Recently, I’ve been doing quite a bit of option trading of US stocks and the platform that I use to buy and sell options is Moomoo (by Futu).

PS: If you don’t have a moomoo account yet, you can sign up here and get up to free 1 Amazon share, SGD 40 stock cash voucher, SGD 60 cash upon deposit and completing the necessary tasks. Promotion valid till 31 Oct 2022, 0959 SGT. Here’s the detail on moomoo’s latest welcome bundle.

The reason I choose to trade options with Moomoo is because I find their platform to be very intuitive and user-friendly. Well, maybe that’s because I’ve spent hundreds of hours on Moomoo.

Anyway, if you are a new user and you are scratching your head trying to figure out how to trade options on Moomoo, fret not.

In this article, I’ll try my best to show you the step-by-step guide on how to buy and sell options on both desktop platform and mobile app.

I will not discuss about option strategies because you can read my in-depth article about option strategies here:

I also won’t explain the basic of options trading because I presume that you are already familiar with those stuffs. If you aren’t, let me know in the comment and I can do another post about the basic of options trading.

In this post, I’ll discuss about:

- What option strategies can you do in Moomoo?

- Moomoo’s options fees

- How to buy and sell options on Moomoo’s desktop platform

- How to buy and sell options on Moomoo’s mobile app

- How to Close a Position

- How to Exercise an Option

- What Happens if Options Expired OTM (Out of the Money)

- What Happens if Options Expired ITM (In the Money)

What option strategies can you do in Moomoo?

By default, you can buy and sell basic calls and basic puts (or cash-secured puts).

You can sell covered calls, but you need to activate covered call function by contacting their customer service. If you don’t request from CS and you go ahead with selling a call, your call will be treated as naked call. The easiest way to contact customer service is via the mobile app, go to Me – Customer Service. They replied quite fast when I contacted them during working hours.

As for other option strategies, such as vertical spreads, straddles, butterflies, etc, Moomoo said that they will be available soon in 2021.

Moomoo’s options fees

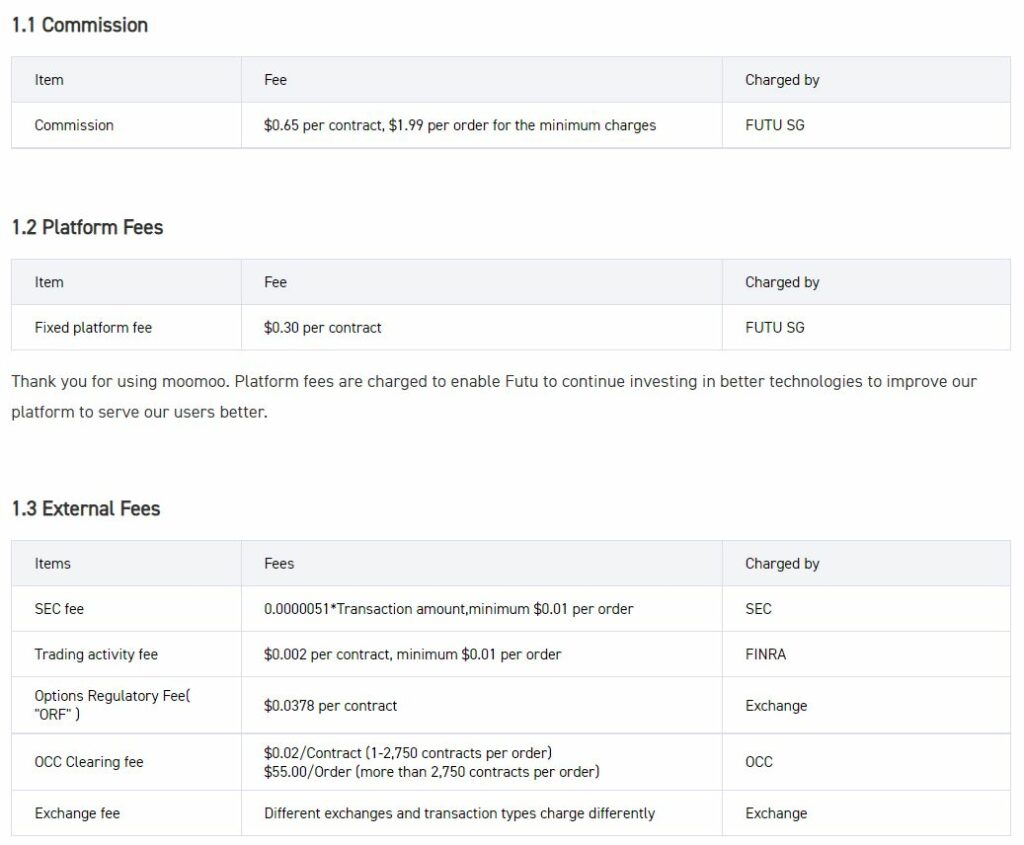

The below image shows the fees you need to pay when buying and selling options on Moomoo, which is screen captured from Moomoo’s website in July 2021.

You will be charged 1x when you open a position. Then, if you close your position before expiry, you’ll be charged 1x again. That means, you’ll be charged 2x in total, 1 for opening and 1 for closing a position.

However, if you hold the option until expiry, you won’t be charged any additional fees during expiration. That means, in total you’ll be charged only 1x, which is when you open a position.

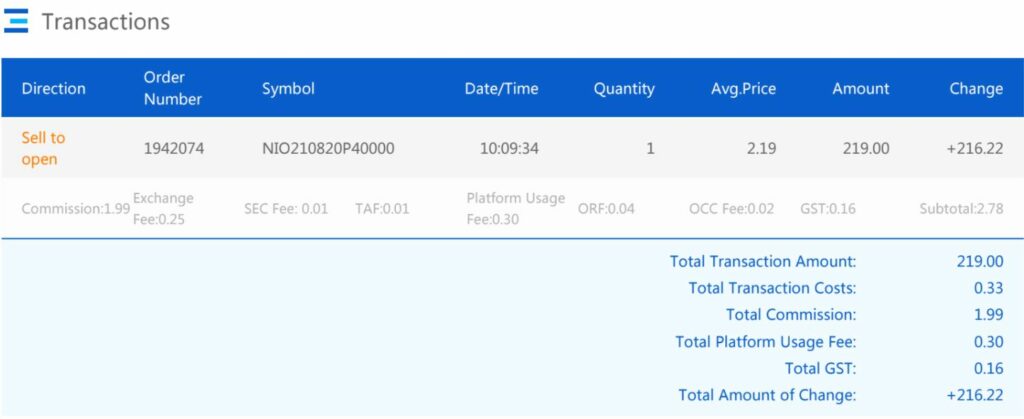

If the table looks too confusing and you want to gauge the fees you’ll be paying when you trade options, below is a sample of option fee that I paid when I sell 1 contract of Nio put (PS: 1 contract means 100 shares). Generally, I pay around $2.5 to $3 everytime I open or close a position of 1 contract.

