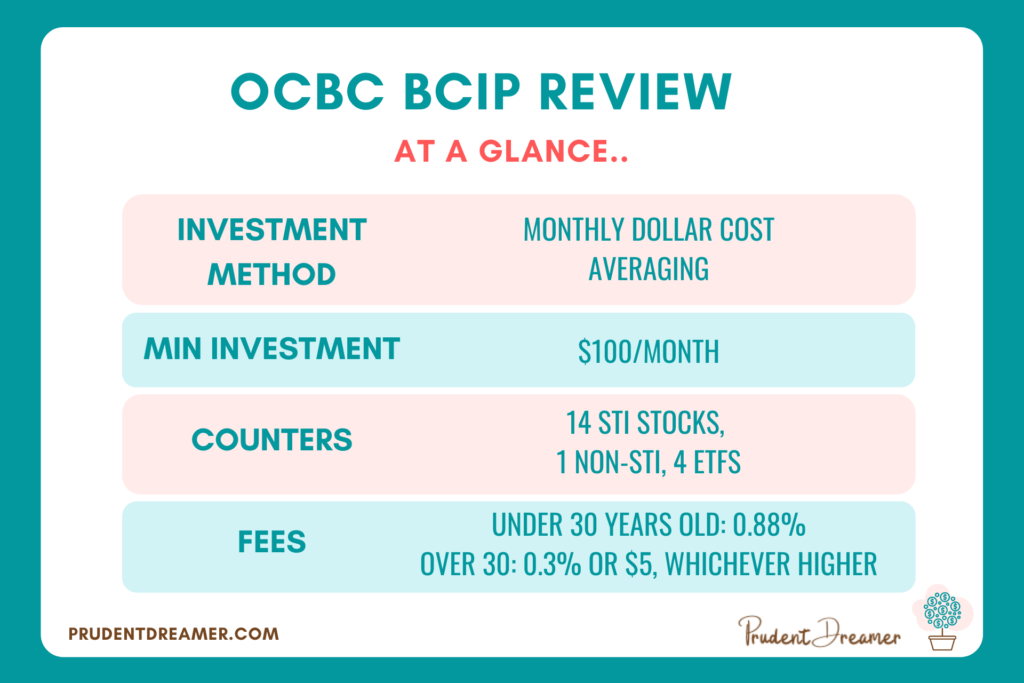

OCBC Blue Chip Investment Plan (BCIP) is one of the regular savings plan that allows you to invest by contributing a fixed amount every month. The minimum investment is SGD 100 a month.

I was an early adopter of this OCBC BCIP because back then when I was in my twenties, the minimum trading lot on SGX was 1000 shares, so blue chip stocks and STI ETF were out of my reach. Thus, when OCBC launched BCIP, it didn’t take me long to sign up. Moreover, I had an OCBC saving account so it was pretty easy for me to get started.

Over the years, a lot has changed with OCBC BCIP and many competitors have appeared in the battlezone. I’ll share my views about whether it’s worth investing in OCBC BCIP or whether it’s better to invest in other provider.

Here are the topics I’ll cover in this review:

- How it works

- Fees

- Counters

- How to apply

- Timeline

- Dividend crediting

- BCIP Section on OCBC Internet Banking

- How to sell

- My Portfolio with OCBC BCIP

- How I track my BCIP Portfolio

- OCBC BCIP vs DBS Invest Saver

- Conclusion

How it works

Traditionally, when you want buy a stock, you need to buy it in lump-sum amount from a brokerage. Hence, the timing of your entry is really important because you want to buy low and sell high.

In a regular saving plan like BCIP, instead of investing in lump-sum amount, you’re investing every month at a fixed amount that you’re comfortable with. Thus, you don’t need to time the market. When the price is high, you’re buying lesser quantity of shares, when the price drops, you’re accumulating more shares.

