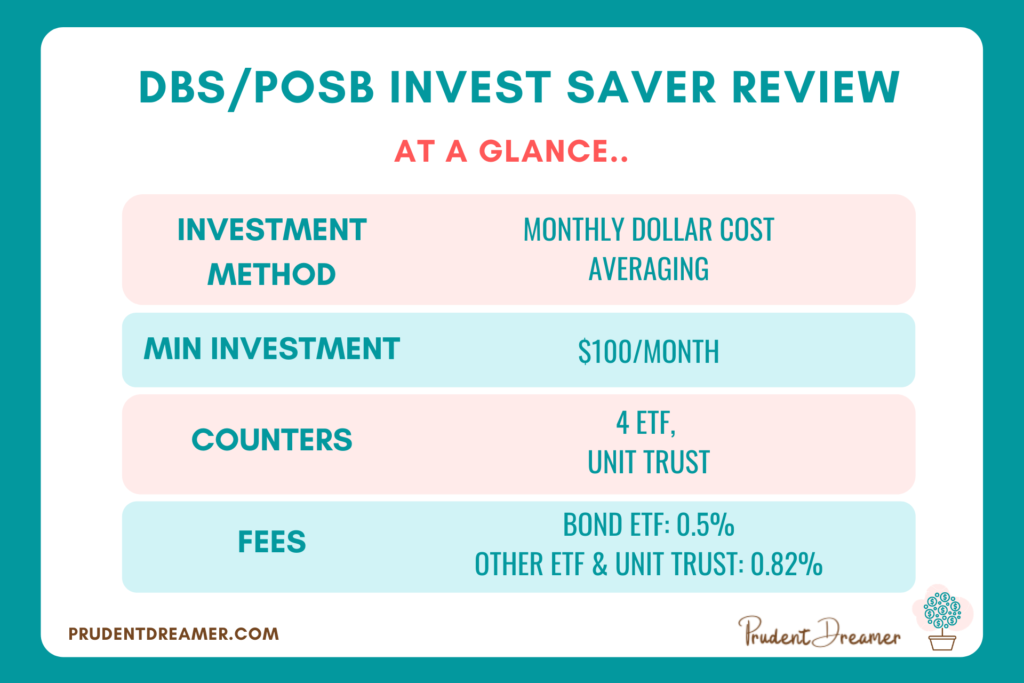

DBS / POSB Invest Saver is one of the regular saving plans in Singapore that allows you to invest by contributing a fixed amount every month. The minimum investment is SGD 100 a month.

I am a late adopter of DBS / POSB Invest Saver because, if I recall correctly, the Invest Saver was launched later than OCBC BCIP. At that time, I had already been investing in BCIP, so I didn’t bother to switch. I only started to invest in DBS / POSB Invest Saver in February 2021 when my risk appetite grew and I wanted to invest in a counter that’s only offered by DBS / POSB Invest Saver.

Before we start, let me address one question that I’ve been asking myself (and I’m sure some of you may be asking too).

What is the difference between DBS Invest Saver and POSB Invest Saver?

Actually, none! Both DBS Invest Saver and POSB Invest Saver are the same thing. So, why 2 different names then? Well, my guess would be, the bank wants to ensure their customers that regardless whether they have DBS or POSB saving account, they’ll be able to enroll in the Invest Saver program. As we all know, DBS has acquired POSB many years ago but they’re still keeping POSB brand intact.

Now that I’ve addressed the elephant in the room, let’s go into the details! Here are the things I’ll cover in this review:

- How it works

- Counters

- Fees

- How to apply

- Timeline

- Dividend crediting

- Invest Saver on Internet Banking

- How to sell

- My Portfolio with DBS/POSB Invest Saver

- How I track my DBS/POSB Invest Saver

- DBS/POSB Invest Saver vs OCBC BCIP

- Conclusion

How it works

DBS / POSB Invest Saver allows investors to invest a fixed amount of money every month. This method is called Dollar Cost Averaging. By doing DCA, there is no need time the market, thus it removes emotional aspect of investing. When the price is high, you’re buying lesser quantity of shares, when the price drops, you’re accumulating more shares.