How to buy and sell options on Moomoo’s desktop platform

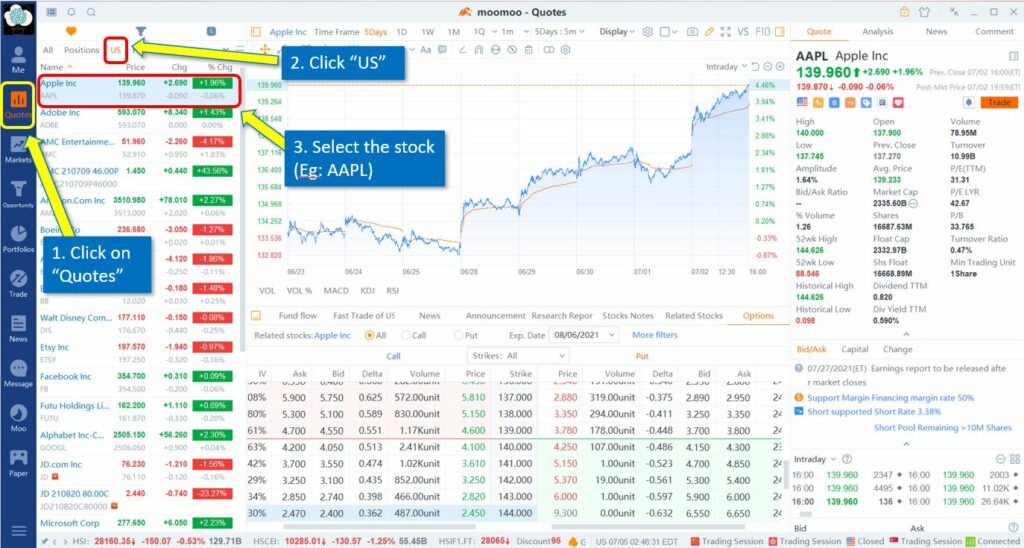

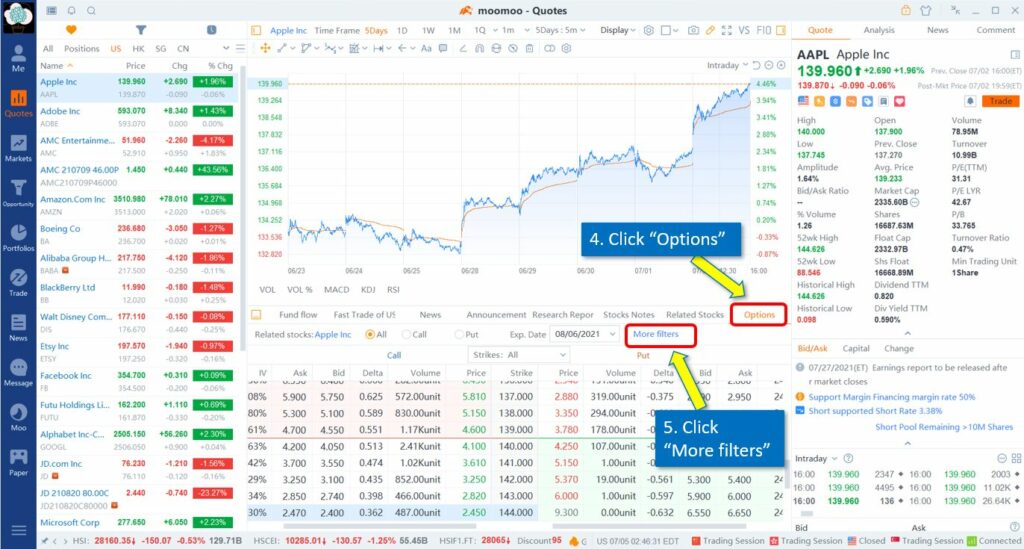

1. Click on “Quotes”

2. Click “US”

3. Select the stock (Eg: AAPL)

4. Click “Options”

5. Click “More filters”

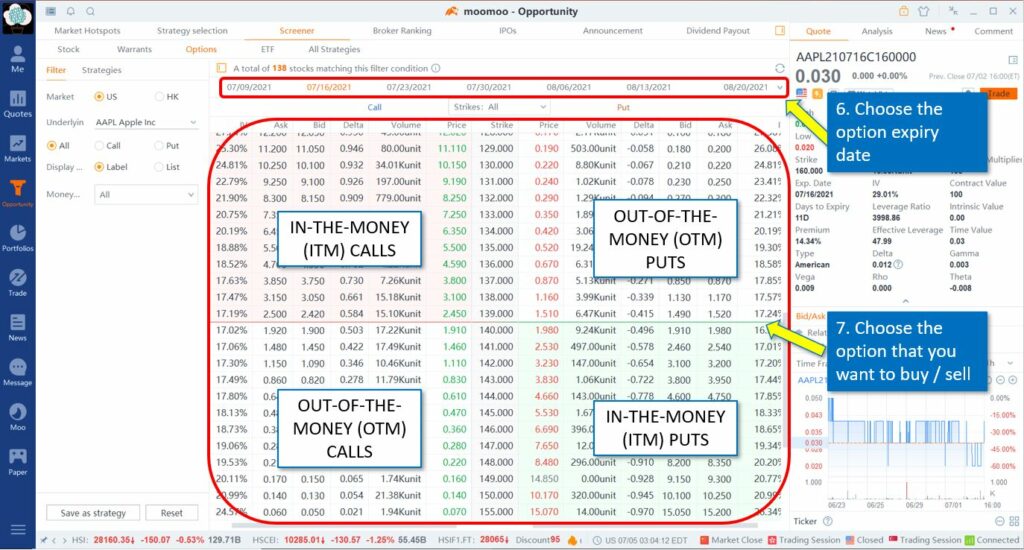

6. Choose the option expiry date

