When I first read that MoneyOwl is backed by NTUC, I told myself that MoneyOwl has got to be THE safest investment fund company in Singapore. So, I began researching the different products that MoneyOwl offered.

And because MoneyOwl’s website is so clean and neat, it took me just minutes to understand their offerings. Basically, they offer 4 main services: financial planning, insurance, investment and will writing. I’m at the stage where I’m more interested in investment, so I dug deeper into the investment section.

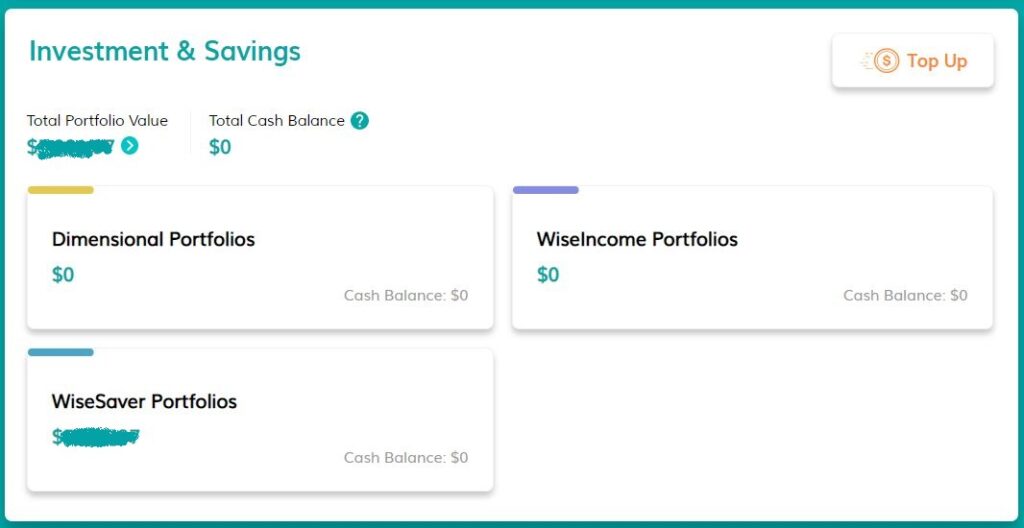

As of the first half of 2021, there are 3 investment products offered by MoneyOwl. They are: Dimensional, WiseIncome and WiseSaver (Cash Savings). If you’ve been investing with robo-advisors, you’ll notice that MoneyOwl’s products are similar to what other robo-advisors are offering.

I decided to open an account for WiseSaver (Cash Savings) to make the money that’s currently sitting idle in my bank account works harder. Through this article, I wish to share my experience, fund performance, and my thoughts on WiseSaver.

In this review:

- What is WiseSaver?

- Is the capital guaranteed?

- Lump sum vs Regular Saving Plan

- Fee

- Return

- How to deposit

- How to view your portfolio

- How to withdraw

- My Portfolio with WiseSaver

- Conclusion

What is WiseSaver?

MoneyOwl WiseSaver is a cash management account that gives higher interest than normal bank saving account.

It is similar to a normal saving account in terms of liquidity. There is no lock-in period, so you can withdraw your fund anytime, but withdrawal takes a few days, so it’s not as immediate as withdrawing from ATM.

WiseSaver uses the money pooled from customers to invest in Fullerton SGD Cash Fund which is managed by Fullerton Fund Management (Temasek-Owned) to earn interest. Then, the interest will be paid to customers in the form of return.

For your info, WiseSaver is not the only way you can invest in Fullerton SGD Cash Fund. Endowus and Grab also offers cash management account with Fullerton SGD Cash Fund.

Is the capital guaranteed?

No, the capital isn’t guaranteed. However, because they invest your money in a very safe fund (Fullerton Cash SGD Fund), there is very little risk of default, hence it is very unlikely that you will experience capital loss, according to MoneyOwl.

Lump sum vs Regular Saving Plan

You can save your money through lump sum (one time), or through regular saving plan (monthly). Both options require a minimum of $10 deposit each time.

Once you transfer your money to your WiseSaver account, it takes several days to show up. So, don’t be alarmed if the money doesn’t show up immediately in your WiseSaver account.

When I did my first lump sum transfer, I kept checking my account every day and was feeling afraid that my money got lost on the way. Luckily it showed up on my dashboard after a week!

Fee

MoneyOwl doesn’t charge any platform fee or management fee.

The Fullerton Cash SGD Fund charges 0.15% p.a. fee. This fee is already factored into the return of the fund. So, there is no more separate fee that you need to pay out of your pocket to MoneyOwl.