Another benefit of regular saving plans like DBS / POSB Invest Saver is that, you don’t need a huge capital to start investing. The minimum amount is only $100 a month. Therefore, it’s a great option for people who want to invest but don’t have much cash.

Here are some sample calculations if you’re allocating $100 a month to buy Nikko AM STI ETF.

Month: January 2021

Nikko AM STI ETF price: 3.04

You’ll get: (100 – fee 0.82)/3.04 = 32 shares + refund $2.72.

Month: February 2021

Nikko AM STI ETF price: 2.97

You’ll get: (100 – fee 0.82)/2.97 = 33 shares + refund $1.99.

If you’re buying NikkoAM STI ETF through lump-sum approach (i.e. not through regular saving plans), you need to buy at least 100 shares per transaction as per SGX regulation, that means you need to fork out between $250 to 350 each transaction. And you need to perform those transactions manually.

POSB / DBS Invest Saver performs transactions on your behalf automatically every month, so it’s a really passive way of investing.

If you have a DBS Multiplier account and you’ve never invested in the Invest Saver before, your contribution in POSB / DBS Invest Saver will count as a transaction in “Investment” category but only for the first 12 consecutive months. From the 13th month onwards, your Invest Saver will no longer count in the “Investment” category.

When you submit your application for POSB / DBS Invest Saver, you need to determine how much you want to invest a month and what counter you want to invest in. Then, every month the bank will deduct the money from your bank account or SRS account and buy the share on your behalf.

You can amend the amount of investment, sell your holding or transfer your shares to your CDP or other financial institutions. When the ETF/Unit Trust you hold declares dividend, you’ll receive the same amount of dividend in your account.

The shares that you buy through DBS / POSB Invest Saver will be held under custody of DBS Bank. Since the shares are not in your CDP, you won’t be entitled to attend AGM or any voting rights.

Counters

Basically, there are 2 categories of fund you can invest in using POSB / DBS Invest Saver: ETF and Unit Trust.

ETF stands for Exchange-Traded Fund, which is a fund that can be bought and sold on stocks exchange, and usually tracks an index. Meanwhile, Unit Trust is a pool of fund that is actively managed by the fund manager.

If you’re going to invest in ETF, you can only use cash. Meanwhile, if you’re investing in Unit Trust, you can use either cash or SRS.

Unlike OCBC BCIP, this POSB / DBS Invest Saver doesn’t allow you to buy individual stocks like Singtel, CapitaLand, etc.

At the time of writing (May 2021), there are 4 ETFs and numerous Unit Trusts you can invest in using POSB / DBS Invest Saver.

Here is the list of 4 ETFs available on POSB / DBS Invest Saver:

| NO | COUNTER NAME | STOCK CODE IN SGX | TRACKS |

|---|---|---|---|

| 1 | Nikko AM Singapore STI ETF | G3B | Straits Times Index (STI) |

| 2 | Nikko AM-StraitsTrading Asia ex Japan REIT ETF | CFA | FTSE EPRA Nareit Asia ex Japan Net Total Return REIT Index |

| 3 | ABF Singapore Bond Index Fund | A35 | iBoxx ABF Singapore Bond Index |

| 4 | Nikko AM SGD Investment Grade Corporate Bond ETF | MBH | iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index |

As for Unit Trusts, there are too many to list on this blog. For easy reference, you can view the complete list here.

Should you invest in ETF or Unit Trust? That is for you to decide.

I personally prefer ETFs, but that’s just my own preference.

Before you decide on an ETF or Unit Trust, do your due diligence and make sure you understand what you’re investing in.

Fees

The fees you’ll need to pay depends on the counter you’re investing in. Here’s the summary.

| COUNTER | FEE |

|---|---|

| ETF: | |

| Nikko AM Singapore STI ETF | 0.82% |

| Nikko AM-StraitsTrading Asia ex Japan REIT ETF | 0.82% |

| ABF Singapore Bond Index Fund | 0.5% |

| Nikko AM SGD Investment Grade Corporate Bond ETF | 0.5% |

| UNIT TRUST: | |

| All Unit Trust | 0.82% |

At the moment, if you’re using SRS to buy unit trusts, additional fees are waived until further notice, according to DBS SRS website.