7. Choose the option that you want to buy / sell

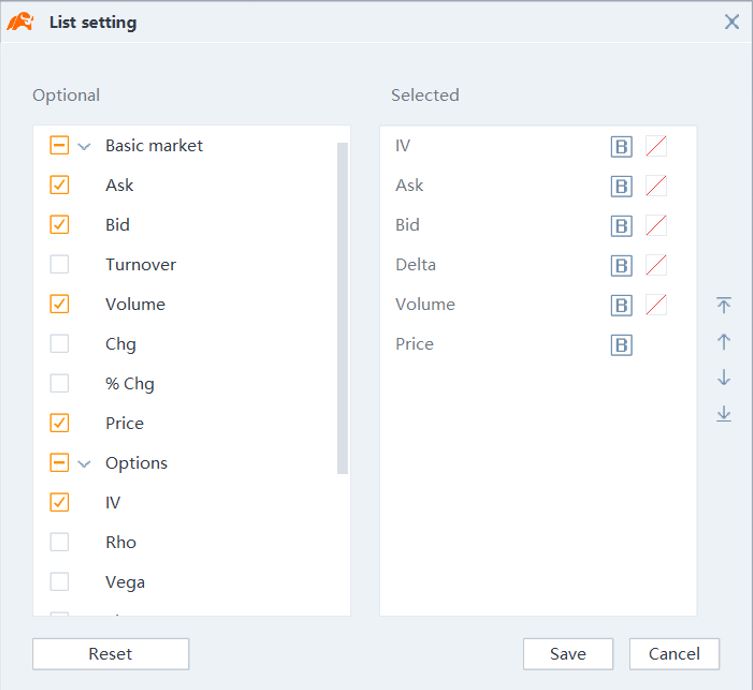

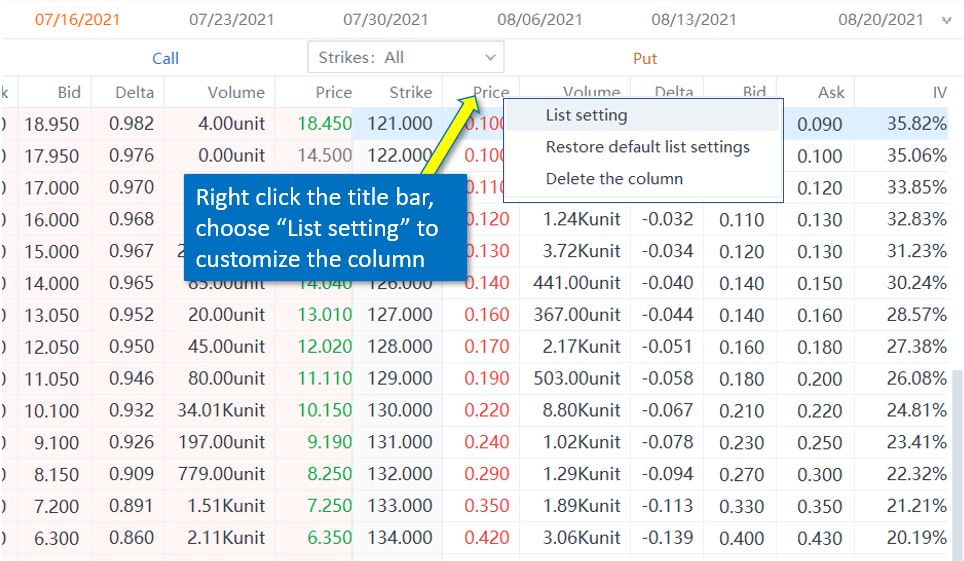

If you don’t like the columns displayed on the option chain, you can customize your display by clicking right on the column title, and choose “List setting.” Then, choose the columns that you want to display.