Return

The return is not fixed. It fluctuates depending on the market and economic conditions. As of 28 May 2021, the current return is 0.43% p.a.

Later in this article, I’ll show you the actual return I get from my portfolio.

How to deposit

Before depositing, you need to decide whether you want to use cash or SRS. Then, you need to create an account with MoneyOwl.

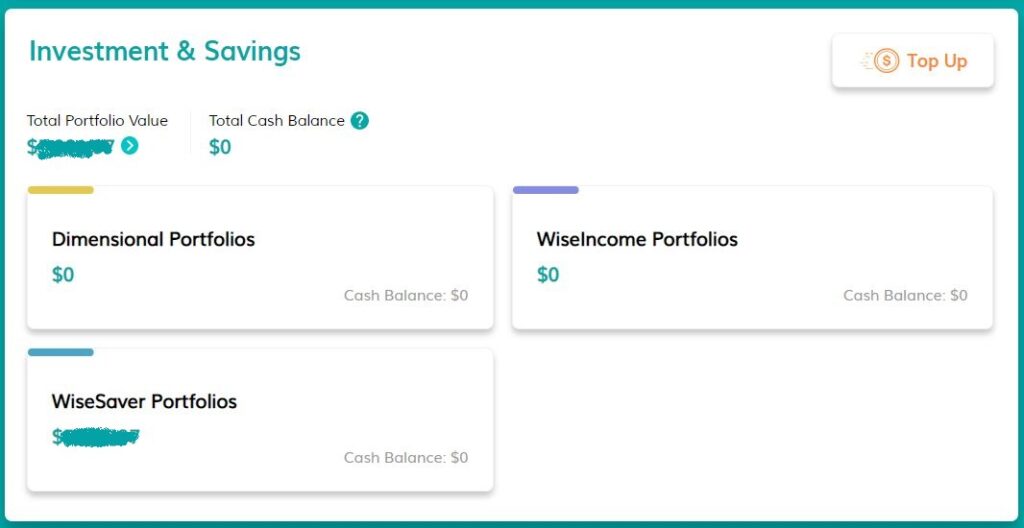

Once you are in your dashboard, you can see that you have 3 investment portfolios, even if you have only opened one portfolio. To deposit, just click “Top Up”.

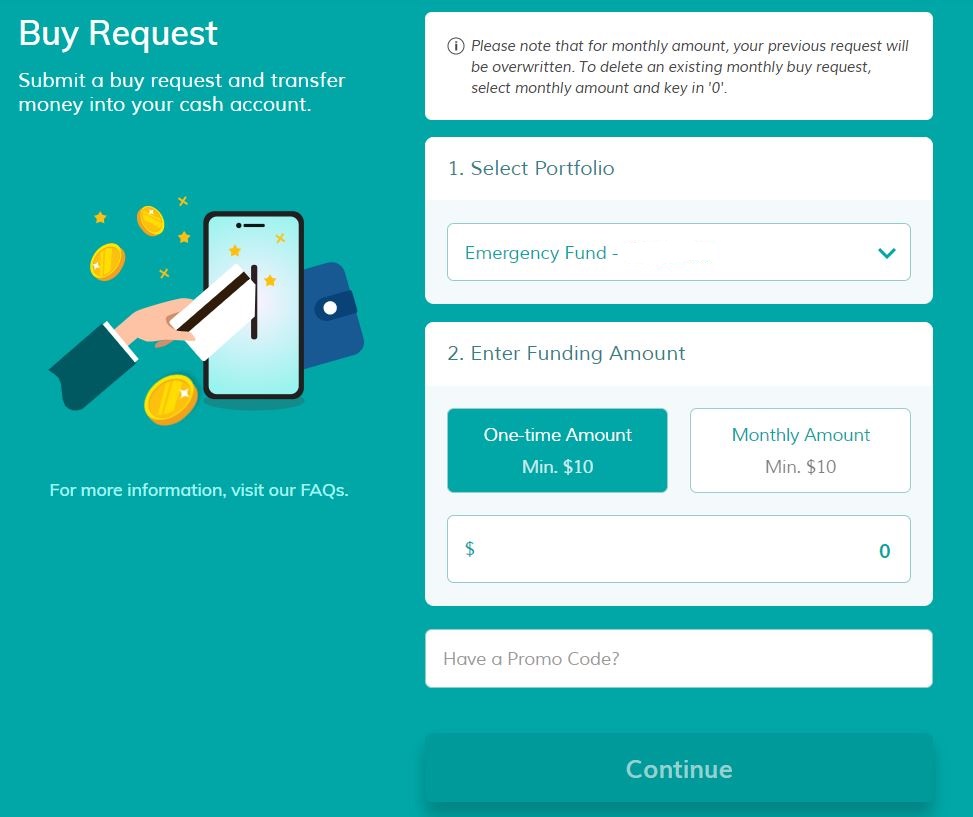

Then, choose the portfolio that you want to top up, and key in the amount. Then click “Continue”.