How to apply

Because DBS / POSB Invest Saver is a Custodian account, you don’t need to apply a CDP account with SGX.

If you have a DBS or POSB account and Internet Banking, you can apply for Invest Saver using your Internet Banking account. The procedure can be found on DBS / POSB Invest Saver website.

If you don’t have DBS or POSB account, you need to open one.

Timeline

Usually, DBS/POSB will deduct the money from your deposit account on 15th every month, or the next working day if 15th is a non-business day. You must ensure sufficient funds in your account two business days before the GIRO deduction date. To be safe, just make sure you have enough fund to last at least 3 months of investment.

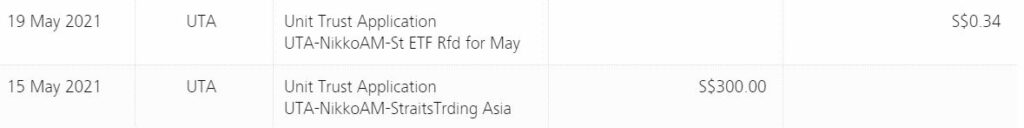

On purchase execution date (around 15th), DBS/POSB will purchase share on your behalf. In a few days, you’ll receive a statement from them stating how many shares were purchased, and at what price. Also in a few days, you can view how many shares you’re currently holding when you login to the online banking. The unused money will be refunded to your account within 3 to 5 working days.

The following screen capture shows how the deduction and refund appears on my saving account.

Dividend crediting

When the ETF or Unit Trust that you invest in pay out dividend or coupon, you will receive exactly the same amount in your account as declared by the ETF/UT. DBS/POSB will not deduct any fee from your dividend or coupon.

If it’s cash dividend, it will be credited to your DBS/POSB saving/current account that you use for Invest Saver. If it’s share dividend, the share will be added to your Invest Saver account.

For ETF, you can’t reinvest your dividend automatically. For selected UT, you can choose to reinvest your dividend automatically, that means your dividend will be used to purchase more units on your behalf.

