August 2021 was the third month I traded options in the US market. This is a relatively quiet month in terms of number of trades. I had my first assignment this month as the put option that I sold expired in the money. No loss was incurred this month.

You can read all of my options trading recaps here.

What options strategies I am trading

I sell cash secured puts, covered calls and credit spread (bull put).

I won’t be going into the details of each strategy, because it’s gonna take another 1000-2000 words. I will write a separate post regarding covered call and credit spread (bull put) in the future when I have the time =) in the meantime, you can use Google or YouTube to learn about them.

What platforms I use

I use Moomoo to trade sell secured puts and covered calls. I had written a post on the step-by-step ways to trade options in Moomoo.

I use Interactive Broker (IBKR) to trade credit spreads because Moomoo doesn’t allow credit spread yet.

What are the sizes of my accounts

At the beginning of the month, my fund sizes are about US$ 17,600 in Moomoo and US$ 940 in IBKR.

Trading Recap

Trading Recap #1: TSLA Sell Credit Spread Bull Put (Profit: $75.73)

Strike Price: $580/575

Qty: 1

Date open: 27 Jul 2021

Expiry date: 20 Aug 2021

Days to Expiration: 24

Stock Price at Open: $647

Delta at Open: 0.17

Date Closed: 20 Aug 2021 (exp)

Days in trade: 24

Option Price at Open: $0.78

Option Price at Close: 0

Fee: $2.27

Profit: $75.73

Return: 75.73/422 = 17.9%

Annualized: 272%

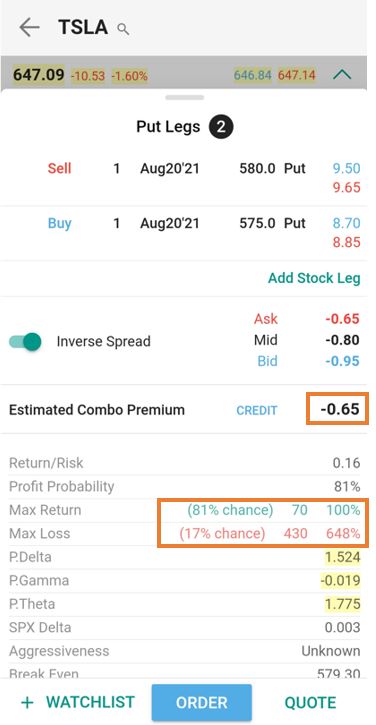

This was my second credit spread on Tesla. I was basically repeating my previous strategy, which is to do vertical bull put spread with strike price 10% below the current price. Tesla was trading at 647, and 10% below 647 is 582. Hence, I chose strike price of 580/575.

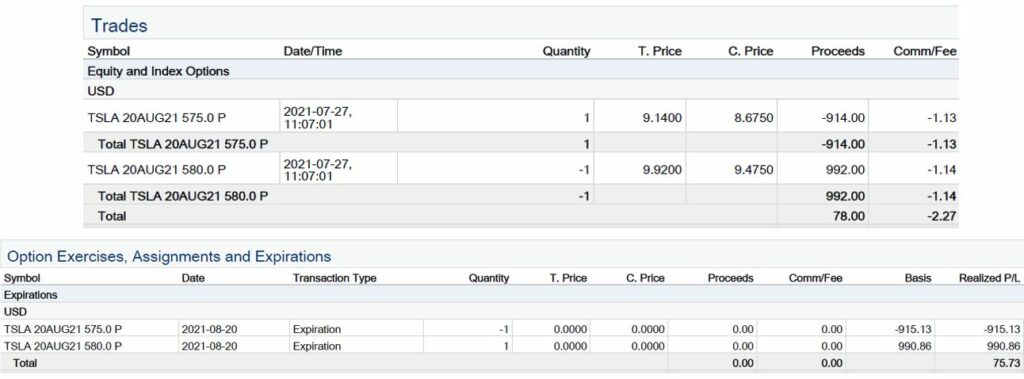

This trade has 17% of losing, and the max loss is estimated to be $430 if TSLA fell to below 575. As can be seen in the screen capture above, my estimated premium was $65. After submitting with market order, my trade went through and earned me $78 premium.

Between 27 Jul to 20 Aug, TSLA was on a bull run. At expiration date, TSLA was trading at $680, hence my spread expired worthless.

Trading Recap #2: JD Sell Cash Secured Put (Profit: $72.09) – Assigned

Strike Price: $65

Qty: 1

Date open: 23 Jul 2021

Expiry date: 20 Aug 2021

Days to Expiration: 28

Stock Price at Open: $72.3

Delta at Open: 0.1

Date Closed: 20 Aug 2021 (exp)