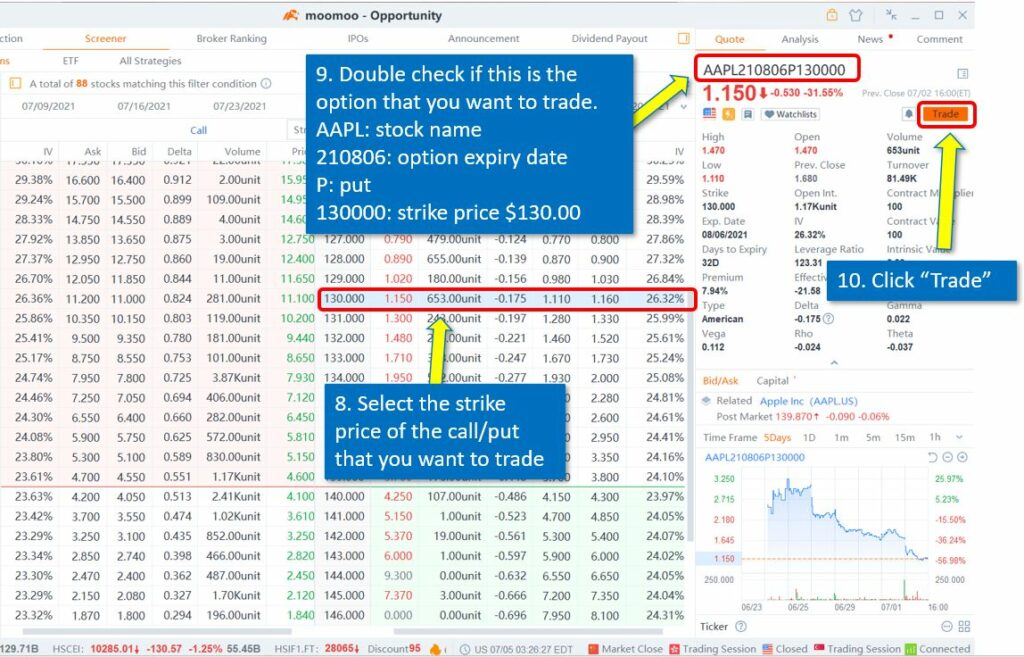

8. Select the strike price of the call/put that you want to trade

9. Double check if this is the option that you want to trade.

AAPL: stock name

210806: option expiry date

P: put

130000: strike price $130.00

10. Click “Trade”

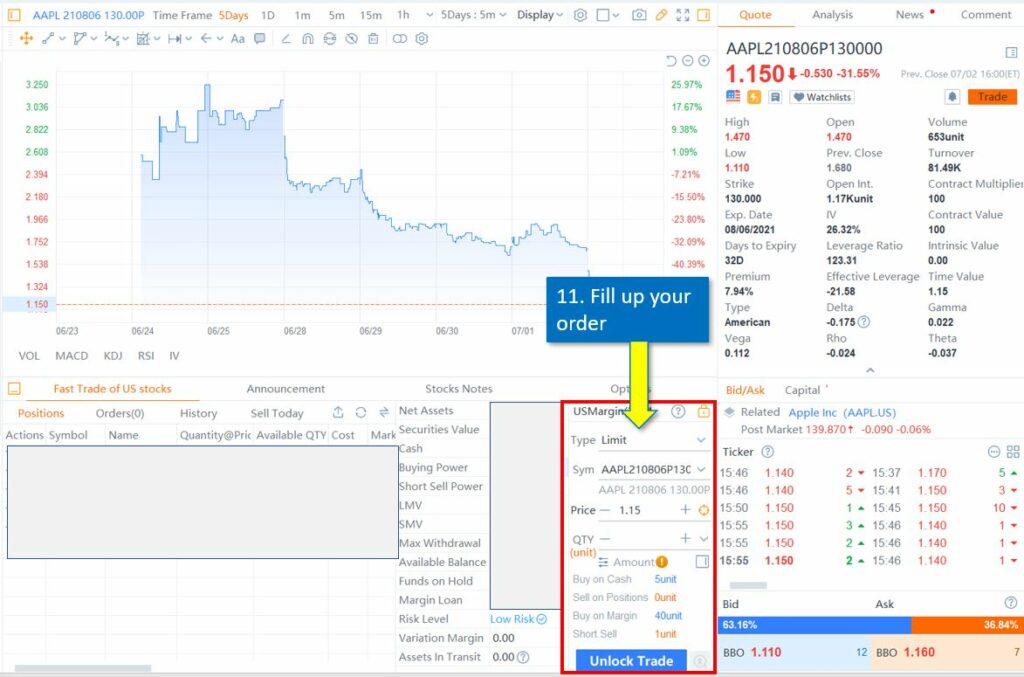

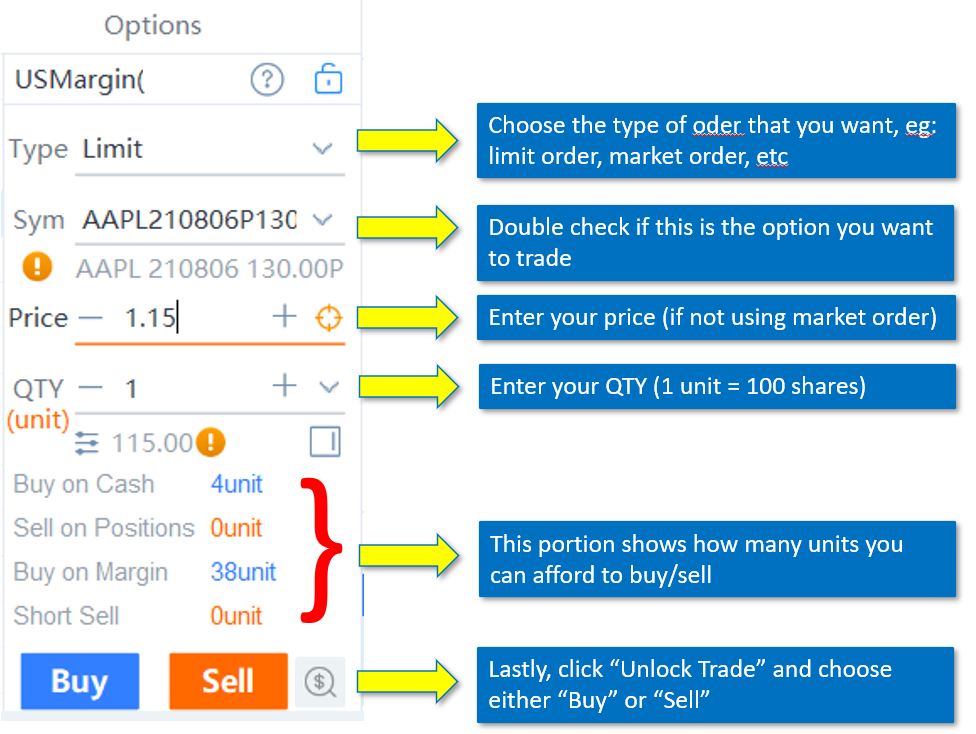