And you don’t need to fork a large amount of money upfront. You simply set aside a couple of hundreds a month (or thousands if you have the capability), and the system will buy on your behalf every month like a clockwork. Because it’s so passive, you’re saving a lot of time that you otherwise will spend monitoring stock prices.

This method of investing a fixed amount every month regardless of market condition is called Dollar Cost Averaging. It’s one of my most favorite investing methods, beside dividend investing.

When you submit your application for BCIP, you need to determine how much you want to invest a month, what counter you want to invest in, and whether you want to invest with cash or SRS.

If you choose cash, every month around 17th, the bank will deduct the amount from your deposit account and buy the share on your behalf. If you choose SRS, every month the bank will deduct directly from your SRS account.

You can amend the amount of investment, sell your holding or transfer your shares to your CDP or other financial institutions. When the share/ETF declares dividend, you’ll receive the same amount of dividend in your account.

The shares that you buy through BCIP will be held under custody of OCBC Securities (if you invest by cash) or OCBC Nominees Singapore (if you invest by SRS). Since the shares are not in your CDP, you won’t be entitled to attend AGM or any voting rights.

Fees

If you are a new customer and under 30 years old, you’re in luck because you get to enjoy the preferential fee of 0.88% (with initial investment amount up to $500) of your buy amount OR sell amount. I’m really jealous of the young people.

If you’re over 30 years old (like me!), you have to be content paying the prevailing rate of 0.3% of buy/sell amount OR $5 per transaction, whichever is higher.

Here are illustration of fees you’ll be paying when you invest in various amount.

| Amount you buy or sell | Fees you pay | Fees in percentage |

|---|---|---|

| $100 | $5.00 | 5.0% |

| $200 | $5.00 | 2.5% |

| $300 | $5.00 | 1.6% |

| $400 | $5.00 | 1.25% |

| $500 | $5.00 | 1.00% |

| $600 | $5.00 | 0.83% |

| $800 | $5.00 | 0.63% |

| $1000 | $5.00 | 0.50% |

| $1200 | $5.00 | 0.42% |

| $1400 | $5.00 | 0.35% |

| $1600 | $5.00 | 0.31% |

| $1700 | $5.10 | 0.3% |

| $1800 | $5.40 | 0.3% |

| $2000 | $6.00 | 0.3% |

As you can see from the above table, the cost of investing is quite high if you invest less than $500 a month. If you can only invest less than $500, and you’re above 30 years old, I wouldn’t recommend that you invest with OCBC BCIP unless you don’t mind the fee.

If you’re using your SRS account to invest, you’ll be imposed with additional processing fee of $0.37 per counter. So, be sure to include this fee when you do your calculation of return or yield.

For transfer of shares, the fee is $10+GST if you transfer to your own CDP or other financial institution or your immediate family members. Otherwise, if you transfer to other people, the fee is a lot higher (at least $150 + GST). The transfer procedure is also quite troublesome, you need to bring supporting documents to OCBC bank. It’s best to avoid it, if possible.

Counters

As of January 2022, there are 21 counters you can invest in using OCBC BCIP.

14 of them are components of Straits Times Index (STI), 1 of them is a blue-chip but not in STI, and 6 of them are ETFs. Here are the complete list.

