February 2022 was the ninth month I traded options in the US market, and also the second month I’m in the red (aka loss) zone. The war was in full force and the stock market was really jittery.

This is the month where I scaled down the number of trades for the first time, partly because it’s too painful to open my moomoo app and see everything falling, and partly because I don’t want to rush into trades and getting burned unnecessarily. I only entered trades I’m feeling comfortable with.

Without further ado, here’s my trading recap for February 2022.

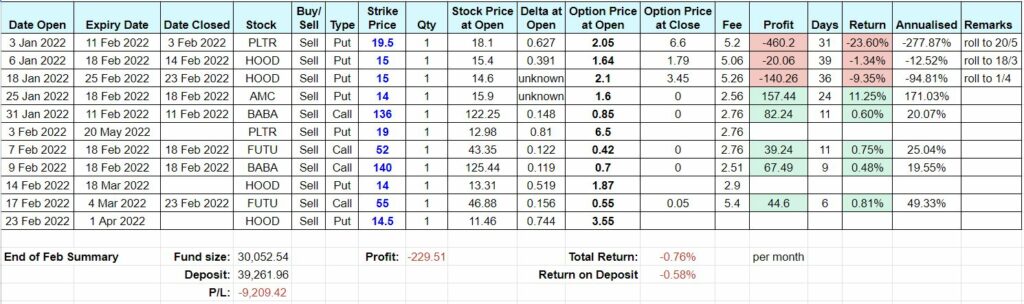

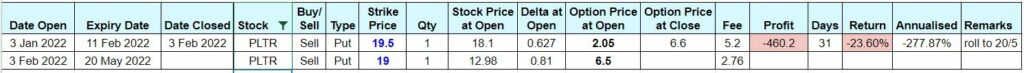

Summary of Trades Done in February 2022

In February 2022, I opened 6 new positions and closed 8 positions. I had 3 losing trades and 5 winning trades.

At the end of the month, there are 3 positions that I carried over to next month. My return is -$229.51 which is -0.76% a month based on my fund size.

This month, my account size shrank to 30k. My deposit was 39k, so essentially I’m at 9k paper loss. It’s hurtful, but this too shall pass.

As I’m writing this, I just realized that ALL of my losses come from the 3 positions that I rolled over (2 HOOD and 1 PLTR). Since what I received is more than what I paid during rolling, that means, as long as I keep rolling these 3 positions until they’re gone, I am not losing money. Now things don’t look that bleak anymore.

Brief Trading Stories about Each Stock

AMC

I had only 1 trade for AMC. It was a short put that I rolled over from a losing trade in January 2022. At open, stock price was $15.9 and strike price was $14. I held this until expiration on 18 February 2022 where the stock closed at $17.9. In summary, the final profit of this trade since January = 160 + 65 – 135 – 5.5 – 2.56 = $81.94. Not a bad profit for 1 month of holding (plus a bit of emotional suffering).

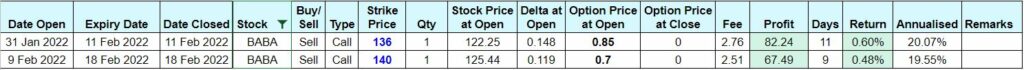

BABA

I sold 2 covered calls for BABA. Trade #1 (expiry 11 Feb) was rolled over from January. Trade #2 was a new trade. Both were held to expiration and expired worthless.

I used to have emotional turbulence when selling covered calls and would panic whenever price spikes up. It feels so good to hold these 2 to expiration, have them expired worthless and conquer my emotional turbulence in the process.

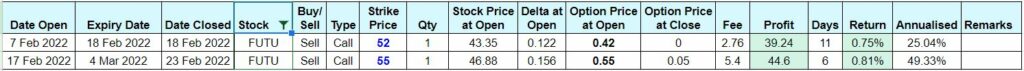

FUTU

My 2 FUTU selling-covered-calls also ended in happy endings. Sold them at strike price of 20% above current price and both of them never went above my strike price.

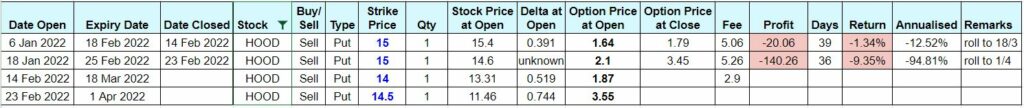

HOOD

As for HOOD puts, I’m still bagholding the 2 losing puts that I opened in Dec & Jan. HOOD kept falling in Feb, and both puts kept being in the money. I decided to roll them further out.

PLTR

Similar to HOOD, PLTR also kept falling and I had to kept rolling my put out. I decided to roll this particular trade 3 months out to May 2022 cos I’m honestly tired of monitoring and rolling trades.

Lesson Learned

This month, I learned to scale down and step back.

I was doing 15+ trades in previous months, but this month, I’m content with doing only 11 trades.

I also stepped back from my laptop most of the trading hours to keep my sanity.

Basically, this month I felt emotionally stable doing option trading.

That wraps up my February 2022 recap!

If you’re new to my recaps, here are some notes about my option trading:

- I use moomoo to do most of my option trading and sometimes IBKR

- I mostly sell cash secured puts and covered calls to earn premium

- You can read all of my previous options trading recaps here

- Here’s my guide to how to trade options with moomoo

- I use this spreadsheet to calculate how much profit I have made versus time decayed at any point in time, track my P/L monthly, as well as to record my deposit and withdrawals.

That’s all for this month. See you in next month’s trading recap! If you want to get notified of my new posts, do subscribe to my email.

PS: If you don’t have a moomoo account yet, you can sign up here and get up to free 1 Amazon share, SGD 40 stock cash voucher, SGD 60 cash upon deposit and completing the necessary tasks. Promotion valid till 31 Oct 2022, 0959 SGT. Here’s the detail on moomoo’s latest welcome bundle.

If you find this post helpful, feel free to buy me a coffee :)