11. Fill up your order

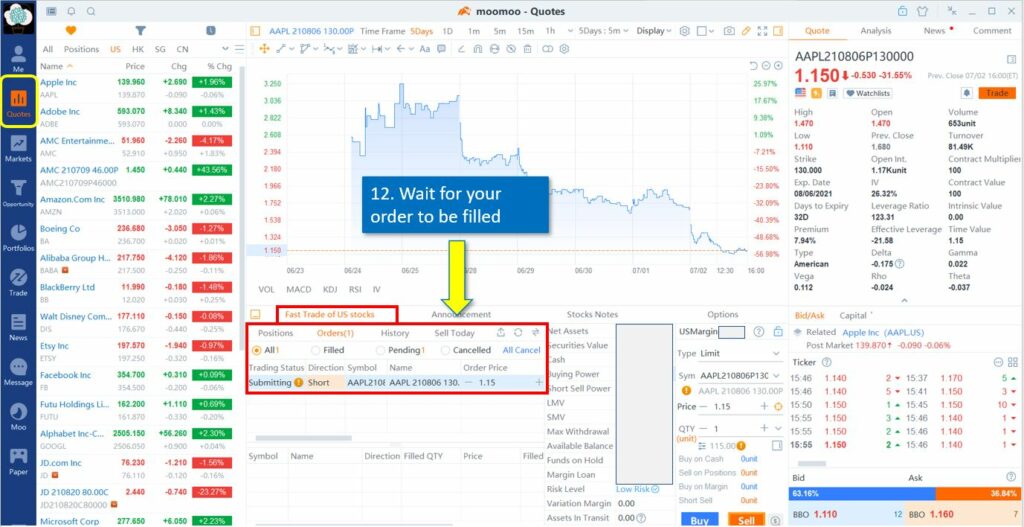

12. Wait for your order to be filled

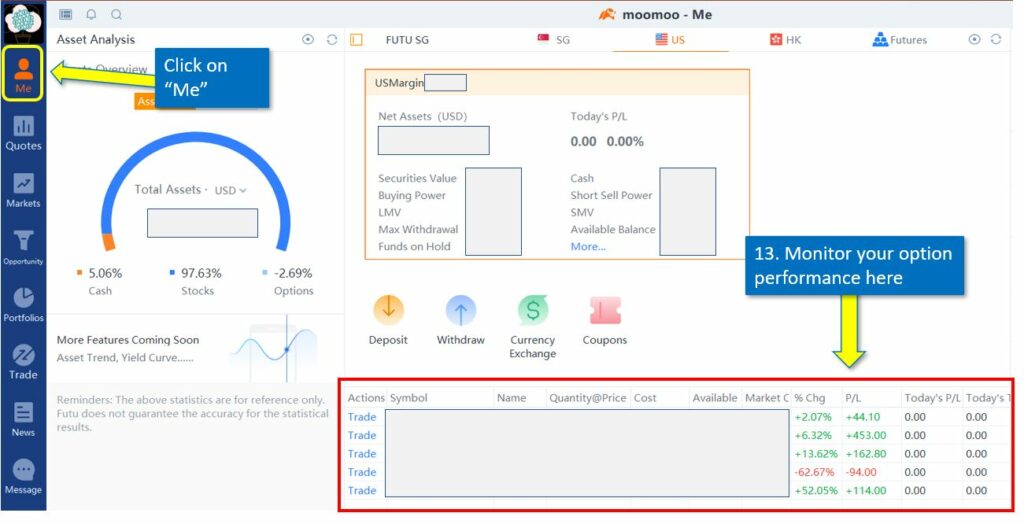

13. Monitor your option performance here. Click “Me”

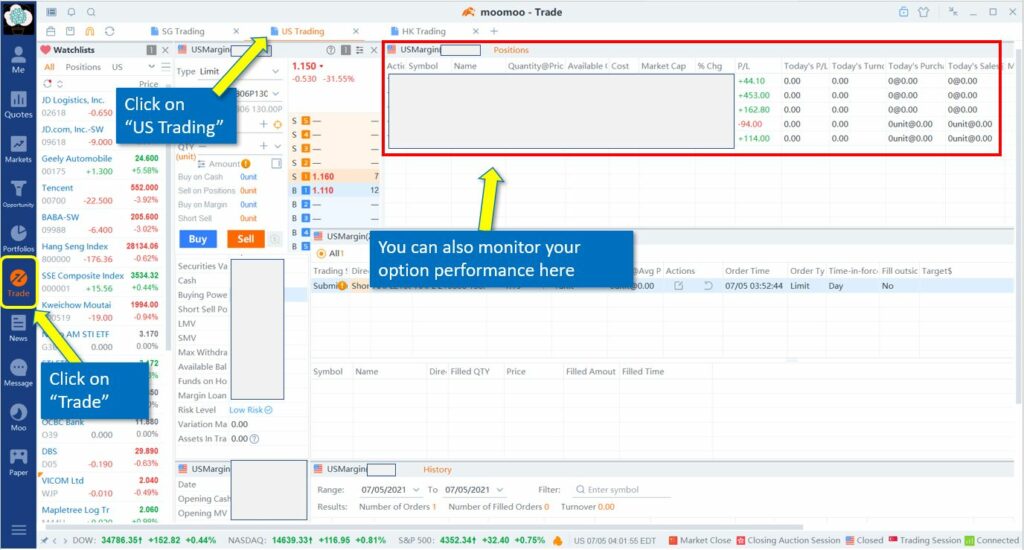

You can also monitor your option performance here. Click “Trade” – “US Trading”