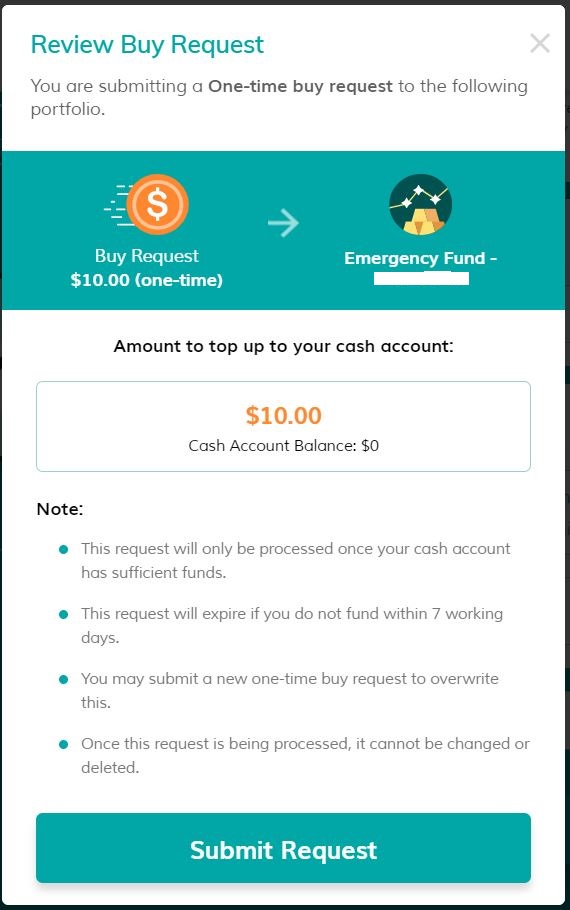

You will then see a confirmation page like the image below. Just click “Submit Request”.

