When trading a single leg option (eg: sell put, buy put, sell call, buy call), there are 2 things that will happen at option expiration: either the option expires worthless (out of the money), or the option gets exercised/assigned (in the money).

If the option expires worthless, no transaction will happen. The option will simply disappear from your portfolio.

If the option expires in the money, it will get exercised. The brokerage (in this case, Moomoo) will execute the transaction automatically.

What is in the money (ITM)?

For put option, in the money means the stock price is less than the option strike price, hence it makes more sense for put buyer to exercise the option and sell their stock to the put seller rather than sell to market.

Meanwhile, for call option, in the money means the stock price is higher than the option strike price, hence it makes more sense for the call buyer to exercise the option and buy the stock from call seller rather than from the market.

What is out of the money (OTM)?

For put option, out the money means the stock price is higher than the option strike price, hence it makes more sense for put buyer to sell directly to the market rather than sell at lower price to the put seller.

Meanwhile, for call option, out of the money means the stock price is lower than the option strike price, hence it makes more sense for call buyer to buy directly from the market rather than buy at higher price from call seller.

My experience getting assigned stocks at expiration

Recently, the put option that I sold expired in the money, hence I got assigned the corresponding stocks.

The put option that I sold was JD210820P65000. Here’s what it means:

- Stock ticker: JD

- Expiry date: 20 August 2021

- Option type: Put

- Strike price: $65

On 20 Aug 2021 (Friday), during the beginning of trading hours, JD was hovering between $63 to $65.2. There is a high chance that my put expires in the money (ITM). So, before I went to sleep, I made sure I had US$6,500 cash ready in my Moomoo account in case Moomoo needed to deduct my cash when stock market is closed (which is about 4am in Singapore).

I woke up on 21 Aug 2021 (Saturday) morning and checked my account. JD closed at $63.62. It is lower than my strike price, hence my option was ITM. But, Moomoo had not deducted $6,500 from my account yet. The put option closed at $1.53 but it did not matter anymore because it had expired.

Below is how my portfolio looks like on 21 Aug, after expiration but before assignment takes place. The put option is still there. FYI, I already own 100 JD shares which I bought in June 2021 for $71.7 per share.

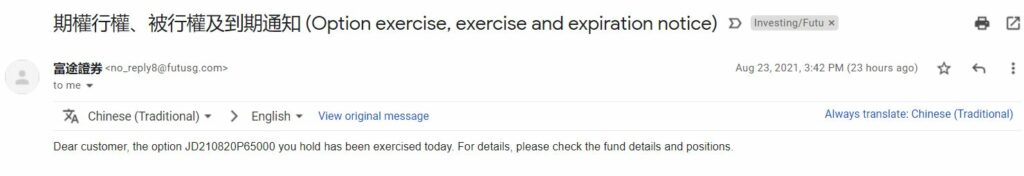

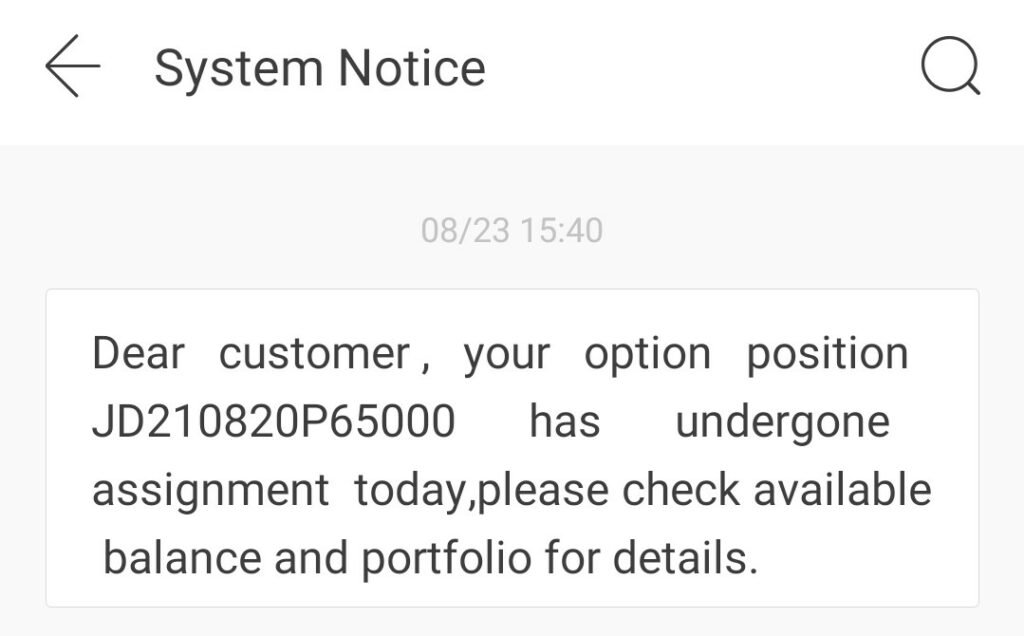

On 23 Aug 2021 (Monday), I received an email as well as a notification in Moomoo app telling me that my option has undergone assignment.