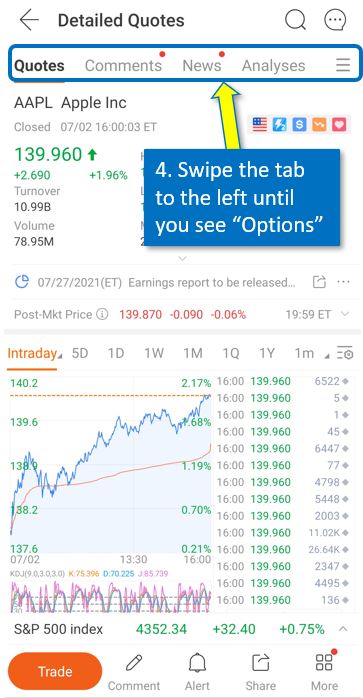

How to buy and sell options on Moomoo’s mobile app

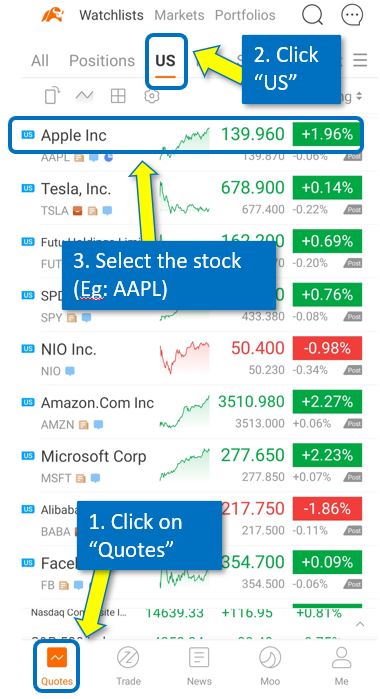

1. Click on “Quotes”

2. Click “US”

3. Select the stock (Eg: AAPL)

4. Swipe the tab to the left until you see “Options”

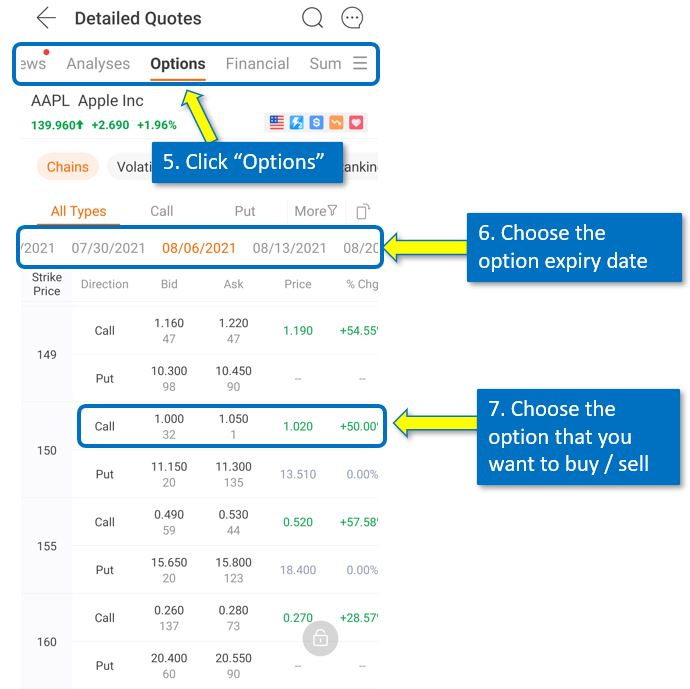

5. Click “Options”

6. Choose the option expiry date

7. Choose the option that you want to buy / sell

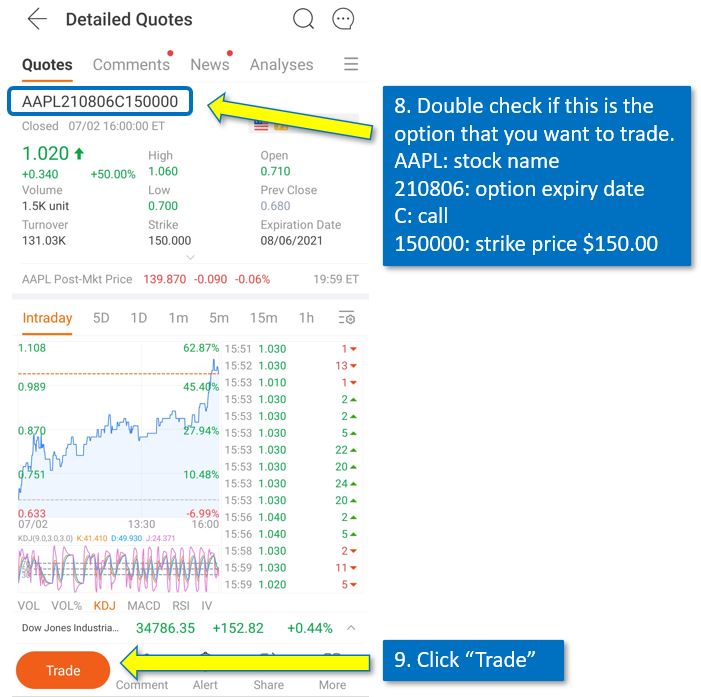

8. Double check if this is the option that you want to trade.

AAPL: stock name

210806: option expiry date

C: call

150000: strike price $150.00

9. Click “Trade”

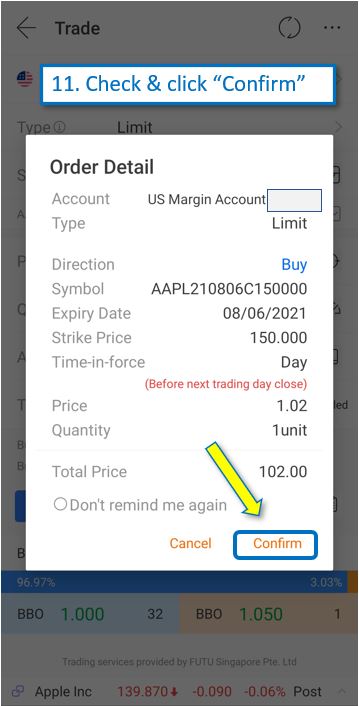

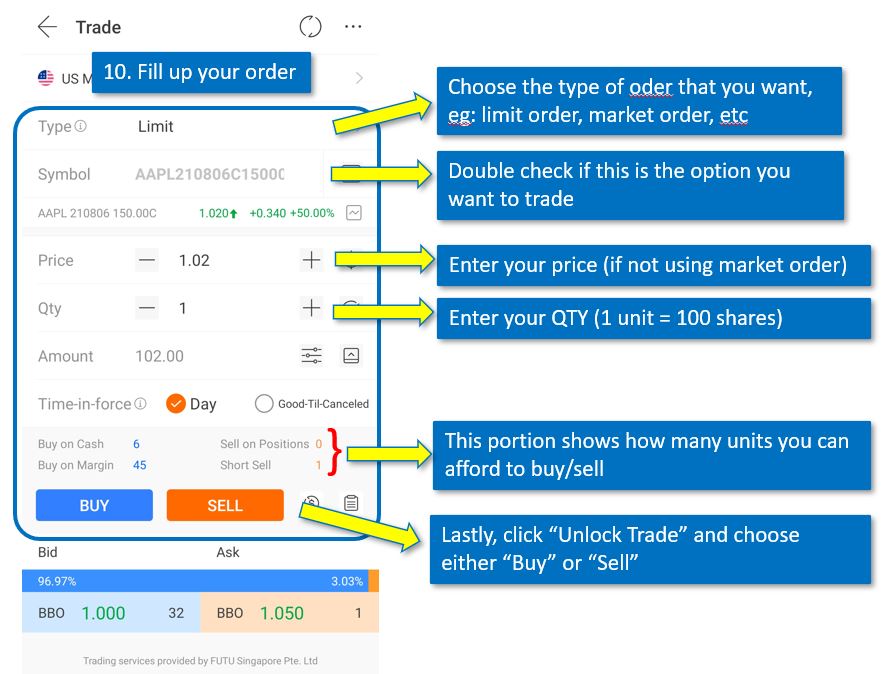

10. Fill up your order

11. Check & click “Confirm”

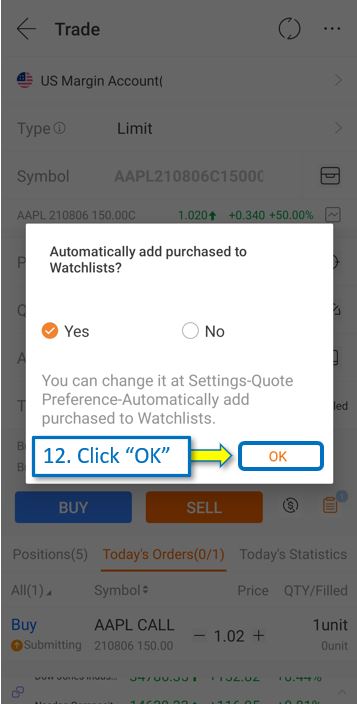

12. Click “OK”

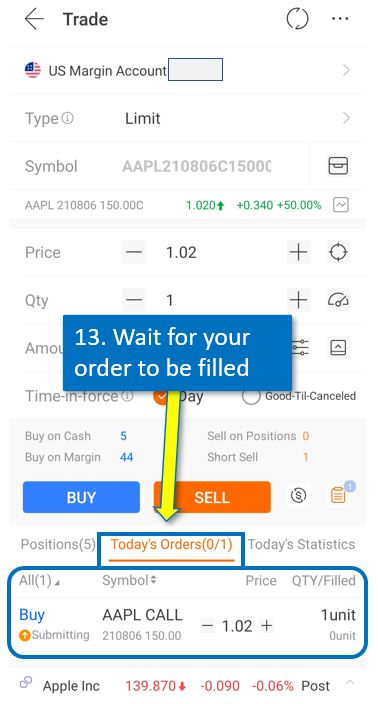

13. Wait for your order to be filled

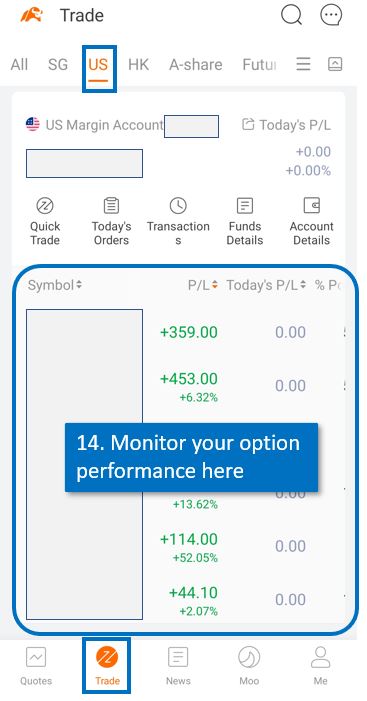

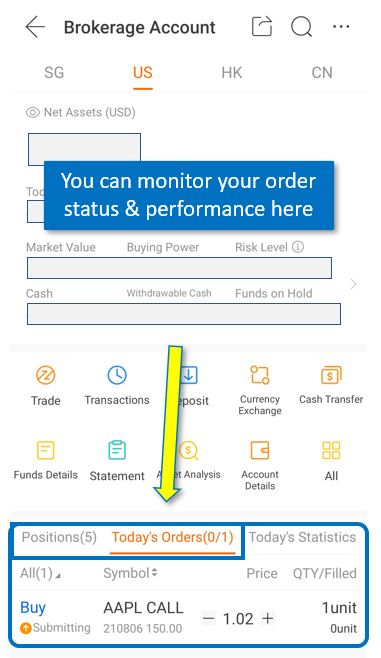

14. Monitor your option performance here. Click “Trade” – “US”

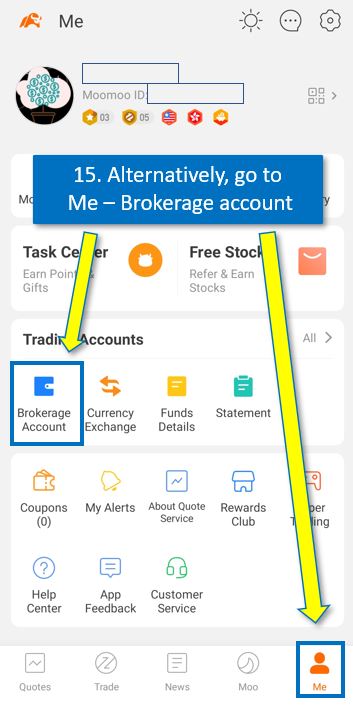

15. Alternatively, go to “Me” – “Brokerage account” to monitor your position performance and your order

How to Close a Position