14 STI components

| No | Counter Name | Stock Code in SGX | Sector |

|---|---|---|---|

| 1 | CapitaLand Limited | C31 | Properties |

| 2 | CapitaLand Integrated Commercial Trust | C38U | Properties |

| 3 | ComfortDelGro Corporation Limited | C52 | Transport |

| 4 | DBS Group Holdings Limited | D05 | Finance |

| 5 | Keppel Corporation Limited | BN4 | Multi-Industry |

| 6 | Oversea-Chinese Banking Corporation Limited | O39 | Finance |

| 7 | SembCorp Industries Limited | U96 | Multi-Industry |

| 8 | Singapore Airlines Limited | C6L | Aviation |

| 9 | Singapore Exchange Limited | S68 | Finance |

| 10 | Singapore Technologies Engineering Limited | S63 | Multi-Industry |

| 11 | Singapore Telecommunications Ltd | Z74 | Telecom |

| 12 | StarHub Ltd | CC3 | Telecom |

| 13 | United Overseas Bank Limited | U11 | Finance |

| 14 | Wilmar International Limited | F34 | Food processing |

1 Non-STI components

| No | Counter Name | Stock Code in SGX | Sector |

|---|---|---|---|

| 1 | Singapore Press Holdings Limited | T39 | Publishing |

6 Exchange Traded Funds (ETF)

| No | Counter Name | Stock Code in SGX | Sector |

|---|---|---|---|

| 1 | Lion-OCBC Securities Hang Seng Tech ETF | HST | Technology |

| 2 | Lion-Phillip S-REIT ETF | CLR | Properties |

| 3 | Nikko AM SGD Investment Grade Corporate Bond ETF | MBH | Not Classified |

| 4 | Nikko AM Singapore STI ETF | G3B | Not Classified |

| 5 | Nikko AM-ICBCSG CN BD ETF SGD | ZHS | Not Classified |

| 6 | Lion-OCBC Securities China Leaders ETF | YYY | Not Classified |

How to apply

Because BCIP is a Custodian account, you don’t need to apply a CDP account.

If you have an OCBC deposit account or OCBC Online Banking, you can apply for BCIP using your Online Banking account or Mobile Banking app. The procedure can be found on OCBC BCIP website.

If you don’t have OCBC deposit account, you need to mail in the form and they’ll settle deposit account opening as well as BCIP account opening for you.

Timeline

Usually, OCBC will deduct the money from your deposit account on 17th every month, or earlier of 17th is a non-business day. You must ensure sufficient funds in your account two business days before the GIRO deduction date. To be safe, just make sure you have enough fund to last at least 3 months of investment.

On purchase execution date (around 22nd), OCBC BCIP will purchase share on your behalf. In a few days, you’ll receive a statement from them stating how many shares were purchased, and at what price. Also in a few days, you can view how many shares you’re currently holding when you login to the online banking.

Dividend crediting

Yes, you will receive dividend when the company/ETF that you invest in declares dividend. The amount of dividend you’ll receive is exactly the same as the amount of dividend paid out by company/ETF that you invest in. OCBC will not deduct any fee from your dividend.

If it’s cash dividend, it will be credited to your OCBC deposit account that you use for BCIP. If it’s share dividend, the share will be added to you BCIP account. If it’s choice, you’ll be able to make a choice whether to receive cash or share dividend.

If you’re using SRS to invest, the dividend (cash or share) will be credited to your SRS account.

If you want to reinvest your dividend, you’ll have to do that manually. OCBC can’t automatically reinvest your dividend for you. To manually reinvest your dividend, just leave the dividend you receive in the OCBC deposit account linked to BCIP.

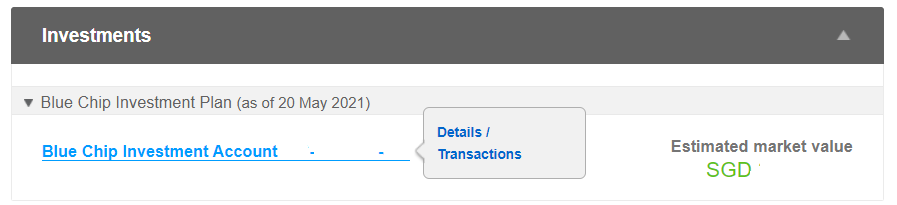

Understanding OCBC BCIP Section on your Internet Banking

Once you have an active BCIP, you will be able to see an OCBC BCIP Section on your dashboard of OCBC Internet Banking. Here’s what you’ll see on your dashboard. Basically, you’ll be able to see the market value of your portfolio.