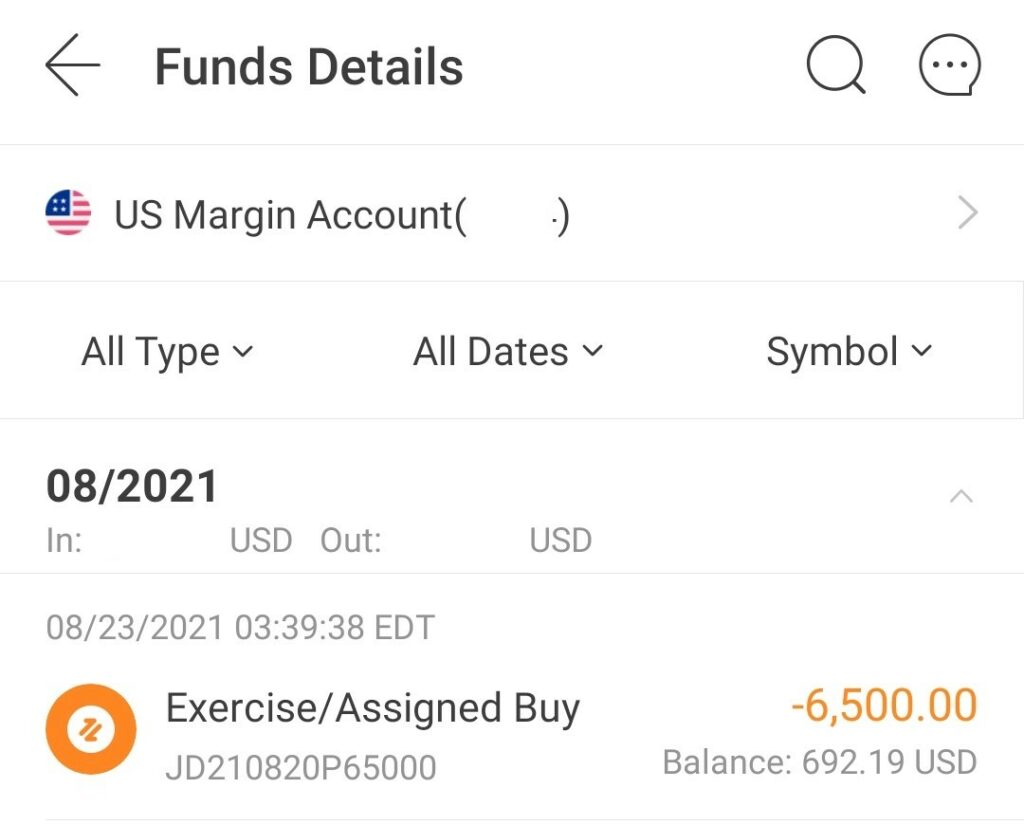

I then checked my Fund detail (Go to Trade – Brokerage Account – US – Fund Details) and saw that Moomoo had deducted $6,500 from my US wallet. No other fees was charged.

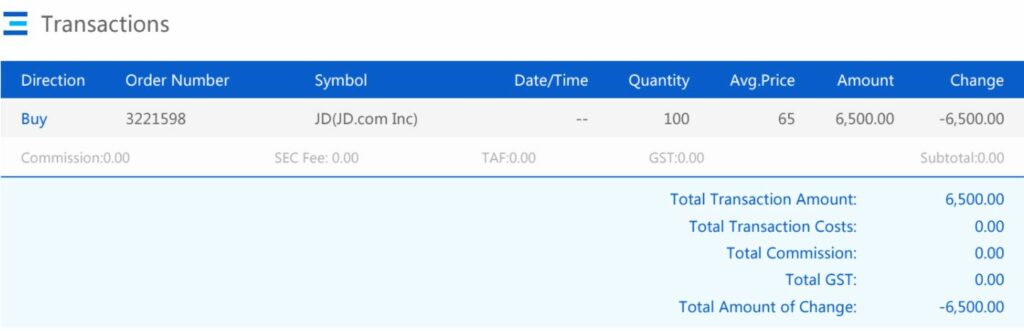

In the daily transaction report, it’s also shown clearly that the option assignment didn’t incur any fee at all.

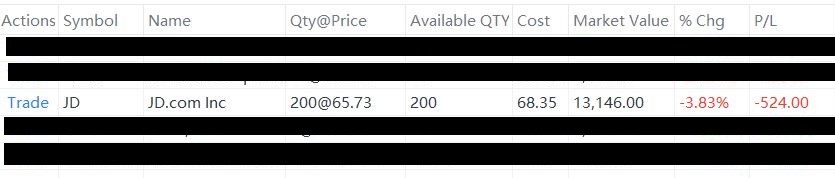

Below is how my portfolio looks like after trading hours of 23 Aug 2021. My put option has been converted into 100 share of JD. I mentioned earlier that I already own 100 shares of JD (which I bought at $71.7) before this option assignment. So, after the assignment, I now own 200 shares of JD. Without accounting for fee or option premium, and just based on the stock price when bought, my current average price is (71.7 + 65)/2 = $68.35 as shown below.