If you have bought an option in the past, and now you want to sell this option (in other words, you want to close your position) before expiration, the process is exactly the same as buying an option except that you now click “Sell” instead of “Buy”.

Similary, if you shorted an option in the past and now you want to buy back an option to close your position before expiration, the process is exactly the same as selling an option except that you now click “Buy” instead of “Sell”.

There is no special steps on how to close a position. It’s just like a stock. If you have a stock and you want to sell it, you simply click “Sell” and your brokerage will dispose it from your account.

How to Exercise an Option

If you’re an option seller, you don’t have the right to exercise the option that you sold before expiration. You are at the mercy of the option buyer.

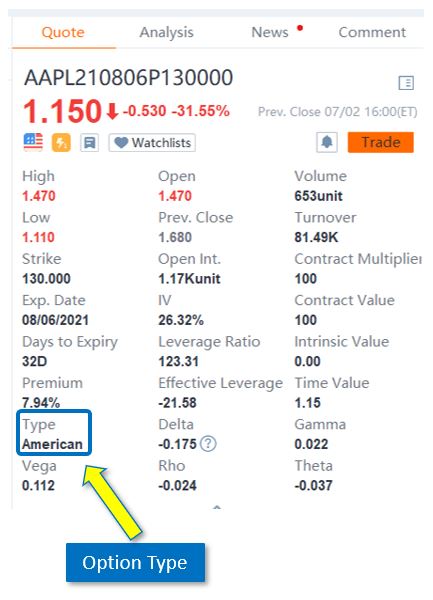

If you’re an option buyer, and the option you’re holding is “American” type, you have the right to exercise your option before expiration. To do so, you need to contact Moomoo manually.

How to know whether the option you’re holding is American or European? You can see it in the Option Quote description, as highlighted in the below image. You can see it on both desktop & mobile, but the example I’m showing below is taken from Desktop. As for European option, to be honest, I’ve never seen it on Moomoo.