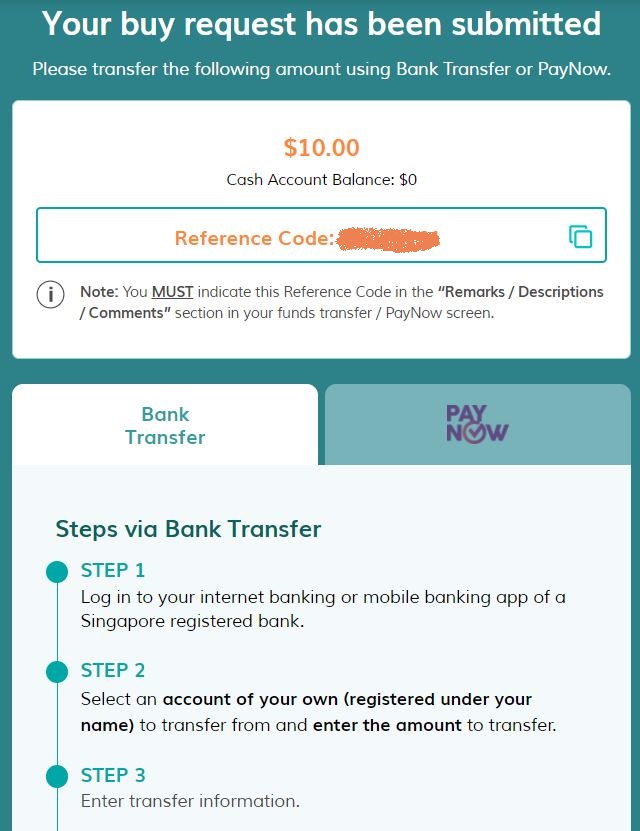

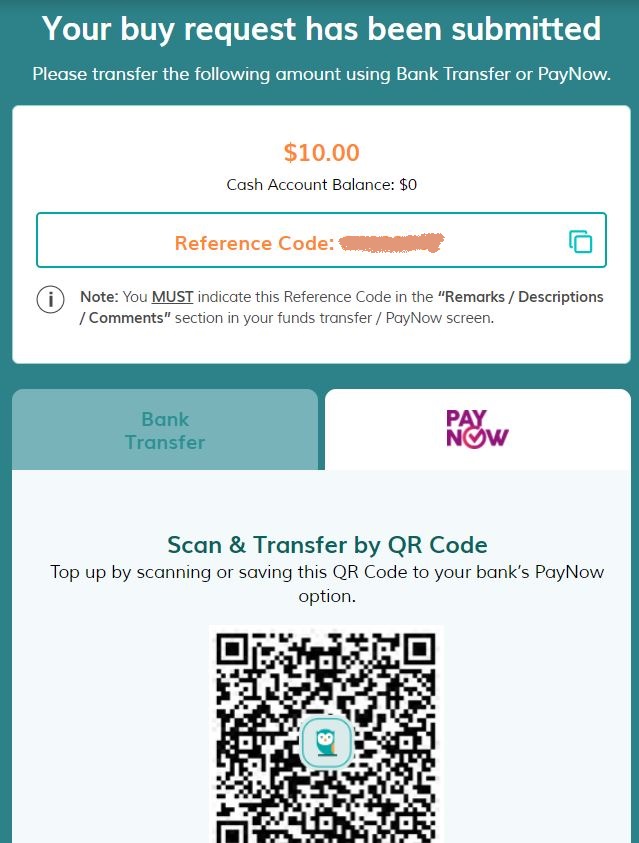

Next, you will see the step-by-step instructions on how to deposit your money via bank transfer or paynow. Follow the instructions and you’re all set up.

Next, just wait for MoneyOwl to process your deposit.

How long does it take to deposit money into MoneyOwl’s WiseSaver account?

Based on my personal experience, here is my actual timeline when I deposit my money for the first time to MoneyOwl:

- Tue, 13 April 2021 evening: submitted my Buy order

- 13 April: deposit my money through bank transfer

- 13 April: MoneyOwl emailed me saying they’ve received my money

- 13 April: MoneyOwl emailed me saying they’ve deducted my money to execute my Buy order

- Thu, 15 April: MoneyOwl emailed me saying they’ve executed my Buy order and it will be reflected in my Investment Account within 4 business days.

- Tue, 20 April: MoneyOwl emailed me saying that my holdings are now reflected in my Investment Account.

In total, it took 2 days from the day I deposit my money, to the day MoneyOwl executes my Buy request. And, it took 7 calendar days from the day I deposit, to the day I see my money on my WiseSaver account. To say that I wasn’t worried my money got lost somewhere is an understatement.

How to view your portfolio

If there is one thing that MoneyOwl should work on improving, it should definitely be the mobile app. At the time of writing, the ONLY way to view portfolio is to log in to MoneyOwl’s website.

To view your portfolio, you need to go to login to MoneyOwl’s website. Then, on your dashboard, choose “WiseSaver”.