Days in trade: 28

Option Price at Open: $0.75

Option Price at Close: NA

Fee: $2.91

Profit: $72.09

Return: 1.1%

Annualized: 14%

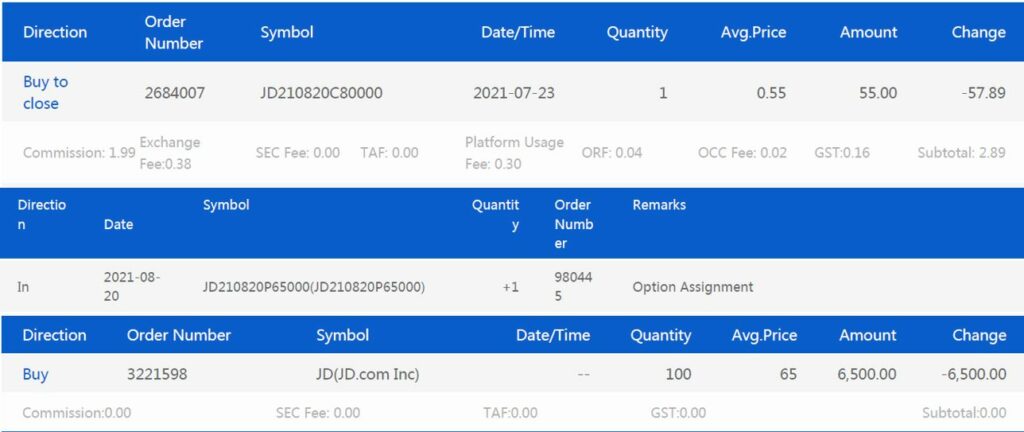

I opened this trade on 23 Jul when JD was trading at $72.3. The recent low was $70 and recent high was $79. I had success with my previous JD CSP (see July recap, trade #5) with strike price of $68.5, which I closed at 90% profit, so I thought that there is no way that JD would fall to the 60s range. To be extra safe, I chose 0.1 Delta, which translated to strike price of $65.

Between 23 Jul and 20 Aug, JD had a wild rollercoaster. It oscillated between $72 and $62. This trade has 28 days to expiration when I sold it. The first 2 weeks were red. In the third week, I had a chance to close the option at 66% to 74% profit for the entire week, but I didn’t close it because I was confident it will expire worthless.

Well, in the final week, news about govt crackdown on tech industry sent JD down to 60s range. On the final day, 20 Aug, in the first trading hour, I actually had chance to exit if I wanted to. But I didn’t. JD closed at $63.62, hence my put option expired in the money and I got assigned 100 shares of JD at $65/share. I wrote about what happened during option assignment in moomoo, if you’re curious you can read that article.

I wouldn’t lie that getting assigned was partly excited (it’s my first time!) and partly stressful (what if JD never go up anymore because of the crackdown??). I tried to be level headed and told myself, well it’s a good company and I got it at a good price and I can sell covered call while waiting for the price to increase, so there’s no need to dwell on it.

After getting assigned, I did sell a covered call while waiting for the stock price to increase. I’ll write about this in Sep recap.

Trading Recap #3: PINS Sell Cash Secured Put (Profit: $147.22)

Strike Price: $55

Qty: 1

Date open: 2 Aug 2021

Expiry date: 27 Aug 2021

Days to Expiration: 25

Stock Price at Open: $58.4

Delta at Open: 0.3

Date Closed: 27 Aug 2021 (exp)

Days in trade: 25

Option Price at Open: $1.5

Option Price at Close: 0

Fee: $2.78

Profit: $147.22

Return: 2.7%

Annualized: 39%

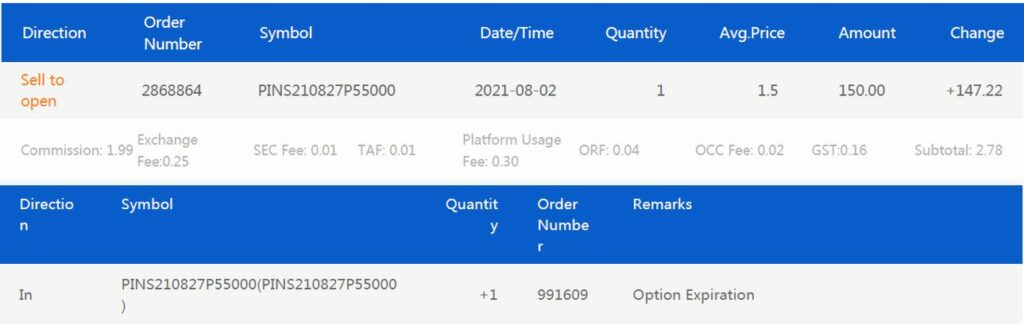

I initiated this trade on 2 Aug when I noticed that the share price dropped to 50s range. A few days ago, Pinterest released their outstanding Q2 earnings where their revenue increased 125% compared to last year’s Q2, and 28% compared to Q1. Meanwhile, their US MAU (monthly active users) is 5% lower than last year’s Q2 and 7% lower than Q1. Since their main earning comes from US users, investors are worried about drop in revenue.

PINS was trading at $58.4 (3-month low) and I felt that there is a potential to go up. Hence, I sold a 0.3 Delta cash secured put, at strike price of $55. The last time PINS traded at $55 was in May 2021.

It was an almost smooth sailing journey until expiration. Out of the 25 days I’m in the trade, only 4 days were in red (2, 18, 19, 20 Aug). The rest of the time were green days. On 27 Aug, the option expired worthless.

Open Positions by 31 Aug 2021

I have 5 open positions by 31 Aug, which I will close in September. 4 of them is in Moomoo and 1 is in IBKR. Because they’ll be closed in September, I will write about them in September’s recap.

Lesson Learned

70% profit is good enough to close a trade. You’ll never know what will happen in the final week before option expiration.

Summary

Total premium earned = 295.04

Yield on fund size = 295/18540 = 1.6%

1.6% is less than my target of 2% a month. I will try to make up for this shortfall in September.

FYI, I track my option performance daily using my simple spreadsheet. That’s how I get to know how much profit I have made versus time decayed at any point in time. I would close my option early if I’ve gained a lot of profit (more than 70%) within a short time.

That’s all for this month. See you in next month’s trading recap! If you want to get notified of my new posts, do subscribe to my email.

If you find this post helpful, feel free to buy me a coffee :)

Nice update! Much appreciated if you can do a post on how you select stock for selling options?

Hi Coco, thanks for your suggestion, that’s a very good idea! My criteria for choosing a stock are all jumbled up in my head and I definitely need to sort them out in an organized manner. Let me work on it, I will arrange my thoughts and present it in an article that’s easy to understand. Thank you!