Invest Saver Section on your Internet Banking

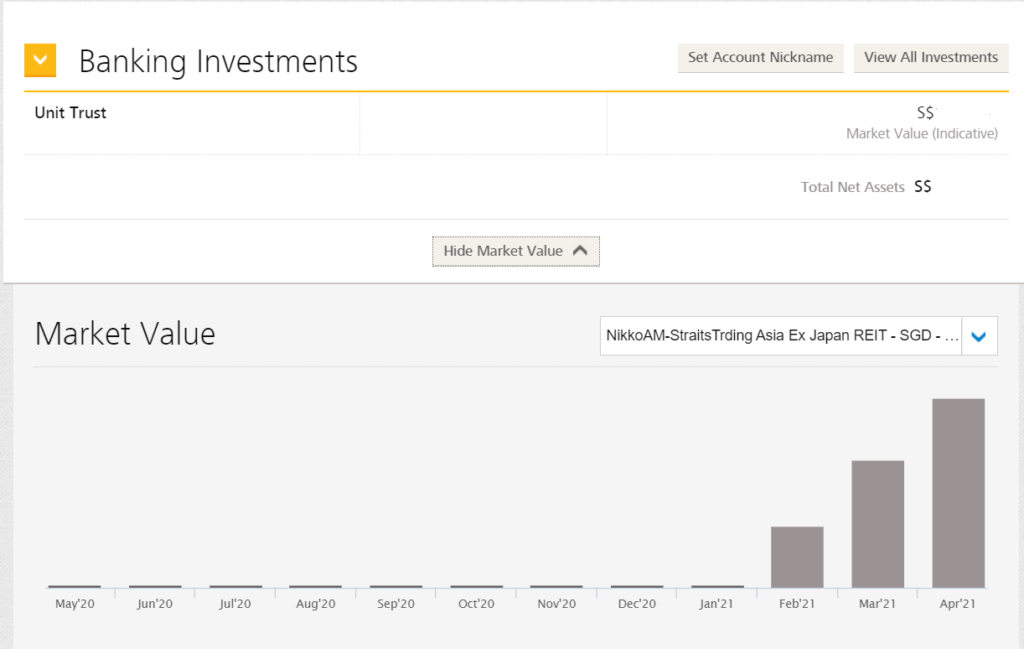

Once you have an active Invest Saver, you will be able to see your portfolio on your dashboard of your DBS/POSB internet banking (also known as “digibank”).

On your dashboard, scroll down past your deposit, paylah, and card sections, then you’ll see “Banking Investment” section, which looks like this:

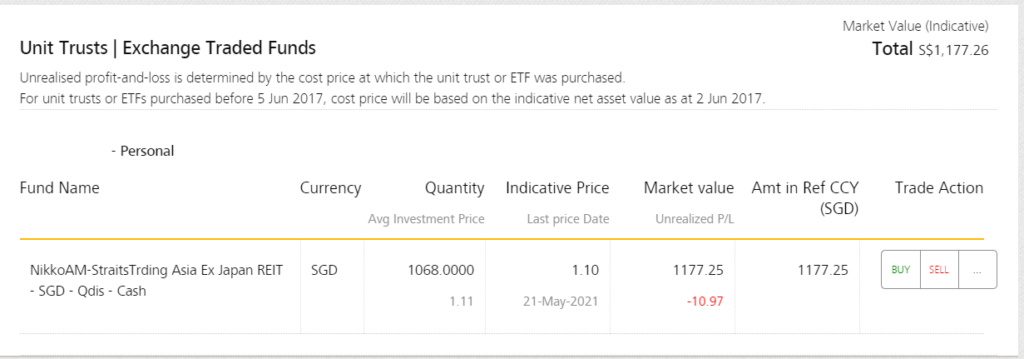

To see the details, simply click on “Unit Trust”. Even if you’re buying ETF, the wording that appears here will still be “Unit Trust.” After clicking, this is what you will see:

In the detailed view, you’ll be able to see the quantity you’re currently holding, the average price you paid, the current price, current market value and unrealized profit/loss. No information about dividend yield was given.

Personally, I don’t really rely on the metrics provided by brokerage because I have my own preference of tracking my investment. For example, I always add transaction fee as my cost price, so my actual cost is $1.12/unit, but the table provided by DBS/POSB above shows that my cost is $1.11. Most of time time, I ignore the table above.

How to sell

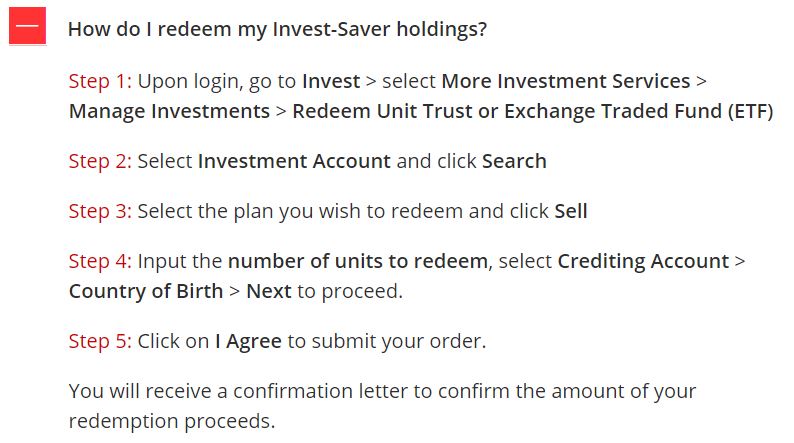

You can sell your Invest Saver holding via DBS/POSB internet banking. The following is the instruction on how to redeem your investment. The fund will be credited to your deposit/saving account within T+7days from the date you submit the sell application.

