December 2021 was the seventh month I traded options in the US market. I thought November 2021 was my worst month, well, it turned out that December 2021 was worse.

There were quite a number of unfavorable outcomes, such as: getting assigned early, clicking the wrong button (buy instead of sell), panic closing.

Part of me wanted to blame the change of daylight saving time as the cause of my misfortunes (trading hours start at 10.30pm Singapore time from Nov to March instead of 9.30pm, thus my brain was too tired to function), but another part of me knew the only one to blame is myself.

Without further ado, here’s my trading recap for December 2021.

Btw, you can read all of my previous options trading recaps here.

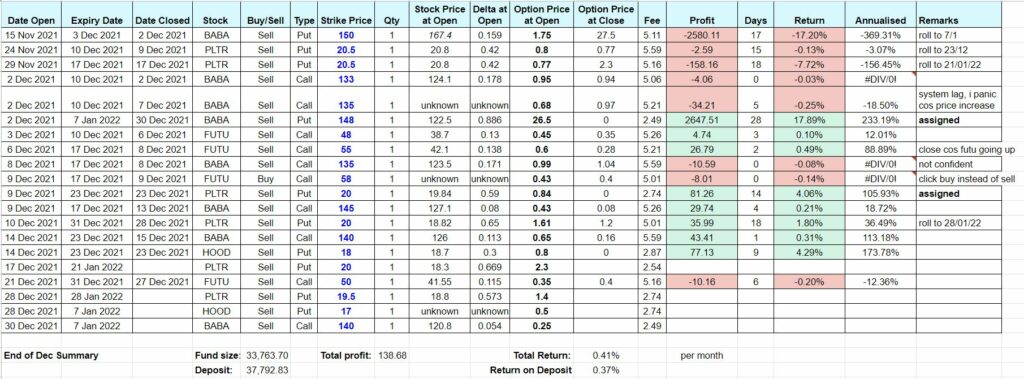

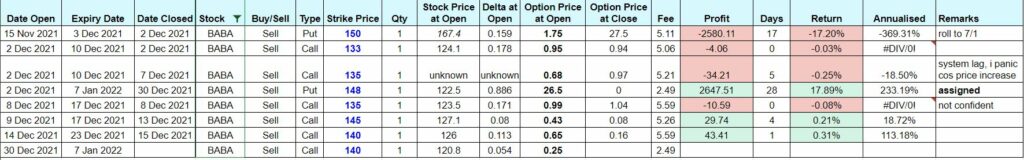

Summary of Trades Done in December 2021

I opened 17 positions and closed 16 positions. At the end of the month, there are 4 positions that I carried over to next month. My return is slightly 0.41% a month (thank God, it’s not minus!).

I had 8 losing trades, 2 assignments and 6 winning trades.

If you pay attention to the bottom line, my fund size is 33k while my deposit is 37k. That’s 4k loss. All my gain in the previous months were wiped out (temporarily, I hope). It was a hard pill to swallow, but I remind myself again, the loss is just a paper loss, mainly caused by BABA sell-off.

At the end of 31 Dec 2021, BABA was at 118 while my average cost was 151, thus the depressed portfolio size at 33k. At the time of writing, mid January 2022, BABA has bounced back to 130+ level.

Brief Trading Stories about Each Stock

HOOD

HOOD Trade #1: Opened a short put position when HOOD was about all-time-low at $18.7. Chose at-the-money strike price of $18 (Delta 0.3) because the stock is already at all time low, and I wanted to get assigned. HOOD traded at $18.9 on expiration day, hence the put expired worthless.

HOOD Trade #2: To be discussed in January 2022 recap.

FUTU

For FUTU, I’m mostly selling covered calls to earn premiums.

FUTU Trade #1: Made the mistake of opening a position when FUTU price was at the bottom ($38). Closed this trade at very little profit because the price suddenly went up to $40 and I was afraid of getting in the money. When doing covered call, I should’ve waited till the price is relatively high.

FUTU Trade #2: After closing Trade #1, I opened this position. Closed it 2 days later when time decay gave me 50% profit and FUTU price goes up to $44. Even though it’s still far from my strike at $55, I didn’t want to wait 9 more days to earn the remaining 50%.