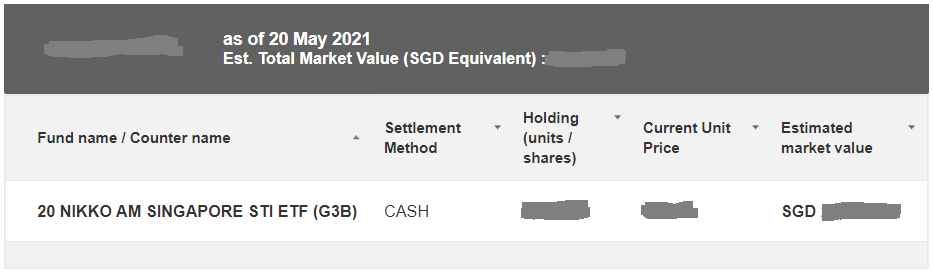

If you want to see a more detailed breakdown, hover on the BCIP blue text and click on the “Details”

Finally, here’s the detailed breakdown. It tells you how many shares you’re currently holding, the current price of the stock, and the estimated market value as of the date stated. That’s all!

Notice that it doesn’t show you your transaction history, nor does it show your average cost. Thus, you won’t know whether your investment is making unrealized profit or loss, let alone dividend yield.

While other people might dislike the simplicity of BCIP’s reporting, I’m actually fine with it, because I have my own investment tracking spreadsheet that allows me to see the metrics that I want to focus on.

How to sell

You can sell your BCIP holding via OCBC online banking. It is recommended that you sell a full lot (100 shares) in order to maximize your profit, because if you have odd lot share, it’ll be sold at cheaper price due to lack of liquidity.

Selling BCIP holding is not immediate. They will pool your request together with other sellers, then execute the sale together. The Average Sale Price is calculated by dividing the total proceeds from all of the shares sold by the total quantity of shares sold. Therefore, all sellers who sold the same share counter will be credited with proceeds using the same average sale price.

To be honest, I have never sold my holdings yet. I am not sure whether the Sale Date is only once a month, or it’s the day after investor submit the request to sell. If you have any idea, do let me know in the comments, thanks!

My Portfolio with OCBC BCIP

I have been investing in Nikko AM STI ETF since Nov 2014 through OCBC BCIP. In the beginning, I invested $200 a month. Back then, I was young and naive, I didn’t know 2.5% fee is considered high. Also, my finance wasn’t stable yet for me to commit a larger amount so $200 was the best I could do. For me, investing a small amount is better than not investing at all.

Five years later, when I grew older and wiser and more financially stable, I decided to invest a larger amount to reduce fee. I’ve been investing $400 a month since then.

As someone who prefers passive investing, I’m quite happy with regular saving plan like BCIP. My dividend always comes on time, the monthly statement is clear and easily understandable. I’ve had late dividends and difficult-to-understand monthly statements from DBS Invest Saver in the past, so I do appreciate the way OCBC does BCIP. The only thing I’m not satisfied with is the minimum fee of $5! I wish BCIP can lower down their fee to 1% or less.

How I track my BCIP Portfolio

As the queen of spreadsheet (I mean, the OCD who loves spreadsheet too much, she tracks so many things and she often loses track of what she tracks!), I have a spreadsheet to record all of the purchase and dividends received from BCIP.

It allows me to easily see my all-time average purchase price, my average dividend yield, unrealized profit/loss, dividend rate trend, etc. OCBC online banking doesn’t show all of these data, so I had to create the spreadsheet myself.

If you want to get a look of my spreadsheet, click here.