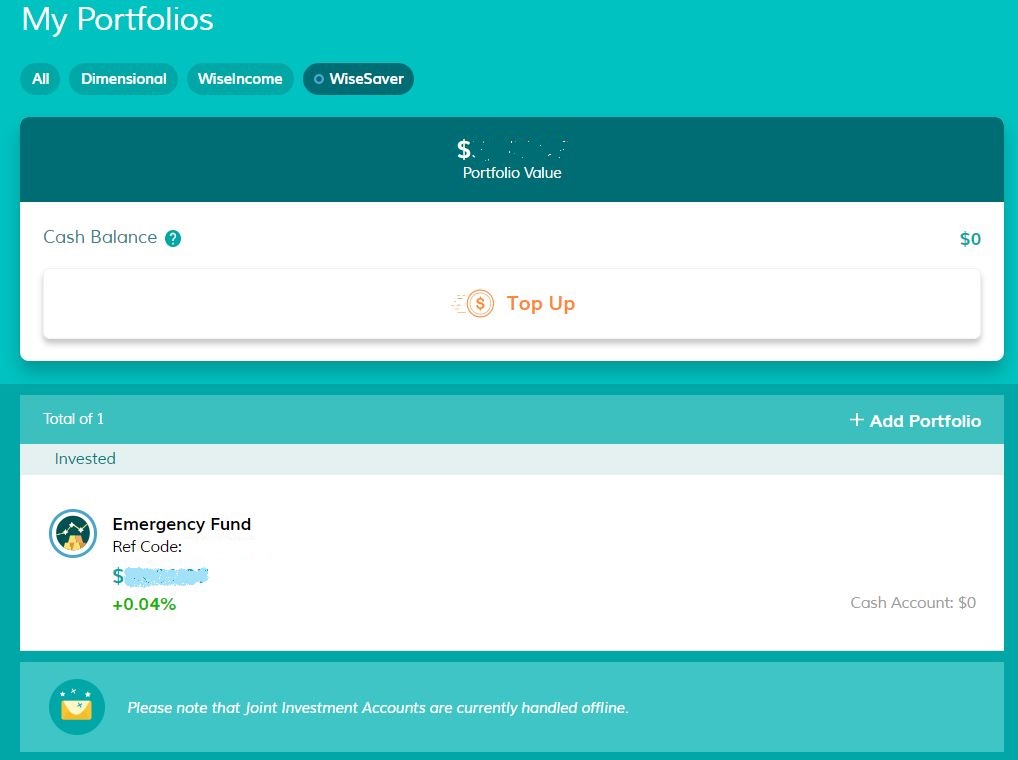

After that, choose the portfolio that you want to view. For your info, you can have more than 1 portfolio in WiseSaver.