What Happens if Options Expired OTM (Out of the Money)

On the next trading day, before market opens, Moomoo will send you:

1. email to announce that option has already expired, and

2. notification in the app to announce the expiration

If your option expires worthless on a Friday, nothing will happen on Saturday & Sunday, the options will still appear in your portfolio. Come Monday, after you receive email and app notification, then the expired option will disappear from your portfolio.

What Happens if Options Expired ITM (In the Money)

On the next trading day, before market opens, Moomoo will:

1. email you saying that option has been exercised

2. notify you in the app regarding the exercise/assignment

3. deduct/deposit money to your account as a result of the exercise/assignment

4. reflect the change of stocks in your account as a result of the exercise/assignment

If your option expires ITM on a Friday, nothing will happen on Saturday & Sunday, the options will still appear in your portfolio. Come Monday, after you receive email and app notification about the exercise/assignment and you’ll see changes in your portfolio as a result of the exercise/assignment. I wrote an article about my own experience getting assigned stocks when my put option expired in the money.

Conclusion

I hope this can help your option trading journey on Moomoo. If you haven’t got a Moomoo account yet, you can sign up with my referral link here and get a free share upon deposit.

If you have any questions, let me know in the comment!

Featured image: Canva Pro/Getty Images

If you find this post helpful, feel free to buy me a coffee :)

Sell-Put,

Do you “Buy” or “Sell” for opening the trade

Likewise for Buy-Put,

Do you “Buy” or “Sell” for opening the trade.

I am assuming to close for both will be the opposite?

I “sell” first, then I “buy” to close the trade. So, the maximum profit I can earn is the premium that I received when I sold it in the beginning.

Hi John!

Thanks for your article. Is truly helpful. I have some question

I have a moomoo account with very less cash inside. When i try to buy call option. I saw the system require me to buy with margin. However my intention was just gamble the stock will rise and to earn the capital gain from option price. I understand that the system require me to exercise the option assuming its in the money.

However, for my situation, since i just want to earn the capital gain from option price. Should I proceed with buy with margin. And sell off directly without being exercising the option? Thanks

Hi, this is not John, I hope it’s ok for me to answer your question. The system triggered you to buy with margin because you don’t have enough cash, but you probably have enough asset which moomoo can liquidate in case your call goes against you. Technically you can do that, buy the call then sell the call when stock price goes up, the system allows you to execute that. But if I were you, I wouldn’t buy call option with margin. Call option itself is already a very risky tool, add the margin portion and you’re increasing your risk multifold.

Thank you very much for this. Many charts are displayed in the post. But an experienced trader can explain this.

Hi I was wondering what your requirments were for selling naked call options? I haven’t been able to find a definite finra minimum and each broerage seems to have there own requirements. for example I was hoping to sell a 830 call option on tesla that expires on 10/8/21.

I am not so sure about the financial requirement for selling naked call options. I suggest that you contact the broker directly for a more definitive answer.

Hello! Chanced upon your blog and found it very helpful! Can you do a post on basic on options trading?

Hi QL,

Sure. Thanks for your feedback!

Hi PrudentDreamer,

Thanks so much for the detailed explanations. Greatly appreciate it!

I have a few questions on how to use the Moomoo platform and hope you can kindly advise/help please.

Situation #1 based on “Sell put”

If the stock price drops below the strike price of my sell put, and I need to buy the 100 units of stock. What are the steps I need to take in Moomoo desktop or mobile app?

Situation #2 based on “Buy call”

a) If the stock price rises high above the strike price of my buy call, and I want to sell away my call contract to earn premium. What are the steps I need to take in Moomoo desktop or mobile app?

b) If the stock price rises high above the strike price of my buy call, but this time I decide to buy the 100 units of stock and keep for long term. What are the steps I need to take in Moomoo desktop or mobile app?

Sincere thanks and hope to hear from you again soon!

Hi John,

Glad my article helps!

Situation #1: There are 2 possibilities. First, if your option buyer decided to exercise his/her put option early before expiration, Moomoo will execute the exercise and deduct your money and deposit the stock to your account. Second, if your option buyer decided not to exercise early, both you and the buyer simply just wait until the expiry date, and Moomoo will settle the transaction. You, however, do not have the right to decide whether you want to get assigned early or at expiration. Most of the time, option buyers rarely exercise their option before expiration.

Situation #2:

a) It’s exactly the same step as buying the call, except this time you’re selling the call. Just click on your call option, then click trade, then sell the qty.

b) As a call buyer, if you want to exercise your call option before expiration, you need to contact Moomoo to tell them your intention. See the details here. Alternatively, you can also wait until option expiry, if the price is still above your strike price, you’re in the money, so Moomoo will take care of the transaction automatically.

Hope it helps. Let me know if you have more question and I’ll be glad to help.

Hi PrudentDreamer,

Thanks very much for the clear and detailed explanations. Greatly appreciate it!

I understand now! All clear and thanks for your advice/help.

Many thanks!

Hi, after I sell a put option, how do I close this position in moomoo before contract expiry.

Hi, it’s the same process as selling. Instead of selling, just click buy. Moomoo can automatically understand that you’re buying to close your position, you don’t have to tell them that you’re buying to close, not opening a new buy position. Hope I make sense.

Hi, can I check if we can sell a call option position or put option position in moomoo before the contract expiry?

Yes, all call/put buy and sell order must be submitted before option expiry.

Do you have the steps to sell a call/put position on moomoo?

This is it. This post that you’re commenting on is the step by step guide.

Hi Prudent Dreamer, thanks for the very detailed post. I have a question on cash secured puts. For example, if I sell a BABA cash secured put @ $150, would I only need the maximum cash amount of $15,000 in my account? because in the extreme scenario that BABA drops to $1, the value of the put option contract would likely exceed $15,000 because of the time value of the option. In that scenario, would I need more collateral in my account beyond the initial $15,000? thank you

Hi AlpacaInvestments, yes you’re right, for selling put option at the strike price of $150, you only need to have $15,000 cash in your account. In the event that BABA price drops to $1, the price of put option will shoot up (let’s say it goes up to $180, hypothetically), but you don’t need to top up your cash. You can simply wait for the option to expire, then your brokerage will deduct $15,000 from your account to purchase 100 share at $150 each.

It is very detailed. thank you for your hard work.

Could you share more how to use the platform features?

Thank you! Any particular feature or just the general how-to-use-moomoo?