Your sell request will be pooled together with other sellers, then the sale will be executed together. The Average Sell Price is calculated by dividing the total proceeds from all of the shares sold by the total quantity of shares sold. Therefore, all sellers who sold the same share counter on the same day will be subjected to the same sell price.

My Portfolio with DBS / POSB Invest Saver

I have been investing in Nikko AM-StraitsTrading Asia ex Japan REIT ETF (also known as Nikko AM STC Asia REIT ETF) since February 2021, for the amount of $300 every month. At 0.82%, my fee is $2.46 per month. The reason why I choose this counter is because I have conviction in Asia’s REIT (especially Singapore). Furthermore, I love the fact that this counter pays quarterly dividend.

In my short stint (4 months) with DBS / POSB Invest Saver, I only have 1 complaint. I hate that my dividend came late! Ugh!

In May 2021, Nikko AM STC Asia’s official dividend payment date was 5 May 2021. However, my dividend didn’t arrive at my saving account on that day. It also didn’t come on 6 May and 7 May. So I decided to call DBS in the late afternoon of 7 May (Friday).

The staff that talked to me also didn’t know when it will be credited. She said that it will be late this month. She also offered to help me monitor the crediting of the dividend, and to call me again when the dividend is credited.

Finally… the dividend came on 8 May (Saturday)! But in my saving account, the dividend was shown to be credited on 7 May. I guess it probably came in the late evening of 7 May.

The lady who offered to monitor the dividend for me called me on Monday to inform me about the dividend crediting. That’s really nice of her and I really commend her service. Unfortunately I did not know her name.

Previously I wrote that I only experienced this issue about late dividend crediting with DBS and not OCBC. However, I’d like to make amendment that I experienced the same issue with OCBC BCIP as well, but the delay was no more than 1 working day.

So, just be aware that dividend crediting may be late by a couple of days when you invest in DBS Invest Saver. It’s not a deal breaker because the dividend will still come.

How I track my DBS Invest Saver Portfolio

As I mentioned in the previous section, I had my own spreadsheet to record all of the purchases and dividends I received from DBS Invest Saver.

It allows me to easily see my all-time average purchase price, my average dividend yield, unrealized profit/loss, dividend rate trend, etc. And it allows me to include transaction fee as part of the cost of my ETF, which I think is a more realistic approach than Invest Saver platform’s approach that excludes fee when calculating the average cost.

If you want to get a look of my spreadsheet, click here.

DBS Invest Saver vs OCBC BCIP

Since DBS Invest Saver and OCBC BCIP are pretty similar, I guess I’ll try to compare apple with apple.

| Category | OCBC BCIP | DBS Invest Saver |

|---|---|---|

| Fees for investors under 30 years old | 0.88% | 0.5% for bond ETFs, 0.82% for stock ETFs |

| Fees for investors over 30 years old | $5 or 0.3%, whichever higher | 0.5% for bond ETFs, 0.82% for stock ETFs |

| Counters | 15 individual stocks, 6 ETFs | 4 ETFs, various unit trusts |

| ETFs counters | • Nikko AM Singapore STI ETF • Nikko AM SGD Investment Grade Corporate Bond ETF • Lion-Phillip S-REIT ETF • Lion-OCBC Securities Hang Seng Tech ETF • Nikko AM-ICBCSG CN BD ETF SGD • Lion-OCBC Securities China Leaders ETF | • Nikko AM Singapore STI ETF • Nikko AM SGD Investment Grade Corporate Bond ETF • ABF Singapore Bond Index Fund • Nikko AM-StraitsTrading Asia ex Japan REIT ETF |

| Unit Trust | No | Yes, many |

For the first category regarding fees for investors under 30 years old, you’d be better off going with DBS Invest Saver in terms of fees, if you are under 30 years old.

For the second category regarding fees for investors over 30 years old, I’ve done the calculation for you. If you’re over 30 years old and you’re investing $600 or less per month, go with DBS Invest Saver. If you’re investing more than $600 a month, go with OCBC BCIP.