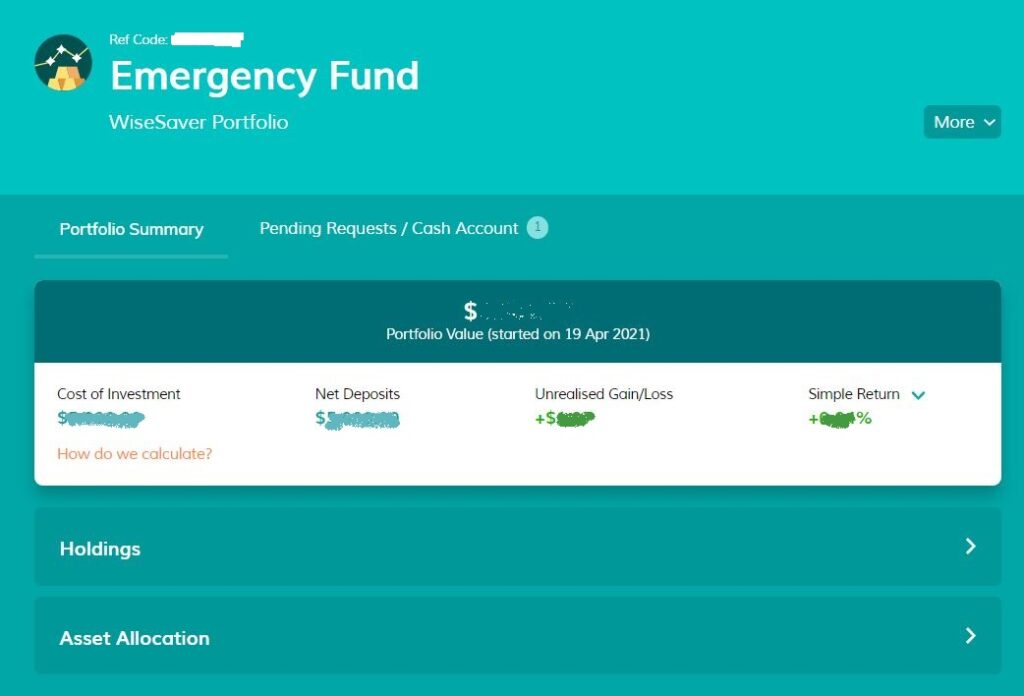

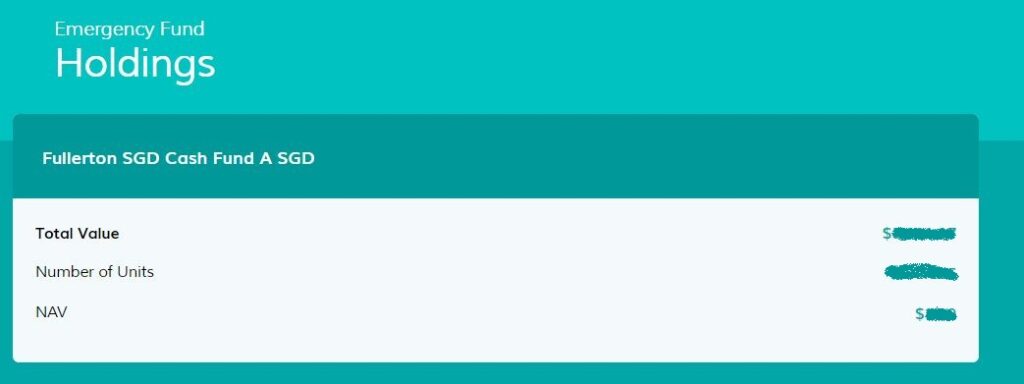

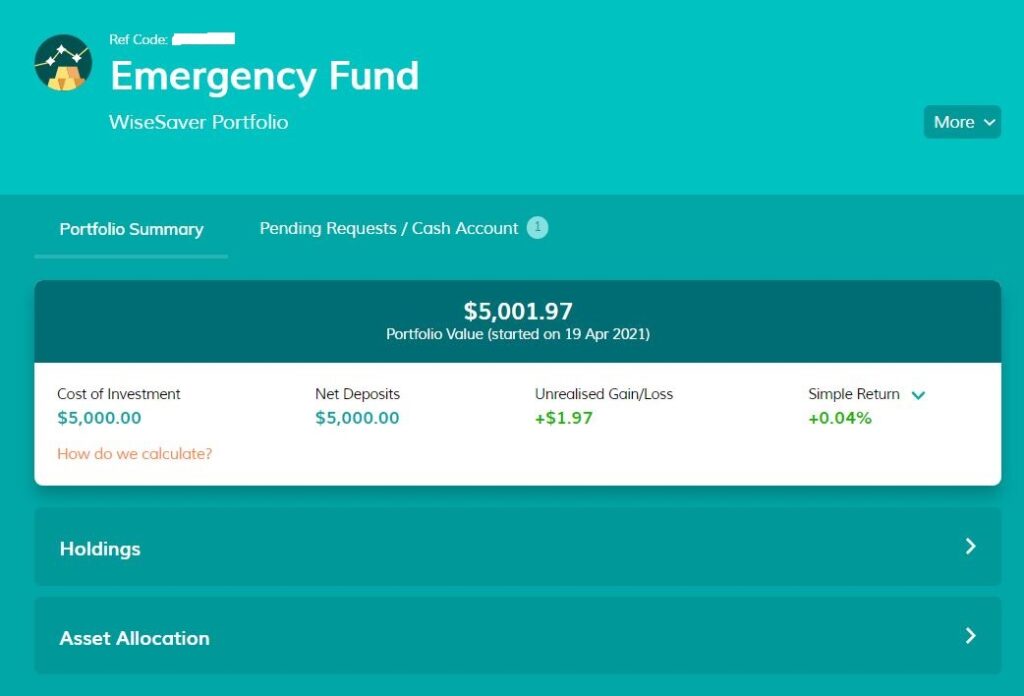

This is how the portfolio summary looks like:

You can see the following information on your portfolio summary:

- Cost of Investment

- Net Deposits

- Unrealised Gain/Loss

- Simple Return/Time-weighted Return

When I click “Holdings” I can see the exact number of units I’m holding and its corresponding NAV. The NAV shown is a rounded to 2 decimal places, while the actual NAV on Fullerton Fund’s website is shown with 5 decimal places.

When I click “Asset Allocation” I can see that 99% of my money is in Fixed Deposit, while 1% is in Cash. I did not set this number, and neither were I allowed to.

How to withdraw

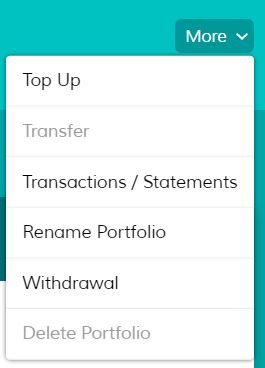

The procedure of withdrawing money is pretty straightforward. Go to your portfolio, then click More -> Withdrawal.