When I sold this put option, I received $75 premium (which translates to $0.75 per share). During option assignment, I paid $6,500 (which translates to $65 per share). Hence, the net price I paid for these new 100 shares is $65-$0.75 = $64.25 per share. I think it’s a fair price.

Moving forward from here, I have 2 choices: I can wait patiently for the price to recover then sell them to take profit, or I can sell covered calls to earn premium. Covered call means I am selling the right to buy my stock at certain strike price. If I proceed to sell covered call, and then my option gets exercised, I have completed the “Wheel” strategy.

Wheel is one of the many option strategies that deserve a full article on its own. I’ll not go into the details of Wheel. When I complete a Wheel strategy, I’ll definitely write about it on this blog, so if you’re keen, you can subscribe to my email so that you’ll get to know when I have new post.

PS: My favorite platform to trade option is Moomoo. If you don’t have a Moomoo account yet, here are the welcome bonus for new users. If you want to start trading option using Moomoo, I have a step by step guide to trade option using Moomoo’s both desktop and mobile platform.

If you find this post helpful, feel free to buy me a coffee :)

If I Sell a Put but want to cash out & not wait till the expiration date, is it possible in Moo Moo to exercise this option?

I know it can be done in some other trading platforms like Robinhood where you need to give back part of the premium you earned.

I think you meant “closing your position”. In that case, you simply buy the same put (same strike, same expiration date), you will then pay the stated price and you won’t have anymore open position of the put.

Exercising option is a different case. As a seller, you do not get to exercise the option, only buyers get to do so.

Hi Thanks for the article that gives better understanding of how Moo moo works on closing of Put options.

I have a query with regards to the premium that we are supposed to receive when we sell a Put.

I have sold a Put recently (and it still has not expired). however, i do not see the premium that i am suppose to receive in my account. Am I suppose to wait until after the expiration to receive the premium?

Will be grateful if u could clear my puzzle. Thank you!

Hi over the moon, the premium will enter your cash wallet as soon as your order is completed, but the transaction fee will be charged 1 day later. Check your “Fund Detail” in your mobile app, or check the daily statement that they send to your email.

Hi Prudent Dreamer, This article is super helpful. Although I came only after 8 months from your post. I have a question and hope you will still be available to answer.

For selling put, I will like to check if stock price goes below the strike price (ITM) before expiration date, I will not be assigned the shares, but I will be assigned the shares if the stock price goes below the strike price (ITM) on my expiration date? e.g. as follows

Stock Code: XYZ

Option Sold date: 20 Mar 2022

Expiry date: 20 Apr 2022

Option type: Sell Put

Strike price: $45

Stock price on 25 Mar 2022: $43 (Question: Can I continue to hold this sell put or will I be assigned on the share by the broker?)

Stock price on 20 Apr 2022 after market close: $43 (Query: I will be assigned on the share right? based on your article)

Hi Freddie, thank you.

For Case 1: Stock price on 25 Mar is $43, you won’t get assigned unless the buyer of your option decided to exercise early (which is very rare, but still possible)

For Case 2: Stock price on 20 Apr is $43 after market close, you will definitely get assigned.

Hope it helps! Let me know if you have more question!

Hi Prudent Dreamer,

Thanks! That really helps to answer my doubts. May I check this logic is similar to sell call too?

Hi Freddie, yes the same logic applies to selling call too.

What happens if I purchase a call option and it expires ITM, but I don’t have enough money in my moomoo account?

Never experienced it myself, so I can’t answer. My guess is, they’ll sell your stock to fund this purchase. If I were you though, I would sell the call option on the last day to cash out profit (assuming you bought the call option at a lower price)

Hi,

I have read your post and would like to ask a few questions. Hope you would be so kind to “guide” me.

I done a sell put on moomoo which should expire on 3/9/21(fri). My strike price is 14 and the stock is currently at 15 which I assumed the option will expire out of the money.

What I am puzzled is, the option is still in my portfolio as of 4/9/21(sat).

1) So does it mean the option is still on going?

2) How long will moo moo takes to clear the option from my portfolio?

3) Do I have to “buy back” the option to close it? 4) What will happen if the option is still in my portfolio?

5) If the price suddenly drop to 14 on the next trading day eg 7/9/21, will I be made to buy the 100shares?

6) Will moo moo send any message/ email to alert me?

Hi,

It takes some time for Moomoo to reflect the expiration in the app. Usually, before market open the next trading day, moomoo will send me email (in chinese language) to inform that my option is expired AND they will also send notification in the app regarding this expiration. Since 6 Sep is non-trading day, the email will probably come on 7 Sep before trading hour. Don’t need to buy back, it’s not possible also cos it’s already expired. Whatever happens on 7 Sep won’t affect you cos the option is already expired, so you have no more obligation to buy the stock. Don’t worry, you are safe =)

I don’t understand how 100 shares has become 200 shares now that you own.

But you are paying for 100 shares at 6500 only right? Do you mean you can sell 200 shares now?

Before the assignment, I already owned 100 shares. So, after assignment, I own 200 shares. Hope it clarifies.

Confirm can sell covered call on moomoo? I do not think so for now. Maybe I am wrong.

Yup, you need to get approval first before you can sell covered call.