FUTU Trade #3: Pressed the Buy button instead of Sell. Quickly closed it at a loss.

FUTU Trade #4: Opened when FUTU price was $41.5. Closed when price went up to $45. Decided to take the loss rather than holding it to expiration cos I was afraid of getting assigned. Looking back, I felt stupid. $45 is still far from $50, and I could always roll it if it gets in the money. I guess I just wasn’t comfortable trading Covered Calls yet, and this is the tuition fee that I have to pay.

PLTR

PLTR Trade #1 & #2: These 2 trades were rolled from November 2021. The original strike price in Nov were $23 and $22. After rolling, the new strike price for both is $20.5. Then, I rolled both further out (see next paragraph).

PLTR Trade #3: This was rolled from Trade #1 for a credit of $7 (received $84, paid $77). The new strike price is $20. I didn’t further roll Trade #3 because I want to get assigned.

PLTR Trade #4: This was a new position that I opened that was obviously a mistake. It was supposed to be rolled from Trade #2, however, I did not close Trade #2 for some reason (I couldn’t recall what it was). I ended up rolling this to Trade #6.

PLTR Trade #5: This was rolled from Trade #2 for $0 credit (received $230, paid $230). Old strike is $20.5, new strike is $20. To be discussed in January 2022 recap.

PLTR Trade #6: This was rolled from Trade #4 for $20 credit (received $140, paid $120). Old strike is $20, new strike is $19.5. To be discussed in January 2022 recap.

BABA

BABA Trade #1: This was the trade that I opened right before the earning in Nov. After the bad earning result, BABA plunged and this put went deep in the money. I rolled this to Trade #4.

BABA Trade #2: It was a covered call (CC) trade I didn’t feel confident about. Closed my position 20 mins after opening it.

BABA Trade #3: Another CC trade that I didn’t feel confident about. When I saw price increased sharply, I got panic and closed at a loss. Actually, the price has decreased by the time I submit my order, but the desktop app is not showing real-time price. Hence, the $30 loss, sob.

BABA Trade #4: This was rolled from Trade #1 for $100 debit (received 2650, paid 2750). Old strike is 150, new strike is 148. I wanted to wait until it’s nearer to expiry date before rolling it, but alas, someone decided to exercise the put early, so I had to purchase 100 BABA share at $148.

BABA Trade #5: Again, similar to #2, I didn’t feel confident with my strike price and my position. Closed this covered call (CC) trade for a loss about 16 mins after opening it.

BABA Trade #6: After 3 consecutive failures in selling BABA covered calls, finally I succeeded.

BABA Trade #7: Another great execution of covered call.

BABA Trade #8: To be discussed in Jan 2022 recap.

Lesson Learned

It takes time to switch the mindset from being a put seller, to being a call seller. I was not used to selling covered calls, so whenever the price spikes a little bit, I got panic and closed my position at a loss. My losses from FUTU and BABA trades were the tuition fee I needed to pay in order to be better at selling covered call.

After making more than 2% return every month for the past 6 months, I thought option trading can be a side hustle that provides consistent income for me. How wrong was I! This is such a humbling experience for me. Never get too complacent or you’ll have a painful fall. Steve Jobs said, “Stay hungry, stay foolish.” I needed to do that.

Life is a rollercoaster. So is trading. You can’t go up all the time, you will come down once in a while. Just remember to hold tight, or else, you’ll fall out of the ride.

So, that’s it! I hope it’s been a fun read. If you get too confused because I rolled too much, you’re not alone. I, myself, was also confused when writing about it!

If you want to take a look at the spreadsheet that I use to track my option trading, click here. That’s what I use to calculate how much profit I have made versus time decayed at any point in time.

That’s all for this month. See you in next month’s trading recap! If you want to get notified of my new posts, do subscribe to my email.

I also want to take this opportunity to wish you a Happy New Year 2022! Hope the new year brings us more prosperity, regardless of which direction the market goes!

PS: If you don’t have a moomoo account yet, you can sign up here and get up to free 1 Amazon share, SGD 40 stock cash voucher, SGD 60 cash upon deposit and completing the necessary tasks. Promotion valid till 31 Oct 2022, 0959 SGT. Here’s the detail on moomoo’s latest welcome bundle.

If you find this post helpful, feel free to buy me a coffee :)