OCBC BCIP vs DBS Invest Saver

Since OCBC BCIP and DBS Invest Saver are pretty similar, I guess I’ll try to compare apple with apple.

| Category | OCBC BCIP | DBS Invest Saver |

|---|---|---|

| Fees for investors under 30 years old | 0.88% | 0.5% for bond ETFs, 0.82% for stock ETFs |

| Fees for investors over 30 years old | $5 or 0.3%, whichever higher | 0.5% for bond ETFs, 0.82% for stock ETFs |

| Counters | 15 individual stocks, 6 ETFs | 4 ETFs only, various unit trusts |

| ETFs counters | • Nikko AM Singapore STI ETF • Nikko AM SGD Investment Grade Corporate Bond ETF • Lion-Phillip S-REIT ETF • Lion-OCBC Securities Hang Seng Tech ETF • Nikko AM-ICBCSG CN BD ETF SGD • Lion-OCBC Securities China Leaders ETF | • Nikko AM Singapore STI ETF • Nikko AM SGD Investment Grade Corporate Bond ETF • ABF Singapore Bond Index Fund • Nikko AM-StraitsTrading Asia ex Japan REIT ETF |

| Unit Trust | 0 | Yes, many |

For the first category regarding fees for investors under 30 years old, you’d be better off going with DBS Invest Saver in terms of fees.

For the second category regarding fees for investors over 30 years old, I’ve done the calculation for you. If you’re investing $600 or less per month, go with DBS Invest Saver. If you’re investing more than $600 a month, go with OCBC BCIP.

For the third category regarding counters, if you prefer to invest in individual stocks, then go with BCIP. Personally I prefer invest with DCA method for ETFs, so both OCBC BCIP and DBS Invest Saver are good for me in terms of counters.

For the forth category regarding ETF counters, both have Nikko AM STI ETF and Nikko AM Bond ETF.

Then, OCBC BCIP has Lion-Phillip S-REIT ETF while DBS Invest Saver has Nikko AM-StraitsTrading Asia ex Japan REIT ETF; both of these are pretty similar, but the latter are slightly more diversified than the former.

OCBC BCIP has Lion-OCBC Securities Hang Seng Tech ETF which is an aggressive fund that focuses on HK-China’s Tech industry, while DBS Invest Saver has ABF Singapore Bond Index Fund which is a defense fund. So, check your appetite and choose accordingly.

For the fifth category regarding unit trust, OCBC BCIP doesn’t offer unit trust because they have a different program for monthly investment in unit trust. Meanwhile, DBS Invest Saver offers monthly investment in unit trust under the same program, the Invest Saver program.

Anyway, I can go on and on about the differences between these 2, but I think I’ve covered the 2 most important aspects, which are the fees and the counters.

Conclusion

Pros of BCIP

- Cheap and easy way to do Dollar Cost Averaging

- Cheaper than traditional brokerage

- Good for investor with little capital

- Able to buy individual blue chip stocks with DCA method

- Investors don’t have to wait until they have the fund to buy full lot (100 shares), they can invest right away

- Easy to apply if you’ve already had an OCBC account

- Able to reinvest dividend manually (yes this is a pro and not con, I prefer to have the ability to decide when and where I want to reinvest my dividend)

Cons of BCIP

- If you’re under 30 years old, OCBC BCIP fee (0.88%) is more expensive than DBS Invest Saver (0.82%)

- If you’re over 30 years old, OCBC BCIP is more expensive compared to DBS Invest Saver if you’re investing less than 600 a month. So, if you’re only investing 600 or less a month, don’t choose BCIP.

- You won’t be able to attend AGM or have any voting rights

- If you’re using OCBC 360 account, investment made through BCIP is not eligible for bonus interest in Invest category

If you don’t have large capital right now, it’s good to start with a regular saving plan. Time in the market is better than timing the market.

If you have the resources to monitor stock prices and are able to invest lump sum amount; in other words, you’re an aggressive investor, then DCA may not work for you.

Featured image credit: Canva Pro/Getty Images Pro

If you find this post helpful, feel free to buy me a coffee :)

may i know how bcip works in the quantity purchased? if the monthly amount is smaller than the price does it mean it will buy with fractional share?