.32%

Annualized: 561.89%

After making 3 very similar trades, I got bored. I needed a variety. I browse the news and something caught my attention. AMC was making headlines as it shot up from $10+ to $30+ in 1 week. That’s a 3X increase! Not wanting to miss the boat, I sold a cash secured put of AMC at strike price of $31, for the premium of $7.62. That’s a crazy high premium for a 30 days to expiration option, all thanks to the high volatility. If this option expires worthless on 2 Jul 2021, I’ll be earning 24% return on collateral in a month! Mind-blowing!

I was really lucky because I got in at the early days of AMC’s rise. When I opened my position on 2 Jun, AMC was trading at $41. Later that day, AMC closed at $62. In the next few days, AMC remained well above $41. A week later, AMC was on a bearish trend, it fell from $55 on 8 Jun to below $50 on 9 Jun. I was stressed out because I was afraid that AMC will be dropping fast and furious back to $10+. I did not want to get assigned at any cost.

I kept researching about option adjustment strategies, what to do if stock price fall when you sell CSP, should I bit the bullet and close early, yada yada. AMC was all I could think about day and night. This is the nightmare that will haunt you if you did not choose the correct stock with the correct fundamental. AMC is a meme stock, its price isn’t dictated by its fundamental. And I was playing with a very risky stock.

On 10 Jun, I made the decision to close my position early. My reasoning is this: I’ve made 50% profit (387/762 = 50.8%) after 8 days in this trade, why would I wait another 3 weeks just to earn another 50%? It doesn’t make sense to keep the option until expiration. Furthermore, the stock price is falling, who knows if it will ever rise again?

In hindsight, AMC did not fall to below $31 by 2 Jul 2021. If I held the option for another week or two, I may earn 70% or 80% profit. Anyway, I did not regret my decision. If AMC did fall to $10+, I might have quit option trading by now.

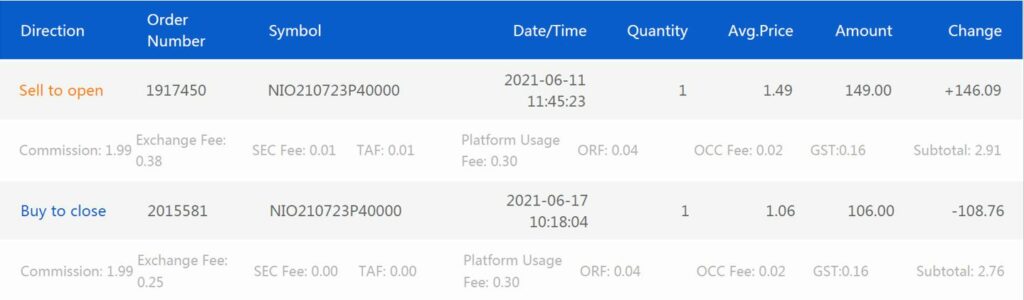

Trading Recap #5: NIO Sell Cash Secured Put (Profit: $37.33)

Strike Price: $40

Qty: 1

Date open: 11 Jun 2021

Expiry date: 23 Jul 2021

Days to Expiration: 42

Stock Price at Open: $45.1

Delta at Open: 0.28

Date Closed: 17 Jun 2021

Days in trade: 6

Option Price at Open: $1.49

Option Price at Close: $1.06

Fee: $5.67

Profit: $37.33

Return: 0.93%

Annualized: 56.77%

After closing trade #3, I re-deployed the collateral to sell CSP for NIO again. This time, instead of near-to-expiration, I ventured into the unknown territory: 42 days to expiration, because I just wanted to know how it feels to sell CSP that is more than 1 month to expiration.

The stock was fluctuating as usual. On 15 and 16 Jun, the stock was bearish and fell to $45. The price of the put option decreases due to time decay (which I should be happy about). But, on 17 Jun, I got cold feet. I had an irrational fear that I had used up all of my beginner’s luck in the AMC option (Trade #4). So, I bought back the put option at $1.06. It was a 28% profit after 14% time decay, not too bad actually.

In hindsight, there were a lot of volatility between 17 Jun to the expiry date of 23 Jul. But the price never fell below my strike price of $40. I didn’t regret my decision because I definitely would prefer many good night sleeps than an extra of $106 in my account.

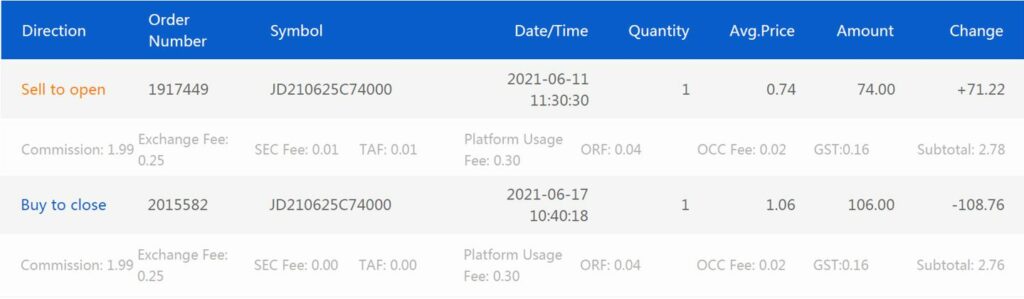

Trading Recap #6: JD Sell Covered Call (Loss: $37.54)

Strike Price: $74

Qty: 1

Date open: 11 Jun 2021

Expiry date: 25 Jun 2021

Days to Expiration: 14

Stock Price at Open: $71.2

Delta at Open: 0.27

Date Closed: 17 Jun 2021

Days in trade: 6

Option Price at Open: $0.74

Option Price at Close: $1.06

Fee: $5.54

Profit: -$37.54

Return: -0.51%

Annualized: -30.86%

I bought 100 shares of JD at $71.7, which I think is a good entry. I sold covered call (CC) because I wanted to earn premium while holding a stock. I chose Delta 0.27 which translates to strike price of $74.