For the third category regarding counters, if you prefer to invest in individual stocks, then go with BCIP. Personally I prefer invest with DCA method for ETFs, so both OCBC BCIP and DBS Invest Saver are good for me in terms of counters.

For the forth category regarding ETF counters, both have Nikko AM STI ETF and Nikko AM Bond ETF.

Then, OCBC BCIP has Lion-Phillip S-REIT ETF while DBS Invest Saver has Nikko AM-StraitsTrading Asia ex Japan REIT ETF; both of these are pretty similar, but the latter are slightly more diversified than the former.

OCBC BCIP has Lion-OCBC Securities Hang Seng Tech ETF which is an aggressive fund that focuses on HK-China’s Tech industry, while DBS Invest Saver has ABF Singapore Bond Index Fund which is a defense fund. So, check your appetite and choose accordingly.

For the fifth category regarding unit trust, OCBC BCIP doesn’t offer unit trust because they have a different program for monthly investment in unit trust. Meanwhile, DBS Invest Saver offers monthly investment in unit trust under the same program, the Invest Saver program.

Anyway, I can go on and on about the differences between these 2, but I think I’ve covered the 2 most important aspects, which are the fees and the counters.

Conclusion

Pros of Invest Saver

- Cheap and easy way to do Dollar Cost Averaging

- Cheaper than traditional brokerage

- Good for investor with little capital

- Investors don’t have to wait until they have the fund to buy full lot (100 shares), they can invest right away

- Easy to apply if you’ve already had an DBS/POSB account

- If you’re under 30 years old, DBS Invest Saver fee (0.82%) is cheaper than OCBC BCIP fee (0.88%)

- If you’re over 30 years old and you’re planning to invest less than $600 a month, DBS Invest Saver fee (0.82%) is cheaper than OCBC BCIP ($5 fee for investment under $1600).

- Able to reinvest dividend manually, not automatically (yes this is a pro and not con, I prefer to have the ability to decide when and where I want to reinvest my dividend)

Cons of Invest Saver

- Not able to buy individual blue chip stocks with DCA method

- If you’re over 30 years old and you’re planning to invest more than $600 a month, DBS Invest Saver fee (0.82%) is more expensive than OCBC BCIP (0.3%).

- You won’t be able to attend AGM or have any voting rights

- If you’re using DBS Multiplier account, investment made through Invest Saver is eligible for “Investment” category only for the first 12 consecutive transactions. After that, it will no longer count.

- Dividend may come late based on my personal experience

If you don’t have large capital right now, it’s good to start with a regular saving plan. Time in the market is better than timing the market.

If you have the resources to monitor stock prices and are able to invest lump sum amount; in other words, you’re an aggressive investor, then DCA may not work for you.

Featured image credit: Canva Pro/Getty Images Pro

If you find this post helpful, feel free to buy me a coffee :)

“From the 13th month onwards, your Invest Saver will no longer count in the “Investment” category.

in this case, any suggestions what we can do to continue to meet the “investment” category for the Multuplier acc? thank you

Hi, do you know what’s the fee occurred for redeeming holdings?

Hi Andy, it’s 0.82% of the transaction amount

Hello! Thanks for the informative post on DBS Invest Saver, I really enjoyed it. I’ve used it personally to bump up the rates of DBS Multiplier for a year, and now that it no longer counts as the investment category, I’m thinking of cancelling it.

Do you know DBS charges a fee for leaving the money in the Invest Saver account? Or do they only charge a commission when you make a transaction?

Yes it was great for Multiplier account holder, too bad the additional interest is only for the first year of investing. From what I understand, the commission is only charged when there’s a transaction. But, I’ve never paused my DCA so I don’t have any experience to back up my understanding.

Thank you!

Thanks for the statement. Very helpful and details. I wonder if the ETF expense ratio is included inside the 0.82% fees ?

No, it’s not. 0.82% is just commission fee that is charged by DBS/POSB.

POSB INVEST SAVER is one of the first tools I used to start my investment journey too! Hassle-free DCA-ed into Nikko AM STI ETF back then.

DBS/POSB Invest Saver definitely makes it so easy to get into investing