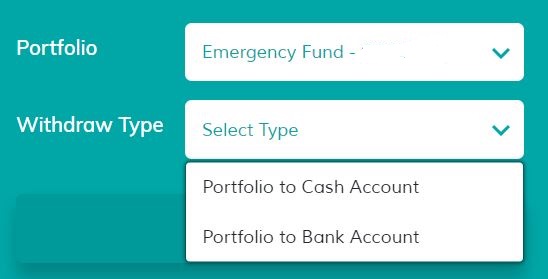

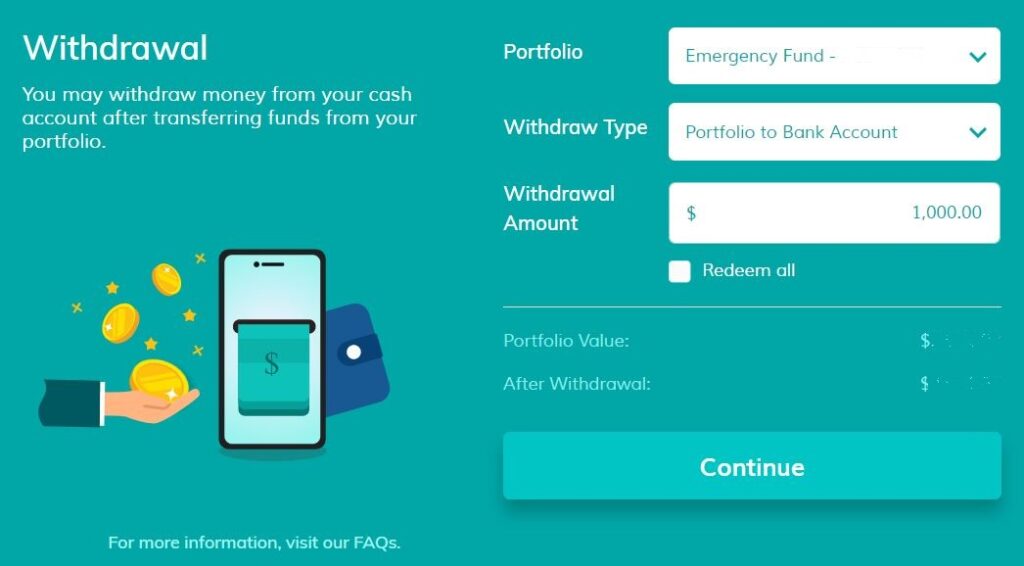

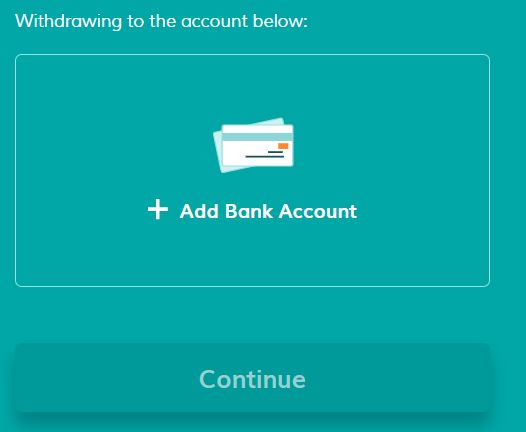

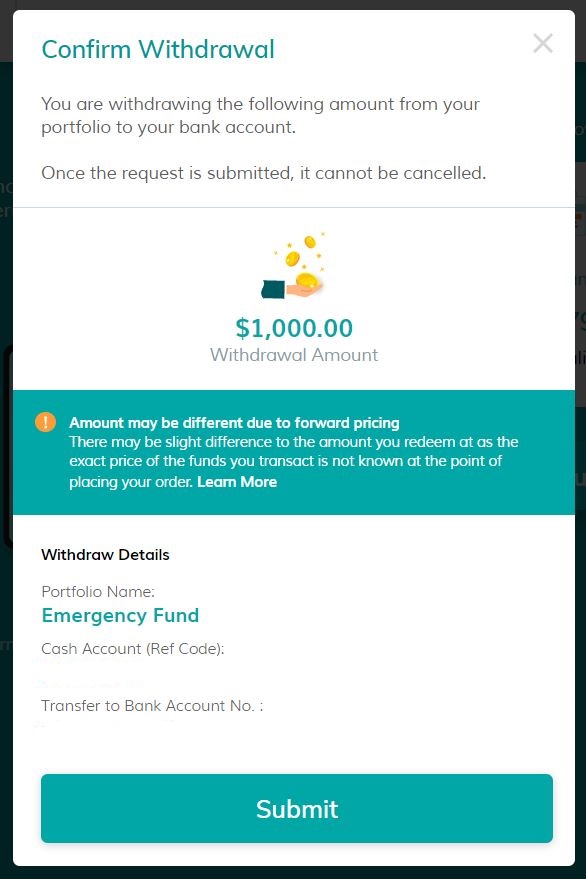

Select the portfolio that you want to withdraw from, and decide if you want to withdraw to Cash Account or Bank Account. Cash Account is a virtual cash account by MoneyOwl; you should choose this if you are withdrawing money from one portfolio and depositing it to another portfolio in MoneyOwl. Otherwise, if you want to cash out your money, than choose transfer to Bank Account.