On 17 Jun, the stock price was increasing and getting closer to my strike price of $74. When the price reached $72.9, I got a panic attack! I realized that JD has a potential to reach higher price, and I really didn’t want to sell at $74. The call option price also increased to $1.06. I made the decision to bite the bullet and buy back the call option at $1.06. This became my first losing option trade. My loss was -$37.54. Lesson learned: do not sell covered call at strike price that you’re unwilling to sell your stocks at.

In hindsight, JD’s price closed at $78.5 on 25 Jun. If I were to hold until expiration, my call would be exercised and I would be selling my JD at $74. So, biting the bullet was a good decision. Of course, during that time nobody knew that China govt would be cracking down the tech industry in the coming months and JD price would dip to lower $60s.

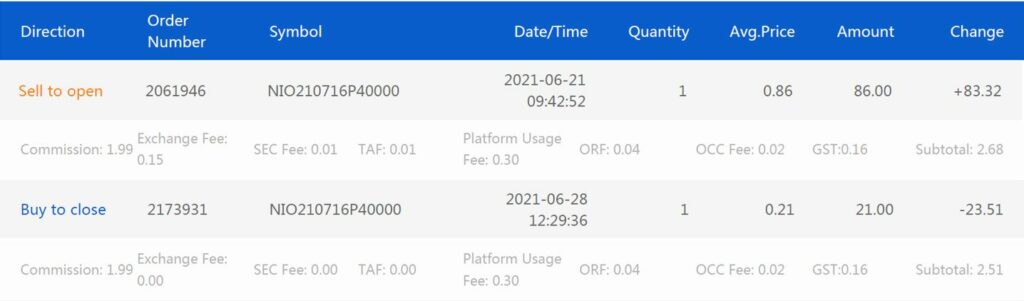

Trading Recap #7: NIO Sell Cash Secured Put (Profit: $59.81)

Strike Price: $40

Qty: 1

Date open: 21 Jun 2021

Expiry date: 16 Jul 2021

Days to Expiration: 25

Stock Price at Open: $45.5

Delta at Open: 0.19

Date Closed: 28 Jun 2021

Days in trade: 7

Option Price at Open: $0.86

Option Price at Close: $0.21

Fee: $5.19

Profit: $59.81

Return: 1.5%

Annualized: 77.97%

This trade is pretty straight forward. It’s the same cash secured put that I’ve done so many times in this month. The option has 25 days to expiration when sold, and NIO was traded at $45.5.

7 days later, NIO price shot up to $49, hence option price decreased rapidly to $0.21. The profit at 7 days was 75%, so it didn’t make sense for me to wait for 18 more days just to get the remaining 25%.

Open Positions by 30 Jun 2021

I have 4 open positions by 30 Jun, which I will close in July. 3 of them are in Moomoo and 1 in IBKR. Because they’ll be closed in July, I will write about them in July’s recap.

Summary

Total premium earned = 547.57

Yield on cost = 547.57/10,386.24 = 5.27%

Total sleepless nights = a couple of nights

FYI, I track my option performance daily using my simple spreadsheet. That’s how I get to know how much profit I have made versus time decayed at any point in time. I would close my option early if I’ve gained a lot of profit (more than 70%) within a short time.

That’s all for this month. See you in next month’s trading recap! If you want to get notified of my new posts, do subscribe to my email.

If you find this post helpful, feel free to buy me a coffee :)

Hey thank you for journaling this ! it sounds like lucrative strategy .

cant wait to try them !!

You’re welcome Germaine! Hope you have a great trading journey! Play safe!

Hi Prudent Dreamer,

Thank you for sharing your options trading journey. You provided an insight on how you go about your options trades and i love to read them. Please share more for your August results.

Hi Coco, thank you so much for your encouragement, I really appreciate it. I will keep sharing my trading recap 🙂

thanks alot prudent dreamer. I hope to be able to be as confident first in order to make my first trade! there seems to be alot to understand in this New complex world to me. thanks for documenting this!

You’re welcome, Jo!

Hi Prudent Dreamer!

This is John again. Thanks so much for sharing. Your articles are really insightful and educational. I am very grateful!

One quick question about your Sell Cash Secured Put in Moomoo system please.

I didn’t realize that we can “close” our position before expiry! I thought we must always wait until expiry date and thus at the mercy of the person who bought my put.

So my question is:

When you close your position earlier, in the Moomoo system, do you go to the Put (which you sold and filled earlier), click the “Trade” button for it and then set the premium price and then click “Buy” in the trading system?

Appreciate your kind advice on the operational steps please.

Sincere thanks!

Hi John! Glad you found my article useful 🙂 Yes, you can close your position early to lock in your profit. Yes, the procedure you mentioned is correct. You can also click on the option from “Quotes” tab. If you notice, when you sell an option in Moomoo, that option will automatically appear on your watchlist under “Quotes” tab. After you buy, Moomoo will automatically understand that you’re closing your position. In the daily transaction report, you will see Moomoo describe your buy as “Buy to Close”. Hope you have a great option trading journey!

Many thanks Prudent Dreamer! Greatly appreciate it!

Look forward to more articles from you again soon…

Have a good weekend!

Thank you. I am beginning to see the light in regards to option trading. Your documentation (by listing each trade ) of your trades are particularly helpful. Thanks again. Hope one day I will have the confidence to begin trading options.

You’re welcome, AN! Take your time, no need to rush 🙂 When you’re ready, you can start with Delta 0.1 for higher chance of winning.