To withdraw to Bank Account, you need to add your bank account details. Then, at the final stage, MoneyOwl will show you a confirmation page where you need to click “Submit” in order to finalize the wirtdrawal. Lastly, you’ll be told to wait for 2 days.

How long does it take to withdraw money from MoneyOwl’s WiseSaver account?

Based on my personal experience, here is my actual timeline when I withdraw money from MoneyOwl to my bank account:

- Tue, 8 June 2021 evening: submitted my Withdraw request

- Tue, 8 June 2021 evening: MoneyOwl emailed me saying they’ve received my request to Redemption request

- Wed, 9 June: MoneyOwl emailed me saying that my Redemption request has been processed and it will be reflected in my Bank Account Account within 2 business days from execution date (at this point, I was confused, does it mean 9 June is my execution date?)

- Thu, 10 June: MoneyOwl emailed me saying that my Cash Withdrawal has been processed and it will be reflected in my Bank Account Account within 2 business days (again, I’m confused, is my execution date 9 June or 10 June?)

- Fri, 11 June: I kept checking my bank account throughout the day, until 10pm+ but nothing came.

- Sat, 12 June: The money appeared in my bank account, it was dated 11 June and labeled as “Cheque Deposit” but it wasn’t withdrawable from my bank account yet. I guess the cheque was not cleared yet.

- Mon, 14 June: Finally the cheque is cleared. My bank account stated that it’s withdrawable.

In total, it took 6 calendar days from the day submitted my withdrawal request to the day I can withdraw the money from my bank account. That’s quite.. long. Because I don’t need the money urgently, I’m fine with the pace. If you need to access your Emergency Fund urgently, then it’s better that you keep the fund in a normal bank account.

My Portfolio with WiseSaver

I am using WiseSaver as a place to park part of my Emergency Fund. I deposited SGD 5000 on 13 April 2021. After parking my fund for 8 weeks in WiseSaver, I earn a grand total of S$ 1.97, which translates to 0.04% total return, or roughly 0.26% p.a. It is definitely better than normal saving account but it’s lesser than what SSB offers (at the moment, for July 2021, SSB is giving 0.38% interest for the first year).

To be honest, I am thinking to cancel my WiseSaver account. Considering all of the hassles I went through (7 days to deposit my money, can only view portfolio by logging in to website, no mobile app, 6 days to withdraw money) just to get 0.26 pa non-guaranteed return, I feel that it is too much work for such a little reward.

Conclusion

If you’ve read everything from the top, I guess you can sense that I am not a satisfied customer of MoneyOwl WiseSaver. The stick that broke the camel’s back is the meagre return that I get (S$ 1.97) for saving S$ 5000 for 8 weeks.

Maybe I have too high expectation? Maybe the market just isn’t bullish at the moment? Maybe. I guess I have forgotten this phrase that’s very commonly spoken in the investing world: low-risk, low return; high-risk, high-return.

MoneyOwl’s WiseSaver is undoubtedly an extremely low-risk cash management account, hence it’s only fitting that the return is low too.

If you can’t jump through the hoops of high-interest saving accounts (like OCBC 360, DBS Multiplier, UOB One, etc), and you’ve maxed out your Singapore Savings Bond (each individual can only hold up to 200k SSB), and you’re not confident parking your money with private robo-advisor platforms (like Endowus, Syfe, Stash Away), then WiseSaver is a good option for you to park your emergency fund.

I do hope that in the future, MoneyOwl offers higher return (with higher risk, of course) cash management account, because I really really like the simplicity and transparency of MoneyOwl. Other cash management doesn’t explicitly says that capital is not guaranteed, but MoneyOwl does warn customers that capital preservation and return are not guaranteed.

I also hope that MoneyOwl can work to reduce the processing time of deposit and withdrawal. 7 days to deposit and 6 days to withdraw are too much for me. Perhaps I’m just too impatient.

Featured image: Raymond H / Canva Pro

If you find this post helpful, feel free to buy me a coffee :)

Hey! Great post! Lots of of useful information. I’m surprised that they took 6 days to return your money. That’s the same as endowus. I’m having a wisesaver portfolio too. I had it for 1 year & 2 week and my return is 0.76%. I don’t know if it’s due to the bad economy. That’s lower than what trust is offering @ 1% pa. I am considering to close my wisesaver and move my funds to cash smart secure by endowus. What do you think? Are you still with money owl or you have move on to a robo advisor?

Hi Adam, I also don’t know if our poor performance is due to economy or other issue. I’ve already withdrawn all my fund from moneyowl, I’m just doing DCA to nikkoam reit (SGX:CFA) for now.